Malaysia’s O&G industry had once experienced the positive impact of stable global oil prices as throughout 2013 and the first part of 2014, the local bourse (Bursa Malaysia) saw a rapid rise in the listing of O&G companies while O&G projects both domestic and international came at a steady rate.

Malaysia’s O&G industry had once experienced the positive impact of stable global oil prices as throughout 2013 and the first part of 2014, the local bourse (Bursa Malaysia) saw a rapid rise in the listing of O&G companies while O&G projects both domestic and international came at a steady rate.

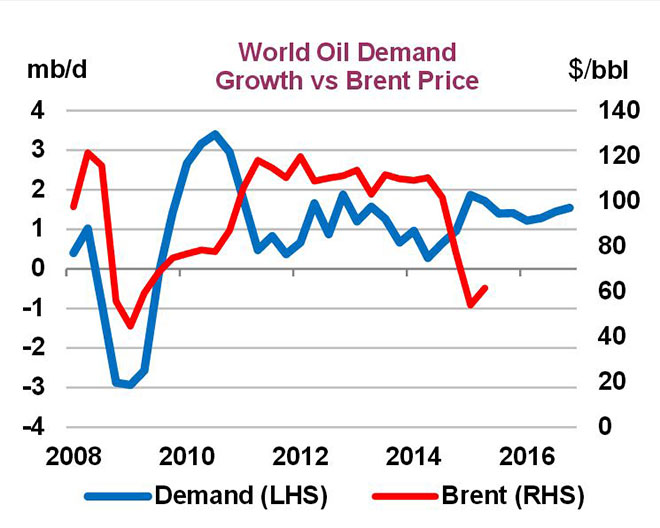

However, by the later half of 2014, the price of crude oil took a nose dive and subsequently, the global O&G industry entered a new downturn, with many O&G companies especially those involved in the upstream segment, recording lower profits.

According to Bloomberg, since its peak in June 2014, the US benchmark West Texas Intermediate (WTI) crude oil price fell nearly 40 per cent. By December 2014, the WTI crude prices dropped to less than US$50 per barrel, with Brent oil prices following suit.

Ernst & Young (EY) highlighted that by late January 2015, Brent crude prices, the primary benchmark for global oil price, had dropped below US$50 per barrel, more than 60 per cent below their most recent peak in mid-June 2014.

Oil’s slick slide in price

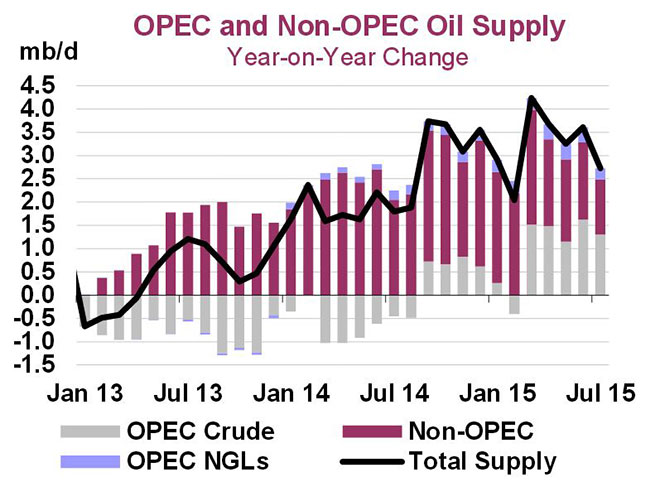

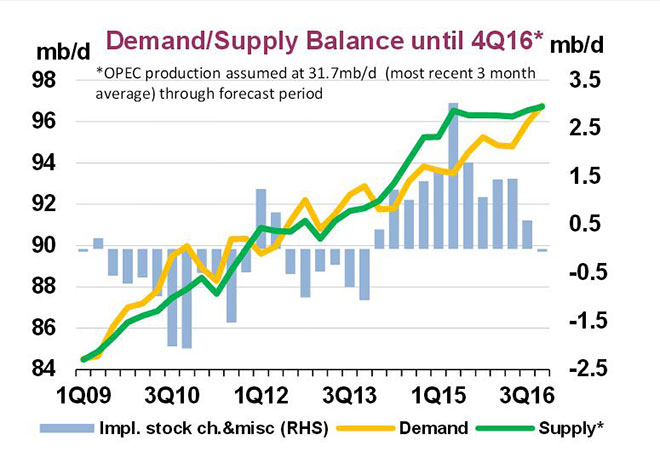

While there are many factors to the recent drastic drop in O&G prices, most analysts believe that the world is currently producing about two million barrels of oil per day, more than what it needs.

The global O&G market is now facing what industry experts call a ‘supply shock’ in crude oil and it has been attributed to many factors including US’ shale ‘revolution’, Iran’s ongoing nuclear deal, and others.

However, industry experts have generally viewed that Organisation of Petroleum Exporting Countries (OPEC) play a huge part in the demand and supply of the movement and hence; the movement of global O&G prices.

EY in its ‘Resilience in times of volatility: Oil Prices and the Energy Industry’ report, noted that since the first quarter of 2014, OPEC, which controls nearly 40 per cent of the world market, has supplied more crude oil than the market has needed.

It has also given current expectations for global oil demand growth and for non-OPEC production growth, and as such, it believed the amount of crude oil needed from OPEC will decline sharply in the first half of 2015.

“With OPEC resolved (at least at this point in time) to maintain its current production ceiling of just more than 30 million barrels per day, and oil demand declining seasonally starting in the first quarter, the market is likely to be over-supplied by as much as 1.5 million barrels per day to two million barrels per day in the first half of 2015 (1H15),” it added.

In a report late last year, The Economist noted that the oil price is partly determined by actual supply and demand, and partly by expectation.

“OPEC’s decisions shape expectations: If it curbs supply sharply, it can send prices spiking. Saudi Arabia produces nearly 10 million barrels a day – a third of the OPEC total,” it was reported as saying.

On why OPEC insists on retaining its production policy despite resistance in the market, PricewaterhouseCoopers (PwC) in its O&G ‘Opportunities in adversity’ report believed that OPEC’s response was borne out of experience from the 1980s.

“In order to preserve the oil price, Saudi Arabia (the largest OPEC producer) gradually decreased its production levels from 10 million barrels of oil equivalent per day (boepd) in 1980 to 2.5 million boepd in 1985 and lost market share to non-OPEC producers despite their higher production costs.

“As OPEC enjoys the lowest cost of extraction of oil of around US$30 per bbl and has accumulated substantial foreign reserves to see their fiscal spending through a period of low oil price, OPEC’s primary objective is to make non-OPEC production less commercial and hence curb its growth,” it pointed out.

Another contributing factor to the decline in O&G prices lie in US’ efforts to be self-sustainable via the ramp-up of its shale oil industry which has contributed to the surge in oil supply.

Since 2008, the US has increased its efforts to boost its domestic oil production. PwC pointed out that this additional supply readily offset production challenges in the Middle East triggered by the Arab Spring in 2011.

Producing over nine million boepd, US’ shale oil now rivals production levels in Russia and Saudi Arabia.

With the US threatening to increase its market share of the global O&G market, analysts believe this might be one of the main causes of the current instability in global O&G prices.

RHB Research Institute Sdn Bhd (RHB Research) in its June regional O&G sector report, pointed out that a new dynamics has started in the global market, which increases the uncertainty and volatility in the oil market.

“Shale oil producers now have to concentrate on the sweet spots, improve technology, lower costs and have more responsible financing.

“They are also now ready to ramp up production once the price of crude oil stabilises at around US$65 to US$70 per bbl.

“We believe Saudi Arabia may have to allow crude oil prices to rise high enough to sustain its own economy, but not to heights that would allow non-OPEC producers to significantly increase production – unless it is to meet that incremental demand. Saudi Arabia still has a strong grip on the oil market and it can choose to boost production and exports at any time, should the occasion arise,” it opined, noting that this could provide a further downside or cap crude oil prices for this year.

Aside from market rift between OPEC and US oil producers, another recent contributing factor to the current volatility is possible relief of Iran’s trade sanctions which could mean its return to the global oil market.

“Iran’s oil supply (post lifting of trade sanction) into the market in 2016 will further depress the global oil net surplus situation,” the research arm of Maybank Investment Bank Bhd (Maybank IB Research) pointed out in its 1H15 O&G sector report.

Lower oil prices and Malaysia’s O&G sector

With global oil market currently at its downturn cycle, what does this mean for O&G net exporting countries such as Malaysia?

According to Malaysian Investment Development Authority (MIDA) the oil, gas and energy (OGE) industry currently contributes about 20 per cent to Malaysia’s gross domestic product (GDP).

There are over 3,500 oil and gas (O&G) businesses in Malaysia comprising international oil companies, independents, services and manufacturing companies that support the needs of the O&G value chain both domestically and regionally.

(SOURCE: International Energy Agency

(SOURCE: International Energy Agency)

For the economy, analysts believe Malaysia could withstand the current O&G industry downturn. AffinHwang Investment Bank Bhd’s research arm (AffinHwang Research) believed that the impact of lower oil prices on the country’s fiscal position is expected to be manageable, and Malays will not likely to raise its deficit target further.

It highlighted that while the current lower oil and commodity prices will likely translate into weaker export earnings, as well as deterioration in Federal government’s revenue, Malaysia is on track to meet its deficit target of 3.2 per cent of GDP projected for 2015.

“Early this year, the authority had based its assumption on Brent oil price to average around US$55 per barrel projected for 2015 (revised lower from its earlier projection of US$100 per barrel), with proposed fiscal measures to reduce government operating expenditure by RM5.5 billion as well as improving efficiency in revenue collection for 2015.

“Going forward, we believe there are rooms for further operating expenditure rationalisation, especially in supplies and services, through more efficient cost management. Government’s dependence on petroleum-related revenue (PITA, petroleum royalty, and Petronas dividend) has fallen from 39.1 per cent in 2009 to 28.3 per cent in 2014 and likely to fall further to 20 per cent of total revenue estimated for 2015,” it opined.

It also noted that with the implementation of GST, it believed the fiscal deficit of 3.2 per cent of GDP is achievable in 2015 even with oil price ranging by an average of US$50 to US$55 per barrel.

“The implementation of GST at six per cent, which replaced the previous sales tax and service tax (SST), will likely generate tax revenue close to RM24.2 billion for the government in 2015. GST collection is expected to bring in an estimated average of RM31.4 billion revenue per year over the next five years,” it added.

Upstream players bear the brunt

Further down the line, however, Malaysia’s O&G players, particularly those in the upstream segment, are bearing the brunt of low O&G prices.

BMI Research in its third quarter of 2015 (3Q15) O&G report, viewed that for Malaysia’s O&G sector, a low oil price environment will hit short-term investment, particularly into exploration, and longer-term production prospects.

“Foreign gas demand for Malaysian gas will also be hit by a more competitive liquefied natural gas (LNG) market,” it opined.

The research firm added, “Weaker incentives to raise production from existing fields to full capacity in a weak oil price environment will see oil output fall in 2015 and 2016.

“The rising cost of projects in Malaysia, as project types increasingly move towards more difficult developments such as deepwater and enhanced oil recovery (EOR), will also see investment into longer term projects hit by subdued oil prices.”

Andy Brogan, EY’s Global Leader Oil and Gas Transaction Advisory Services further noted, “Transaction activity may have hit a five-year high in 2014, but the first quarter of 2015 was one of the quietest in recent years.

“The sudden and steep drop in oil price forced many companies, particularly those in upstream and oilfield services, to adopt an intense internal focus – aggressively cutting spending and costs.

“Transaction opportunities in the form of mergers and divestments have been delayed by uncertainty over oil price outlook.”

For Malaysia’s state-owned oil firm Petroliam Nasional Bhd (Petronas), which contributes about half of Malaysia’s oil revenue, its 1H15 net profit declined 47 per cent, in line with subdued global oil prices.

Maybank Investment Bank Bhd’s research arm (Maybank IB Research) in its August O&G report, viewed that cost cutting/rationalisation and capital discipline will go into a higher gear in 2016 and Petronas is unlikely to waver on its 30 per cent capital expenditure (capex) and operating expenditure (opex) reduction commitment for 2015 to 2016.

As a national oil firm which oversees many major O&G projects in Malaysia, Petronas’ capex/opex cut has taken a toll on many O&G players in the country.

“In fact, these cuts have been evident with its recent re-negotiations with service providers (rigs, offshore service vessels) and acute slowdown in its domestic offshore activities. If the situation turns bleaker, cuts may happen on headcount, as other global oil companies have started on that,” Maybank IB Research pointed out.

In Sarawak, O&G players such as Dayang Enterprise Sdn Bhd (Dayang) are also not spared by the weak crude oil price condition.

Its 2Q15 net profit saw a 35 per cent decline year-on-year due to lower hook-up and commissioning (HUC) work orders as compared to last year amid cost-cutting measures from its product sharing contract (PSC) clients.

According to Kenanga Investment Bank Bhd’s research arm (Kenanga Research), this was worsened by loss of RM3.7 million registered in the quarter compared to a profit of RM5.9 million previously from its associate, Perdana Petroleum Bhd (of which, Dayang has acquired in July) due to lower vessel utilisation.

Nevertheless, the research team pointed out that despite weaker the group’s weaker net profit, Dayang recorded better overall earnings before interest and tax (EBIT) margin of 29 per cent (compared to 27.9 per cent) possibly due to efficiency gains helped to offset the decline in profitability.

In a joint statement in its Annual Report 2014, executive chairman Datuk Hasmi Bin Hasnan and managing director Tengku Datuk Yusof Tengku Ahmad Shahruddin acknowledged the repercussions of declining crude oil price and believed that the group will be able to weather the storm via its RM4 billion orderbook.

“Dayang could leverage on its outstanding track record to offer its relevant services to tap into the offshore O&G industry in Malaysia.

“We still have call-out contracts estimated at RM4 billion which will at least last until the financial year 2018. In addition, we have an outstanding tender book of RM800million.

“We are also adopting various cost-cutting measures and initiatives to streamline our operations to make our outfit even more efficient in order for us to deliver stronger financial results for our shareholders. We believe that we will prevail through this challenging time,” they said.

Winners of lower oil price

On a positive note, while the decline of global crude oil price has negatively affected economies and sectors, several sectors have benefitted from this decline including the transportation sector.

“Although there will be a negative impact on the oil and gas sectors, other manufacturing and services will benefit from lower energy costs and a depreciated exchange rate.

“The positive impact on exports could be further increased by an improved outlook in trading partners, particularly the US,” the International Monetary Fund said in a its March country report of Malaysia.

Analysts believe that in the O&G field itself, among O&G players that will likely remain relatively resilient amidst low oil price environment are brownfield service providers as major O&G companies seek ways to produce efficiently without expanding its capex.

Dayang, for example, has been viewed positively by analysts for its position as a brownfield service provider as the company had recently been awarded a RM250 million contract for the provision of Facilities Improvement Project) for Petronas Carigali in Sarawak and Sabah.

Uzma, a company specialising in brownfield services, had also been awarded a Water Injection Facility (WIF) contract from Petronas Carigali to rejuvenate the D18 brownfield at offshore Sabah to improve its recovery rate to 30 to 35 per cent, from 20 per cent.

“We are positive on the WIF contract won amidst low oil price environment. This reemphasis our investment thesis that Uzma’s exposure to E&P opex instead of capex spending which should help it weather through this challenging period,” the research arm of Hong Leong Investment Bank Bhd (HILB Research) said in a report.

Aside from that, the aviation industry is also expected to benefit from the current low oil price.

TA Securities Holdings Bhd’s research arm (TA Securities) in a report, noted that for AirAsia Bhd (AirAsia), while the weakening of ringgit might affect its fuel cost and interest cost, it believed that this can be fully offset by the decline in jet fuel price.

“In our earnings projections, we are using ringgit assumptions of RM3.90 per dollar, 9.30 thai baht per ringgit, 3500 rupiah per ringgit and jet fuel price assumption of US$70 per barrel for 2016.

“However, if we base these assumptions on current spot rates of RM4.33 per dollar, 8.30 Thai baht per ringgit, 3286 rupiah per ringgit and jet fuel price of US$60 per barrel, AirAsia’s FY16 earnings forecast will be revised upward by 34 per cent, assuming the company will not pass on any fuel cost savings to consumers,” it explained.

The lower crude oil price will also augur well for consumers.

As lower prices mean that “sensitive” subsidies on the fuel gas are not being tackled for political reasons, most countries have found this period as ideal to cut back or eliminate subsidies to keep control its inflation rate.

Late last year, Malaysia’s government had opted to scrap the subsidies on fuel prices to cushion the impact of falling global crude oil prices.

As at September 2, 2015, according to Bernama, the price of RON95 and RON97 petrol have dropped 10 sen per litre to RM1.95 and RM2.35 respectively, while the price of diesel fell 15 sen per litre to RM1.80.

Outlook for Malaysia’s O&G for 2H and beyond

Given the current macro condition, analysts believe that the downturn cycle in the O&G industry will likely remain until 2016.

Kenanga Invesment Bank Bhd’s research arm (Kenanga Research) highlighted that Brent crude price resumed its downwards trend after rebounding to the US$60 to US$70 per bbl level in 2Q15, reflecting market’s fears of potential fresh supply from Iran post the sanctions lifting deal.

“We believe crude oil prices will remain at these levels at least until late 2016 given the economic slowdown in China, high US crude inventory and OPEC’s near-term decision to maintain its production level,” it pointed out.

However, significant production cuts in crude oil are not expected in the near-term as the drop in US rig counts are plateauing while the US production has declined 0.4 million bbl/day, which hardly make a dent as the supply surplus in the global oil market is expected to be at circa two million bbl/day.

“Notwithstanding, we anticipate more meaningful decline in production, especially in non-OPEC countries as the lag-effect of current capex cuts by oil majors take effect over the longer term,” Kenanga Research pointed out.

It also noted that sector valuations have not bottomed yet with Big Caps currently trading at 14.2-folds on average and Small Caps at 12-folds, still relatively higher than Big Caps/Small caps’ target price earnings ratios of 10-folds and seven-folds.

“We believe that the O&G sector has not bottomed yet despite the recent decline in share prices with more earnings disappointments expected,” the research firm said.

(SOURCE: International Energy Agency)

“The recent destabilisation of oil prices has again dampened the prospect of oil players especially drillers, OSV vessel owners and fabricators.

“Aggressive delays in vessel and rig deliveries are common nowadays in the wake of rig and OSV rate cuts.

“The whole industry, in our opinion, is going through a structural cost revamping cycle whereby cost cutting measures are applied across the board to make oilfield development projects economically viable at the current oil price range.

“This means margin pressures on service providers and asset owners in the medium-term as typically the costing structure are stickier compared to pricing whereby fixed overheads (which is depreciation) take a longer time to be reduced compared to services pricing.

“All in, we do not expect any sharp recovery in oil prices to US$80 per bbl and higher any time before 2017 while recovery in stability of earnings for O&G companies is seen only after cost readjustments by the oil majors,” it opined.

As such, Kenanga Research advised, instead of hoping for a sharp rebound in oil prices, industry players have to realign their costing structure and business model to survive in a prolonged oil price slump for the medium-term.

EY: Focus on strength and resilience

For energy executives managing in this uncertain world, EY in its ‘Resilience in a time of volatility: oil prices and the energy industry’ report, highlighted that there are three major areas of focus that can provide the strength and resilience needed to weather an extended period of lower prices.

“Operational resilience: Executives must gain a thorough understanding of marginal and break-even costs and use that knowledge to challenge operational assumptions.

“In the current environment, it is more critical than ever to deliver capital projects on time and on budget. Leadership teams must be willing to take bold action – such as re-scoping, deferring or stopping outright – any projects that are not on track.

“In addition, companies should be working to re-engineer their business models to lower their cost base, as well as renegotiating their supply chain and supplier arrangements to reduce expenses and collaboratively drive efficiency.

“By optimising their financial position, reshaping their portfolio, limiting costs and reducing risks, companies can weather a lower-price environment and position themselves for even greater success when prices rebound,” it said.

EY pointed out that companies must also learn to manage the imbalance between new levels of cash generation in a lower-priced environment and their internal and external obligations.

Financial resiliency includes optimising the company’s capital structure, restructuring the balance sheet, refinancing certain loans, if possible, and raising equity.

“Portfolio resilience: What are the strategic implications and risk exposures when investment assumptions no longer hold true? Which assets are underperforming or are distressed and could be carved out or divested?

“Now is a good time to optimise the company’s overall portfolio by restructuring capital allocations away from high-cost, lower-return projects.

“For companies with stronger balance sheets, it may also be time to seek out opportunistic acquisitions of challenged businesses or expand into growth markets. Joint ventures to share risk capital could also be explored,” EY suggested.

All in, EY said, while every oil and gas company can benefit from seeking resilience in finance, portfolio and operations, not every company is impacted in the same manner by lower oil prices.

“Regardless of market fluctuations, the integrated majors will survive – and even thrive. Many of the largest oil and gas companies will see a new normal as an opportunity to pursue affordable acquisitions that strengthen their strategic positions.

“Most national oil companies will endure intense fiscal and political pressures, but will survive.”