Early this week, financial markets started direly across the globe as 61.3 per cent of the Greeks voted against more austerity measures in Sunday’s referendum, risking the nation to a financial market collapse and even out of the eurozone.

Early this week, financial markets started direly across the globe as 61.3 per cent of the Greeks voted against more austerity measures in Sunday’s referendum, risking the nation to a financial market collapse and even out of the eurozone.

The outcome from Tuesday’s summit saw a five-day extension granted to Greece until this coming Sunday to come up with concrete plans in order to receive further financial aid.

On Thursday, Greece submitted a new bailout proposal that includes pension and tax reforms, pending parliament voting before Sunday’s summit. Meanwhile, the Chinese government struggled to stop the equity market from falling further.

Almost half of the listed companies in China stock exchanges halted trading to prevent further tumbling of their share prices. Bursa Malaysia and other exchanges experienced spillover effects and were all in red on Wednesday. The ringgit was also hard hit and breached 3.8 against the US dollar on Monday, the level at which the currency was pegged to the US dollar back in 1998.

Other regional peers also weakened against the greenback as the risk-off sentiment lessened demand for emerging-market assets while safe haven assets denominated in US dollar were sought after.

Nonetheless, the Chinese equities rebounded later during the week while Greece’s bailout proposal restored hopes among investors.

All in all, a series of uncertainties strained on the local bond market, causing the yields of MGS to rise by 2bps to 10bps across the curve.

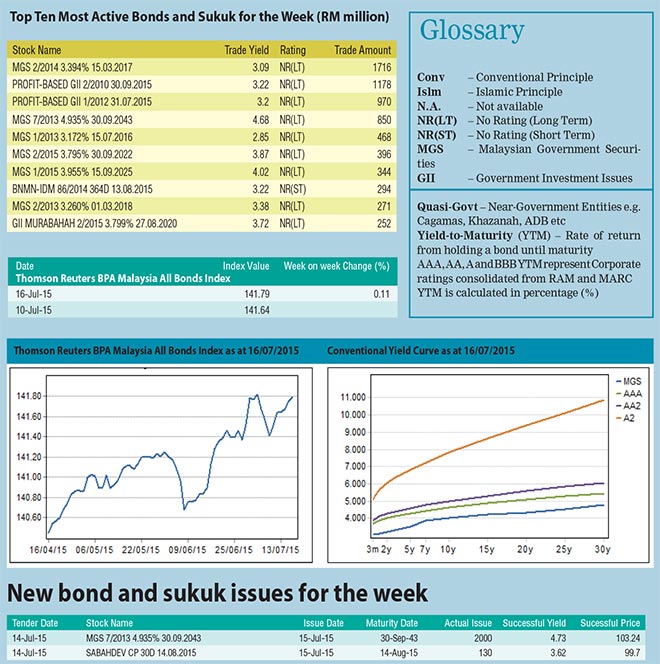

As a result, the Thomson Reuters BPAM All Bond Index closed the week lower by 0.13 per cent at 141.64 compared to 141.82 last week. On Tuesday, BNM released the data on foreign reserves.

The international reserves dropped US$0.9 billion to US$105.5 billion as at June 30, 2015, sufficient to finance 8.2 months of retained imports and cover 1.1 times the short term external debt. On Thursday, BNM’s Monetary Policy Committee meeting concluded with no change in the Overnight Policy Rate.

BNM in its Monetary Policy Statement has cautioned that international financial markets have become increasingly vulnerable to developments in Europe and policy uncertainties in several major advanced economies.

Apart from that, it also pointed out that there is sufficient liquidity in the domestic financial system to withstand the ringgit’s weakness.

Trading activities in the ringgit bond market were relatively quiet amid market-wide risk aversion.

The trade volume of the top 10 most actively traded bonds has shrunk to RM10.51 billion, compared to RM12.97 billion last week.

Off-the-Run GIIs and BNM Islamic short-term paper topped the list with a total of RM5.46 billion changed hands. On July 10, 2015, BNM announced the tender details of the re-opening of the 30-year benchmark MGS maturing on September 30, 2043.

The amount of the re-opening is RM2 billion and the tender will be closed on July 14, 2015. On July 6, 2015, Krung Thai Bank Public Company Ltd (KTB) issued a 10-non-callable-5-year Tier-2 subordinated Medium Term Note (MTN) worth RM1 billion with a coupon rate of 5.1 per cent.

The MTN is rated AA2 by RAM Ratings with a stable outlook.

KTB is the only state-owned commercial bank in Thailand and hence its rating is underpinned by sovereign support.