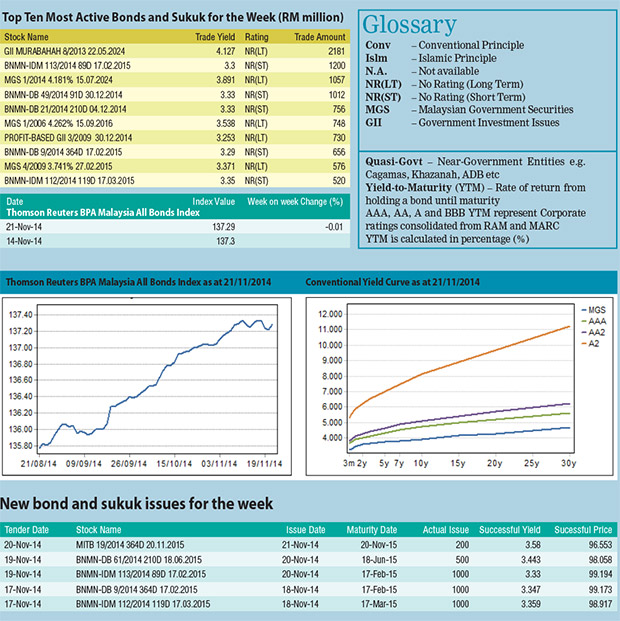

The Thomson Reuters BPAM All Bond Index ended the week on negative note with the index closed lower by 0.01 per cent to 137.29 from 137.30 previously.

The Thomson Reuters BPAM All Bond Index ended the week on negative note with the index closed lower by 0.01 per cent to 137.29 from 137.30 previously.

MGS yields have shifted higher by two basis points (bps) to seven bps from three-year to 30-year region.

On Friday, Department of Statistics Malaysia reported that domestic inflation as measured by the Consumer Price Index (CPI) has accelerated to 2.8 per cent year-on-year in October from 2.6 per cent in the previous month.

The increase was partly attributed to higher transport cost that has risen by 5.3 per cent.

To recap, the Malaysian government had previously increased the price of RON95 petrol and diesel to RM2.30 and RM2.20 per litre respectively on October 2, 2014.

Top 10 most active bonds:

The turnover of the top 10 most actively traded bonds continued to contract this week.

The volume has dropped to RM9.4 billion from RM10.8 billion previously.

On-the-run 10-year GII maturing on May 22, 2024 topped the list with approximately RM2.2 billion transacted.

New bond(s):

On November 18, 2014, Cagamas Berhad issued a three-year and a five-year Islamic Medium Term Note (IMTN) with profit rates of 3.98 and 4.15 per cent respectively. The total issuance size is RM47 million.

On November 20, 2014, Temasek Ekslusif Sdn Bhd (TESB) issued a five-year IMTN worth RM300 million.

The profit rate is 4.62 per cent. The TESB’s IMTN is guaranteed by Gamuda Bhd and rated AA3(s) with a stable outlook by RAM Ratings.

On the same day, Puncak Wangi Sdn Bhd (PWSB) issued a three-year sukuk with an issuance size of RM40 million. The profit rate is 4.35 per cent.

The PWSB’s sukuk is rated AAA(fg) with a stable outlook by RAM Ratings and guaranteed by Danajamin Nasional Bhd.

On November 21, 2014, Central Impression Sdn Bhd (CISB) issued 10 tranches of bonds with tenures ranging from two to 11 years. The coupon rates are between 4.65 per cent and 5.55 per cent.

The total issuance size is RM120 million. The bonds are rated AA- with a stable outlook by MARC.