Following the release of a better-than-expected employment data in the US last Friday, most MGS yields shifted higher during the week by three bps to 10bps. This occurred alongside a weakening Ringgit, which had closed at 3.7595 against the greenback from 3.7185 last Friday, as the robust non-farm payroll data bolstered prospects for an interest rate hike by the Federal Reserve before the end of the year.

Following the release of a better-than-expected employment data in the US last Friday, most MGS yields shifted higher during the week by three bps to 10bps. This occurred alongside a weakening Ringgit, which had closed at 3.7595 against the greenback from 3.7185 last Friday, as the robust non-farm payroll data bolstered prospects for an interest rate hike by the Federal Reserve before the end of the year.

Early this week, the seven-year benchmark MGS yield spiked as high as 16bps within a day. Some of the losses were then erased later in the week due to the assurance from the Bank Negara Malaysia Governor that the ringgit’s weakness was temporary and not reflective of the fundamentals of the Malaysian economy.

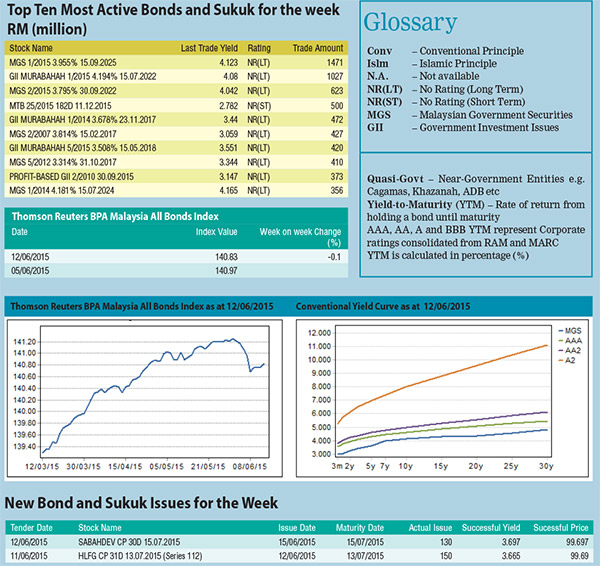

As a result, the Thomson Reuters BPAM All Bond Index registered a 0.1 per cent loss during the week, ending with a reading of 140.83 on Friday. Meanwhile, investors remained cautious as they await the upcoming rating reviews on Malaysia’s sovereign credit by international rating agencies.

On the international front, Bank of Korea had cut its policy rate by 25bps to 1.5 per cent in tandem with the outbreak of MERS that had dampened consumption and investments. The Reserve Bank of New Zealand had also cut its interest rate by 25bps to 3.5 per cent and hinted that further easing is possible depending on the upcoming economic data. World Bank further lowered its global growth forecast for 2015 from three per cent to 2.8 per cent, citing the slowdown and softer outlook in emerging markets and the US while urging the Federal Reserve to delay the rate hike to next year.

Top 10 most active bonds:

Trading activities in the ringgit bond market were subdued as the total volume of the top 10 most active bonds this week was halved to RM6.08 billion compared to RM12.2 billion last week. This could be attributed to the lacklustre trading during the school holidays and the absence of government bond auctions.

New bond(s):

On June 11, 2015, Grand Sepadu (NK) Sdn Bhd (GSNK) issued three tranches of sukuk with a total issuance size of RM210 million. The five-year, eight-year and 15-year sukuk carry profit rates of 4.75, 5.05 and 5.35 per cent respectively. The sukuk are rated AA- IS with a stable outlook by MARC. GSNK is the concessionaire of the 17.5-kilometre New North Klang Straits Bypass Expressway following the company’s acquisition of the concession rights in December 2014.

On June 12, 2015, Telekom Malaysia Bhd issued a RM300 million seven-year sukuk with a profit rate of 4.23 per cent. The sukuk is rated AAA with a stable outlook by RAM Ratings.