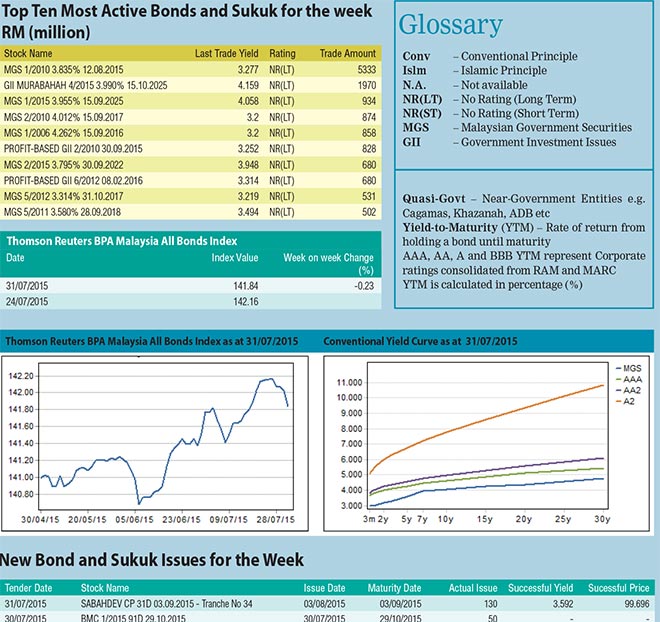

Over the week, the Thomson Reuters BPAM All Bond Index ended the week a tad lower at 141.84 posting a loss of 0.13 per cent. This was largely due to the bearish movements in MGS segment. On Friday, the five-year and seven-year MGS yields surged significantly from their previous close as ringgit continued to depreciate against the US dollar due to lower oil prices coupled with positive economic data reported in US over the week.

Over the week, the Thomson Reuters BPAM All Bond Index ended the week a tad lower at 141.84 posting a loss of 0.13 per cent. This was largely due to the bearish movements in MGS segment. On Friday, the five-year and seven-year MGS yields surged significantly from their previous close as ringgit continued to depreciate against the US dollar due to lower oil prices coupled with positive economic data reported in US over the week.

On the international front, the Federal Reserve of US (Fed) concluded its two-day Federal Open Market Committee (FOMC) meeting on Wednesday leaving interest rate unchanged. According to its press release, the economic activity in the country continued to expand moderately and job market continued to improve while inflation remained below the committee’s longer-run target. On the timing of liftoff, the committee is of the view that further improvements in the labour market and inflation are required to warrant a raise in the federal funds rate.

On Thursday, the US Department of Commerce’s Bureau of Economic Analysis reported that the US economy expanded by 2.3 per cent in the second quarter of 2015 and revised the first quarter GDP upward from minus 0.2 per cent to 0.6 per cent.

The ringgit bond market was relatively quiet this week with the total trade volume of the top 10 most actively traded bonds decreased by about 28 per cent to RM13.2 billion, as compared to RM18.3 billion last week. The off-the-run MGS maturing in August 2015 topped the list with RM5.3 billion changed hands, followed by the 10-year benchmark GII at RM1.97 billion.

On July 28, 2015, Bank Negara Malaysia announced the tender details for the reopening of 10-year GII maturing on October 15, 2025. The amount of the re-opening is RM3.5 billion and the tender was closed on July 30, 2015 with lukewarm bid-to-cover ratio of 1.854. The highest, average and lowest yield at 4.118, 4.105 and 4.087 per cent respectively.

On July 29, 2015, Cagamas Bhd issued an one-year and three-year MTN with a total issue size of RM115 million.

Putrajaya Holdings Sdn Bhd issued five tranches of IMTNs maturing in four to nine years respectively with a total issue size of RM900 million. The profit rates range from 4.03 to 4.48 per cent.

On July 31, 2015, Sabah Development Bank Bhd issued an one year MTN with an issuance size of RM185 million. Sunway Treasury Sukuk Sdn Bhd issued a seven-year IMTN with an issuance size of RM10 million.

On July 28, 2015, RAM Ratings revised the outlook on the rating of Tenaga Rapi Sdn Bhd’s RM60 million Nominal Value Secured Bonds from positive to stable while reaffirming the issuer’s AA2 rating.

On July 31, 2015, RAM Ratings upgraded the ratings of Mecuro Properties Sdn Bhd’s RM12 million Senior Class B and RM15 million Senior Class C bonds from AA2 and A1 to AAA.