KUCHING: The oil and gas (O&G) sector, as covered in last week’s feature ‘Volatilty in the O&G Market’, has experienced much instability of late with oil prices impacted by various ongoing factors.

KUCHING: The oil and gas (O&G) sector, as covered in last week’s feature ‘Volatilty in the O&G Market’, has experienced much instability of late with oil prices impacted by various ongoing factors.

This has not slowed oil and gas giant Shell plc (Shell) from continueing its stride in the local markets as it had

Any Sarawakian will know the Shell brand – it has been in Malaysia for 120 years, first making its mark in Miri. It was also in this country where Shell’s upstream industry actually first began, with the country’s first oil well discovered by Shell on Canada Hillm Miri back in 1910.

Since then, Shell’s upstream business has grown from strength to strength: from Sarawak to Sabah and back down to Bintulu, where a natural gas liquefaction venture was formed,

The abundance of gas also prompted the establishment of the world’s first commercial middle distillate synthesis – the Shell Middle Distillate Synthesis plant – in Bintulu in 1993. As the first commercial Gas to Liquids (GTL) plant of its type, this allows Shell to sell ultra clean GTL products to the world.

From there, Shell eventually ventured into the deepwater industry offshore Sarawak.

In the downstream business, Shell has a large retail and distribution network and has the leading market share in the fuels retailing business in Malaysia. With over 950 service stations located across the country and a refinery in Port Dickson, Shell Malaysia Downstream business manufactures, markets and distributes a wide range of oil products.

Shell makes and sells more than 600 different lubricants in Malaysia for the automotive sector, heavy-duty transport, food processing and power generation. Shell also remains as the lubricants market leader in Sabah and Sarawak.

As for the projects and technology (P&T) business, Simon Ong, managing director of Shell Global Solutions Malaysia, Projects and Technology said in a project briefing recently that it is relatively new in Malaysia with the business having started as a very small group which expanded over the years.

The P&T business, which was officially launched in January 2010, provides technical services, technology capability and helps facilitate major project delivery to both the upstream and downstream businesses.

P&T also oversees safety and environment peformance and procurement processes across Shell.

“So, it is quite a big integrated business and in the Shell group, Shell in Malaysia is actually considered as a ‘mini-Shell’ because we actually have all the various businesses compared to other countries which may be only upstream or downstream-focused,” Ong told BizHive Weekly.

Shell is currently the petroleum retail market leader in Malaysia, catering to one-third of Peninsular Malaysia and half of Sabah and Sarawak’s market requirements.

Under production sharing contracts with Petroliam Nasional Bhd (Petronas), Shell is the largest natural gas producer in Malaysia.

BizHive Weekly looks at Shell’s many achievements both globally and domestically.

Shell: Delving into deeper waters

Shell places much focus internationally on deep water developments as it tries to increase its production and contribution from this segment.

According to Ben van Beurden, chief executive officer of Royal Dutch Shell Plc, the group reduced its capital investment from US$46 billion in 2013 to US$37 billion in 2014.

“We expect organic capital investment to be lower in 2015 than 2014 levels of around US$35 billion… but we want to preserve our growth to ensure we continue to generate cash flow and dividends for our shareholders.

“That is why we are still planning to invest in economically-sound projects this year in key growth areas, such as deep water and LNG,” van Beurden said.

Ong noted that Malaysia is a big part of that investment, through Gumusut-Kakap, Malikai and other Shell awarded projects.

Globally, Shell has produced around 370,000 barrel of oil equivalent (BOE) every day from deep water projects in 2014, comprising nearly 12 per cent of the group’s total global production.

According to the International Energy Agency (IEA), around 270 billion barrels of recoverable oil lie beneath deep water.

Shell noted that these will be a vital part of the energy mix as global demand rises.

The group further noted that deep-water oil already accounts for seven per cent of all conventional oil produced.

“The IEA predicts an expansion to 11 per cent in 2040, reaching a level of almost 11 million barrels a day,” Shell added.

Malikai a continued success

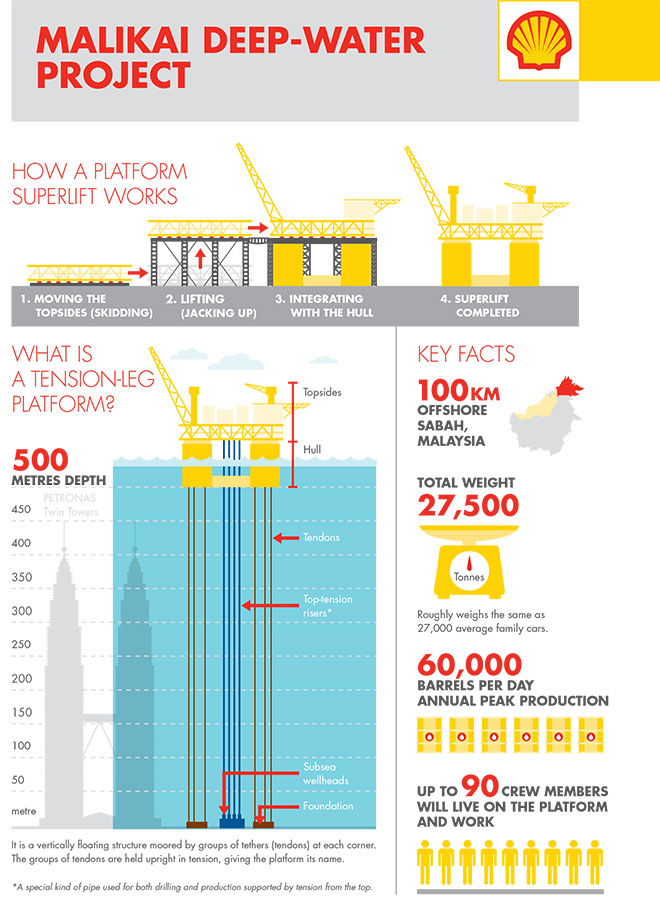

Malikai, Malaysia’s fourth deep-water development and Shell’s second in the country following the successful start-up of Gumusut-Kakap last year, employs the first platform of its kind in the country and strengthens Malaysia’s position as a regional deep-water hub.

The Malikai oil field lies around 100km or 60 miles offshore Sabah, at a water depth of around 500 metres (1,640 feet) and consists of two main reservoirs with peak annual production of 60,000 barrels per day.

(SOURCE: Shell)

Despite the fact that it is a smaller portion of what Gumusut-Kakap is producing, Malikai’s project manager Momas Modon mentioned in the project briefing that this will still help to sustain the production of oil in the country for decades to come.

Shell noted that the field’s tension-leg platform (TLP) will pipe oil to the shallow-water Kebabangan platform 50km (around 30 miles) away for processing.

“It also produces natural gas which will both power the TLP and be pumped into the production tubing to help oil flow from the reservoir (gas lift).

“Any extra gas will be sent out via the Kebabangan platform,” the group said.

On why TLP was chosen for Malikai, Modon explained that it was mainly due to the water depth, the nature of the water, as well as the size and scope of the facilities that they are going to have out there.

According to Shell on its website, the field is part of the Block G Production Sharing Contract awarded by Petronas in 1995.

Shell, the operator, and Conoco Phillips each hold a 35 per cent interest in the development while Petronas Carigali has 30 per cent.

The Malikai development will require wells drilled from the 27,500-tonne TLP production facility. The contracts for the engineering, procurement and construction of the TLP have been awarded and work is under way.

Shell said the first stage of drilling – the top part of the wells or “top holes” – was completed safely in January 2015 and that the main drilling campaign is scheduled to start in 2016.

Recently, Petronas, Shell and Technip-Malaysia Marine and Heavy Engineering Bhd (MMHE) Joint Venture (TMJV) safely integrated the topsides of its Malikai deepwater platform onto the hull, at Pasir Gudang, Johor.

Completed safely and on time, this achievement is the world’s first jacking and skidding at this scale and is also considered a major milestone for Shell’s first TLP designed and fabricated in Malaysia.

According to Ong, this record-breaking feat was achieved thanks to the excellent collaboration among Petronas, Shell, TMJV, ALE Heavylift Sdn Bhd (ALE) and their other subcontractors.

“Unlocking energy in deep water below the ocean’s surface poses major technical and project management challenges. It also requires advanced technologies, high safety standards and a responsible approach.

“Our projects in Malaysia have allowed Shell to share deep-water expertise with the Malaysian oil and gas industry, assisting in the government’s goal to create an offshore industry hub,” he said.

Leading up to the ‘superlift’, over 100 pieces of major equipment were successfully installed. In addition, around 9,000 pipe spools were fabricated and installed on the topsides while approximately 640km (equivalent to a roundtrip from Kuala Lumpur to Johor Bahru) of electric cables were pulled.

Gumusut-Kakap: Shell’s first deepwater project

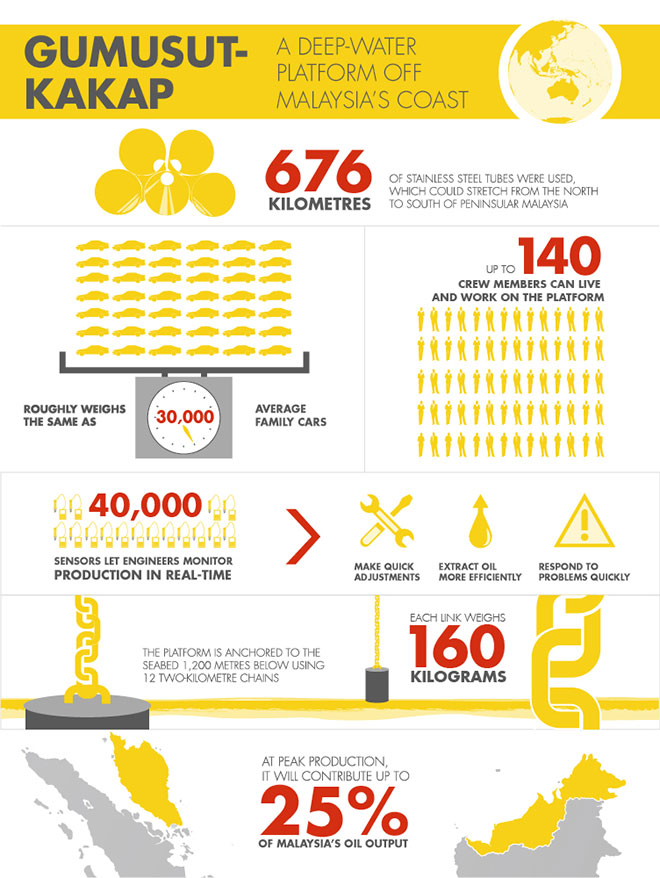

Gumusut-Kakap is Shell’s first deep-water project in Malaysia which uses the group’s advanced technology to safely produce and pipe oil from the Gumusut-Kakap field beneath seas of 1,200 metres or 3,900 feet deep.

Shell started oil production from the Gumusut-Kakap floating platfom last year in October and it is now producing on average over 100,000 barrels per day.

(SOURCE: Shell)

Shell noted that assembling the vast structure of the floating platform, whose four decks totalled nearly 40,000 square metres, involved the world’s heaviest onshore lift.

“The project uses Shell Smart Fields technology to carefully control production from the undersea wells to achieve greater efficiency.

“Oil is transported to the Sabah Oil and Gas Terminal onshore at Kimanis, Malaysia via a 200 km-long pipeline,” it said.

The Gumusut-Kakap project is a joint venture between Shell (33 per cent, operator), ConocoPhillips Sabah (33 per cent), Petronas Carigali Sdn Bhd (20 per cent) and Murhpy Sabah Oil (14 per cent).

The platform was fully built by Malaysian Marine and Heavy Engineering Sdn Bhd in Johor.

Overall, the project allowed Shell to share deep-water expertise with Malaysian energy companies, assisting in the Malaysian government’s goal to create an offshore industry hub.

“Shell is pleased to be able to play an active role in developing the nation’s deep-water resources and deep-water service industry.

“Deep-water resources are critical to Malaysia’s long-term energy security.

“The Gumusut-Kakap field is expected to contribute up to 25 per cent of the country’s oil production,” Shell Malaysia chairman Iain Lo had commented then.

Still lacklustre outlook for oil

KUCHING: Oil remains a tough subject today in lieu of disparate conditions.

Analysts from the research arm Public Investment Bank Bhd (PublicInvest Research) said among other factors, the still-possible Greek default shadowing global equity markets which has pushed on the strength of the US dollar.

While the US dollar is often a form of safe haven during economic turmoil, PublicInvest Research did however note that this does not bode well for oil prices since oil is traded in dollars and thus would be more expensive.

The research arm also highlighted on the Federal Reserve interest rate ‘gradual’ hike – a short-term variable that could send oil prices up or down.

“Where a quicker decision is expected to increase interest rates which could press down oil prices, a looser policy may push prices up,” it said.

In addition, PublicInvest Research noted the Organization of Petroleum Exporting Countries (OPEC) may see a change in leadership, as Ali al-Naimi, the Saudi oil minister is anticipated to retire and has a successor being groomed.

The research arm said that Naimi’s legacy strategy to keep output steady amidst a growing oil supply glut that caused prices to plummet, would indeed make him remembered.

It added that with Iran entering the fray and Naimi’s potential retirement on the table, the next OPEC meeting in November could be far more exciting.

Other factors affecting the oil price included geopolitical escalations, in particular in the Middle East and between Russia and the US, and the International Energy Agency (IEA) landmark report on recommendations to achieve “peak emissions” by the end of this decade.

PublicInvest Research also mentioned Iran’s “appealing” oil contract terms that include a collection of attractive contract terms to international oil companies which would pay more for higher production.

“It is also rumoured that Iran may even be prepared to offer production sharing contract (PSC) terms,” the research arm said, adding that it is also believed that Iran needs to joint venture (JV) with international oil majors to share its technology.

While the unstable oil prices has likely affected the O&G businesses in Malaysia, comprising international oil companies, independents, services and manufacturing companies that support the needs of the O&G value chain both domestically and regionally, leading energy company Shell is standing firm with its investments.

Harry Brekelmans, Projects & Technology director of Royal Dutch Shell plc, said in a speech at the Shell Innovation Open House, Mexico City, Mexico on June 3, that the current oil price is leading some companies to cut investments.

However, Brekelmans affirmed that Shell is determined not to fall into the trap of a start-stop approach, stressing that continued investment is critical, given that production from oil fields typically declines at a rate of on average five per cent a year.

“If there is no further investment in global oil production the gap between supply and demand could be 70 million barrels per day by 2040. This is the equivalent of six times the daily oil production in Saudi Arabia.

“This means that the world needs sustained and substantial investment to meet the demand to fuel economic growth, especially in the developing world,” he said.

According to the Organization of the Petroleum Exporting Countries (OPEC) Monthly Oil Market Report published on September 16, in 2015, world oil demand growth is expected to be around 1.46 million barrels per day (mb/d) after an upward revision of around 84 thousand barrels per day (tb/d), mainly to reflect better-than-expected data from the Organisation for Economic Co-operation and Development (OECD) region.

“In 2016, world oil demand is anticipated to rise by 1.29 mb/d after a downward

revision of around 50 tb/d,” it said.

On the world oil supply, it noted that non-OPEC oil supply is expected to grow by 0.88 mb/d in 2015, following a downward revision of around 72 tb/d, due to lower-than-expected output in the US while in 2016, non-OPEC oil supply is expected to increase slightly by 0.16 mb/d, a downward

revision of 110 tb/d from its previous report.

It also stated that OPEC natural gas liquids (NGLs) are expected to grow by 0.19 mb/d in 2015 and 0.17 mb/d in 2016.

“In August, OPEC crude production averaged 31.54 mb/d, according to secondary sources,” OPEC added.