Malaysian palm oil futures edged lower on Friday to 2,170, due to prices tracking of oil prices which reversed after a rally on Thursday. This was caused by the conflict concerns happening in the Middle East.

Malaysian palm oil futures edged lower on Friday to 2,170, due to prices tracking of oil prices which reversed after a rally on Thursday. This was caused by the conflict concerns happening in the Middle East.

Future Crude Palm Oil (FCPO) benchmark June 2015 contract settled at 2,170 on Friday, up 15 points or 0.7 per cent from 2,155 last Friday. Trading volume decreased to 176,884 contracts from 216,269 contracts from last Monday to Thursday.

Open interest based on decreased to 706,665 contracts from 799,438 contracts from last Monday to Thursday.

Cargo surveyor Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during March 1 to 25 increased 3.5 per cent to 856,474 tonnes compared with 827,273 tonnes during February 1 to 25.

Societe Generale de Surveillance’s (SGS) report showed that Malaysia’s palm oil exports during March 1 to 25 increased 3.7 per cent to 846,217 tonnes compared with 815,763 tonnes during February 1to 25.

Overall, demand rose from China, India, and the US, while demand weakened for the European Union and Pakistan.

Spot ringgit weakened on Friday to 3.6830, as investors removed bearish bets on the second worst performing Asian currency and as oil prices rebound.

The USDA reported that it has cut its forecast for Malaysian palm oil production for 2014 to 2015 to 20 million tonnes instead of 20.5 million tonnes, due to adverse weather reduced crop yields.

The USDA said that damaging floods affecting the East Coast of Malaysia in late 2014 and dry weather during the first quarter of 2014 that caused palm oil production to drop 12 per cent during the October 2014 to February 2015 period.

Yemen shut its major seaports, on Thursday, industry and local sources said, after neighbouring Saudi Arabia and Arab allies struck the Iran-allied Houthi forces who have been fighting Yemen’s Western-backed president.

On Monday, the price rose as the Indonesian government announced plans to impose levies on crude palm exports caused hurried buying but gains were limited, due to concerns that gains are unsustainable as global demand slowed.

On Tuesday, the price fell, due to a weak technical position, coupled with a strengthening ringgit and concerns over weakening global demand from buyers.

On Wednesday, the price rose due to export volumes from Indonesia which recorded an increase for the first time in three months.

On Thursday, the price rose due to the tracking of strengthening crude oil prices and subsequently, on Friday, the price fell as it tracked reversing oil prices caused by the escalating conflict in the Middle East.

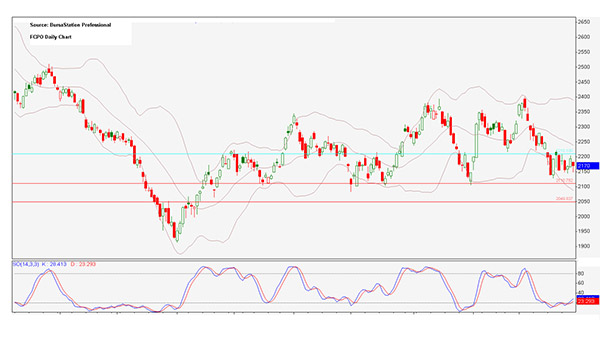

Technical analysis

According to weekly FCPO chart, the price fell while it ranged between psychological barrier 2,200 and the previous week’s closing price at 2,150. It was unable to test either middle or bottom Bollinger bands.

According to the daily FCPO chart, on Monday, the price initially rose, testing resistance line 2,210 but gains were lost in the later session and the price closed below psychological barrier 2,200.

A doji candlestick was formed, indicating that the market is in a period of indecision.

On Tuesday, the price fell as it continued to range between the bottom and middle Bollinger bands, as the SO remains in oversold territory.

On Wednesday, the price rose while it continued to range within the sideways pattern.

On Thursday, the price tested the psychological barrier at 2,200, and later closed below, while the SO exited oversold territory.

On Friday, the price opened below 2,200 then fell, while remaining stayed within the sideways boundary, closing below psychological barrier 2,200. In the coming week, the price has the potential of ranging between 2,100 and 2,200.

Resistance lines will be placed at 2,210 and 2,260, while support lines will be positioned at 2110 and 2050, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report on March 31 (Tuesday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.