Malaysian palm oil futures climbed higher on Friday to 2,239, due to the expectation of rainy season will hamper production till the end of the year.

Malaysian palm oil futures climbed higher on Friday to 2,239, due to the expectation of rainy season will hamper production till the end of the year.

Futures Crude Palm Oil (FCPO) benchmark February 2015 contract settled at 2,239, up 35 points or 1.59 per cent from 2,204 last Friday.

Trading volume decreased to 145,407 contracts from 168,094 contracts from last Monday to Thursday.

Open interest based decreased to 854,849 contracts from 884,108 contracts from last Monday to Thursday.

Cargo surveyor, Intertek Testing Services (ITS) reported that exports of Malaysia palm oil products during November 1 to 15 decreased 4.5 per cent to 598,269 tonnes compared with 626,482 tonnes during October 1 to 15.

ITS also reported that exports of Malaysian palm oil products during November 1 to 20 decreased 6.4 per cent to 837,659 tonnes compared with 894,697 tonnes during October 1 to 20.

Societe Generale de Surveillance (SGS) report showed that Malaysia’s palm oil exports during November 1 to 15 decreased 2.5 per cent to 605,624 tonnes compared with 621,145 tonnes during October 1 to 15.

SGS also reported that exports of Malaysian palm oil products during November 1 to 20 fell 4.6 per cent to 843,707 tonnes compared with 884,628 tonnes during the October 1 to 20 period. Demand from the EU and India fell, while demand from China increased.

Spot ringgit weakened on Friday to 3.3525, due to the yen rebounding after the Japanese Finance Minster warned against the currency weakening position.

By the end of the year, Malaysian and Indonesian crude palm oil production will likely slow due to the monsoon season.

Export duty remains zero per cent in November, import of palm oil into Malaysia expected to increase which could offset depleting inventories. Initially, the price rose due to technical buying, however gains were limited due to poor export data coupled with investors anxious with regards to output of crude palm oil in November.

The price continued to edge higher, due to a weakening ringgit, coupled with market expectation production in November could be lower than estimated.

Overall, traders wait for clearer market direction with regards to output and demand.

The price then dropped, as gains in the morning session were offset by heavy losses in the afternoon session, due to weakening competing vegetable oil prices.

However the price was supported by a weakening ringgit. The price continued to fall, due to poor export data, but again a weakening ringgit held up the price. By the end of the week, the price rose, due to potential monsoon season which could reduce output, although poor export data limited gains.

Technical analysis

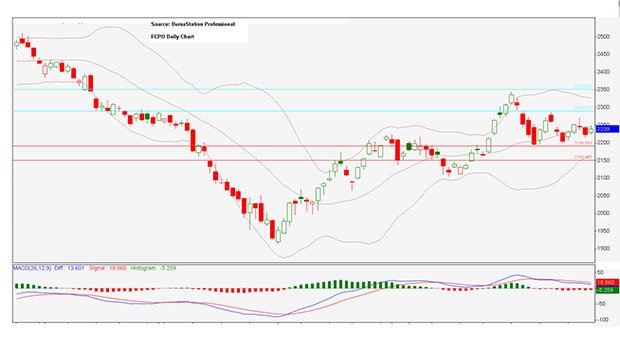

According to weekly FCPO chart, the price continued to edge higher from middle bollienger band. Over the coming weeks, the price could range 2,150 to 2,400.

According to the daily FCPO chart, at the beginning of the week the price rose, testing middle bollienger band, closing above.

The price continued to rise, above middle bollienger band, and closing above resistance line 2,250.

The price continued to rise in the morning session, but then fell heavily in the afternoon session, closing below resistance line 2,250.

The price continued to edge lower, breaking and closing below middle bollienger band. The price then rose, testing resistance line 2,250, and middle bollienger band, closing below.

In the coming week, the price has potential to range between 2,250 and 2,160.

Resistance lines will be placed at 2,290 and 2,340, while support lines will be positioned at 2,190 and 2,150, these will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report on November 25 (Tuesday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.