It was a momentous Friday when Prime Minister Datuk Seri Najib Tun Razak finally announced a people-centric budget themed ‘prospering the rakyat’ on October 23.

It was a momentous Friday when Prime Minister Datuk Seri Najib Tun Razak finally announced a people-centric budget themed ‘prospering the rakyat’ on October 23.

Aside from carrying various measures to meet the demands of the people, particularly those in the middle-income and lower-income groups, Budget 2016 also outlined several projects and initiatives to promote investment and strengthen economic activities in the country.

Perhaps of specific highlight for East Malaysians is the proposed allocation of RM29.2 billion in total in a bid to intensify development in the two states.

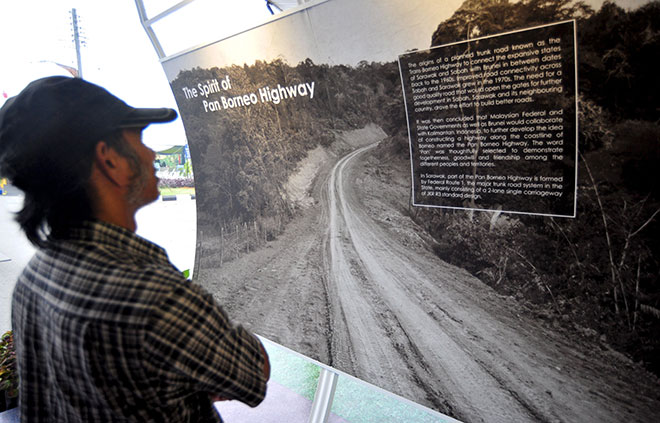

The largest allocations were for Sarawak’s Pan-Borneo Highway spanning 1,090-kilometre (km) which is expected to be completed in 2021 with an estimated cost of RM16.1 billion while in Sabah, construction work on the 706-km highway from Sindumin to Tawau is to commence in 2016 with an estimated cost of RM12.8 billion.

A bonus was thrown in with Najib announcing that Pan-Borneo highway will be toll-free.

Meanwhile, the development agenda also covered air transportation, which Najib acknowledged is one of the main modes of transportation for people in the interior areas of Sabah and Sarawak as well as Labuan.

The government has thus exempted the domestic air transportation for economy class passengers on Rural Air Services (RAS) routes from goods and services tax (GST).

Najib had also announced a new programme, whereby RM70 million would be provided through Bank Simpanan Nasional in collaboration with the state government of Sabah and Sarawak for interest free loans for the purpose of building longhouses with a maximum loan up to RM50,000 for every unit in the longhouse.

Other than the above, the government has allocated RM70 million subsidy for hill paddy fertiliser to increase food supply and income of hill paddy farmers in Sabah and Sarawak.

“The programme will cover 65,000 hectares of crop areas in Sarawak and 11,000 hectares in Sabah,” he said.

Under Budget 2016, RM260 million would be provided to ensure price uniformity of selected items nationwide through the 1 Price 1Sarawak and 1 Price 1Sabah programmes.

The Prime Minister also highlighted that RM115 million would be allocated to the Special Programme for Bumiputera in Sabah and Sarawak, such as for native customary rights, including mapping procedures and customary land surveys as well as for building native courts.

“For native customary rights, RM20 million is provided for land surveys in Sabah and RM30 million in Sarawak,” he added.

Lastly, Budget 2016 will be providing for the enhancement of services of 1Malaysia Mobile Clinics in the interior areas of Sabah and Sarawak including procurement of new boats and vehicles.

On whether this RM29.2 billion allocation was sufficient enough, Regina Lau, executive director of KPMG Tax Services Sdn Bhd (KPMG), stressed that it never is for these two states.

“How much is sufficient? It’s never enough – Sarawak and Sabah are the two largest states in the country and most parts are in dire need for very basic infrastructure that people in urban areas take for granted – clean piped water, electricity, access and communication.

“The allocation in the Budget meets but a small part of what East Malaysia really needs. RM29.2 billion is a start but we would certainly welcome more,” she said.

Lau added that what is not allocated to the states is hopefully utilised efficiently and effectively for other developments which will benefit East Malaysians indirectly.

This budget takes care of the middle and low-income groups, said Yeo Eng Ping, partner and tax leader of EY Malaysia, through initiatives such as the enhancement of various personal reliefs, the expansion of the goods and services tax (GST) zero-rated list to include more essential food items, controlled medicines and ‘over the counter’ medication, as well as specific measures to raise the income and wealth of the ‘below 40’ (B40) households.

“Not surprisingly, high-income earners have been called to pay more tax. We have observed similar developments in other countries such as Singapore and Japan.

“However, this is a rather bold move, considering this comes immediately after the decrease in personal income tax rates in last year’s budget together with the introduction of GST,” Yeo opined.

According to Lau, increasing the income tax rates for the high income group may not actually translate into much additional tax revenue for the Government.

“The proportion of salaried individuals falling in this category is not significant and those with other sources of income can structure their income package such that they receive their income in the form of dividends which are tax exempt under the single-tier dividend system of companies,” she said.

Lau noted that the adverse related tax impact on corporations paying the dividends is negated by the lower corporate income tax rate.

“The individual tax rate increase also reduces our competitiveness in this region – although Singapore announced an increase in their top income tax rate for individuals earlier this year, their rates are still much lower than ours.

“In addition, the increase may also adversely impact the government’s measures to attract talents back from overseas,” she added.

Additional relief

On another note, Lau highlighted that the new relief of RM1,500 on each parent is mutually exclusive from the existing relief of RM5,000 on medical treatment and special needs/care of parents.

Hence, an individual to whom both reliefs are relevant can only claim one, she noted.

“For the new relief to be really meaningful and beneficial, the mutually exclusive condition should be dispensed with,” she said.

As for the zero-rating of more basic goods, Lau opined that this is definitely good as zero rate means lower costs for consumers.

“As with all government policies, enforcement is key to ensure that the zero rating achieves the intended objectives.

“There is a need to ensure that the suppliers pass on the savings to the end consumers,” she said.

Areas for improvement

When queried on areas from the Budget 2016 which could be improved, Lau pinpointed the longer term measures needed to empower lower and middle income groups.

She acknowledged that the budget considers and tries to address the people’s main concerns on increasing costs and affordable homes.

“Measures such as the new tax relief on parents and enhanced existing reliefs will help to relieve some tax burden on the middle income group,” she said, adding that since these measures do not much benefit the lower income group not caught in the tax net, the budget provides for an increase in 1Malaysia People’s Aid (BR1M) and minimum wages.

Generally, while these measures would give immediate financial relief to the lower and middle income groups to a certain extent, Lau emphasised that longer term measures need to be put in place to empower these groups to increase their earning capacity and move them up the income ladder, which would also be in tandem with Malaysia’s aspiration to become a high income nation by the end of this decade.

And the key to such empowerment is education and training, Lau said.

“However, the budget allocation for education, training, health, housing and well-being is insignificant at only RM13.1 billion.

“A higher allocation should be given to these areas which are key to improving the livelihood of the people,” she added.

Lau also highlighted on the fact that development expenditure at RM52 billion constitutes less than 20 per cent of the overall budget allocation while in contrast, RM70.5 billion of the budget allocation goes to ‘Emoluments’ under operating expenditure.

“Serious attempts need to be made in trimming operating expenditure and increasing development expenditure for sustainable growth and benefits to the economy,” she said.

On aspects of Budget 2016 which should have been included, Lau noted that as opposed to just increasing BR1M, more specific measures were needed to address the people’s concerns of inflation.

According to Lau, the budget attempts to address the people’s concerns of inflation with measures to put more money back into the pockets of the lower and middle income groups so that private consumption can drive economic growth.

“Generally though, measures such as increasing BRIM are akin to treating the symptoms but not tackling the cause of the illness.

“The small sums put back into the pockets of these groups do not increase their real income or spending power.

“More specific measures of increasing real wages of the people are needed,” she said, adding that an increase in minimum wages without looking at productivity is not a solution and may even exacerbate inflation.

As for the sectors that are likely to benefit from Budget 2016, Lau said that the budget emphasises on infrastructure projects as a catalyst for economic growth.

“With the continuation of logistics infrastructure development, the construction sector and those in the supply chain should be the biggest benefactors,”

Sarawak construction sector scores big

Announcements under Budget 2016 vindicated predictions by analysts believing that the government will be more generous to developing Sarawak’s construction sector.

According to the research arm of TA Securities Holdings Bhd (TA Research), the proposed allocation of RM52 billion for development expenditure in Budget 2016 is 9.7 per cent higher than the amount of RM47.4 billion allocated in the revised Budget 2015.

“For the construction sector, Budget 2016 mainly focuses on the construction of rail networks and highways/ expressways,” TA Research observed.

The research arm of Kenanga Investment Bank Bhd (Kenanga Research) noted that for the construction sector, Budget 2016 was largely within expectations with the announcement of mega infrastructure projects namely MRT2 (RM28 billion), LRT3 (RM10 billion), highway projects like Pan Borneo (RM28.9 billion), Damansara-Shah Alam Elevated Expressway (DASH) (RM4.2 billion), Sungai Besi-Hulu Kelang Expressway (SUKE) (RM5.3 billion) and Refinery and Petrochemicals Integrated Development (RAPID) (RM18 billion).

According to Second Finance Minister Datuk Seri Ahmad Husni Hanadzlah, the announcement on the toll-free Pan-Borneo Highway could ensure the people in Sabah and Sarawak to have the opportunity to earn higher income.

“Admittedly, the people in Sabah and Sarawak are a little behind compared to people in the peninsular, that is why we (the government) build the highway, so that the people could be connected and their economies improved,” he said.

Meanwhile, Works Minister Datuk Seri Fadillah Yusof believed that the highway project could strengthen the country’s economy.

Fadillah said the project was in accordance with the government’s efforts to bridge the infrastructure gap between the peninsular, Sabah and Sarawak.

“We really want to close the gap, mainly involving urban and rural areas in Sabah and Sarawak. Furthermore, the toll free highway will not burden the people,” he said.

With the Sarawak state elections due to be held next year, AmResearch Sdn Bhd (AmResearch) envisaged several job flow opportunities for local home-grown contractors such as Hock Seng Lee Bhd (HSL) and KKB Engineering Bhd.

AmResearch also expected more allocations to develop Sarawak, particularly via the construction of hydro dams under SCORE and rural infrastructure.

The research house said that this would benefit Sarawak Cable Bhd (Sarawak Cable), which is the leading domestic transmission line player.

HSL shared with BizHive Weekly that the group was pleased to see the ongoing allocations for infrastructure in Sarawak.

“The Pan-Borneo Highway is a project which can generate considerable work for the construction industry.

“As a leading local contractor, we can expect to benefit,” it said.

Becoming a reality

The construction of the Pan Borneo Highway has finally become a reality more than 50 years later since it was first mooted around the times of Malaysia’s inception in 1963, the research arm of TA Securities Holdings Bhd (TA Research) observed.

It noted that the construction of the Pan Borneo Highway began in March 2015 with the stretch between Jalan Nyabau and Simpang Jalan Bakun.

“However, we are cautiously optimistic on the completion of the whole 1,090km stretch in Sarawak by 2021 given the weak soil condition along the coastal area of Sarawak.

“As comparison, the 772km North-South Expressway, which was shorter distance, was constructed in several phases and it took more than a decade to complete the entire expressway,” the research arm said.

On a side note, Julie Tan, executive director of Business Tax at Deloitte Malaysia told BizHive Weekly that with high expectations on this sector, there was disappointment that proposals by the Master Builders Association Malaysia (MBAM) for import duties reduction for heavy construction machinery did not materialise.

Tan noted that such machineries such as the hydraulic truck mobile cranes are levied with 30 per cent duty.

“The increase in minimum wage from RM900 to RM1,000 for Peninsular Malaysia and RM800 to RM900 for East Malaysia will also squeeze the already thin margin of six per cent to seven per cent that the industry currently makes,” she said.

Improving telecommunication infrastructure in rural areas

Najib had announced that to improve the telecommunication infrastructure, Malaysian Communications and Multimedia Commission (MCMC) will provide RM1.2 billion, among others, for rural broadband projects which will see a four-fold increase in Internet speed from five megabyte per second to 20 megabyte per second; National Fibre Backbone Infrastructure; High-speed Broadband (HSBB); and undersea cable system.

According to Kenanga Research, the budget allocation for the country’s broadband project is not new as it had previously been announced during the Budget 2014, Budget 2015 and 11th Malaysia Plan.

“Under this initiative, more Universal Service Provision (USP) projects are expected to be introduced and will likely benefit the tier-two telecom players,” it said.

The research arm noted that Redtone International Bhd (Redtone) will be the key beneficiary as the group has a strong track record in various USP projects as well as strong presence in East Malaysia.

Meanwhile, telecom tower builders such as OCK Group Bhd (OCK) may benefit from the higher telecom tower demand and some USP projects going forward, Kenanga Research said.

It further noted that on the HSBB and underwater cables project front, network back haul providers such as Telekom Malaysia Bhd (TM) and Time dotCom Bhd (Time) are likely to benefit from this angle.

On another note, JF Apex Securities Bhd (JF Apex) said that the cable laying investment might benefit Opcom Holdings Bhd (Opcom) (fibre optic cable company), Sarawak Cable (manufacturer of power and telecom cable), while the building of fibre infrastructure could benefit Instacom Group Bhd (Instacom), OCK, R&A Telecommunication Group Bhd (R&A) (players in telecommunication infrastructure).

Choo Seng Choon, executive director of Instacom, told BizHive Weekly that there is a strong co-relation between how strong a country’s broadband infrastructure to its development phase in today’s digital economy.

Propping the digital economy

According to Choo, broadband bridges the digital divide and empowers more businesses and people to participate in the digital economy.

“Through the Internet, local companies – especially small and medium enterprises – are able to tap into new markets and forge global partnerships to take their products and services further,” he said.

Choo noted that in light of this, the government’s move to improve telecommunication infrastructure particularly in rural areas throughout the country is a strong step in the right direction for Malaysia.

“Just as the Industrial Revolution changed the way products were manufactured and sold, the digital economy is the key towards Malaysia’s economic growth as it spurs the nation’s businesses on the path of high tech revolution,” he added.

At Instacom’s end, the group is optimistic to be involved in this nation building project.

As the leading end-to-end solutions provider for the telecommunications industry with bases throughout East and West Malaysia and, Instacom takes pride of its involvement in the nation’s telecommunication infrastructure development.

“We have been active in Malaysia’s telecommunication industry since 2001, and has been involved in the growth and expansion of this industry – from analog to digital, 2G to 3G to 4G, and now LTE and 5G.

“Currently, we are undertaking multi-million projects throughout Malaysia,” he said.

xxxxxxxxxxxxxxxx SIDE ARTICLE ON PAGE 9 xxxxxxxxxxxxxxxxxxxx

GST exempted airfares, construction of new airport in Sarawak garner neutral views

Analysts were generally neutral on the Budget 2016 announcement that air transportation services for passengers within and between Sabah, Sarawak and Labuan for economy class under the Rural Air Services are to be determined as an exempt supply.

“Obviously, this particular measure aims in helping frequent travelers within these areas in GST savings but we do not think this will stimulate air travel demand significantly,” TA Research said.

On the other hand, while MIDF Research was unsure of how the measure will be implemented, i.e. in the classification of a rural resident, the research arm viewed the move as slightly positive as it encourages rural folk to travel more by air and less by land or sea transport.

Meanwhile, Budget 2016 also allocated a sum of RM42 million for the construction of Mukah Airport, Sarawak as well as the upgrading of airports in Kuantan and Kota Bharu.

MIDF Research noted that the allocation complements the previous RM200 million allocation for the construction of Mukah airport to replace the old airport.

-What else is in store for businesses from other sectors?-

Property

According to Tan of Deloitte, Budget 2016 continues to propose some measures to provide affordable houses such as a RM1.6 billion allocation for 175,000 units PR1MA houses, RM200 million allocation to subsidise the building of 10,000 units under the Rumah Mesra Rakyat programme, RM200 million allocation to establish a First House Deposit Financing Scheme, and RM40 million allocation to revive abandoned low and medium cost housing projects.

In addition, Budget 2016 has allowed for the exemption on stamp duty to be given on financing instruments to contractors who revive the project as well as the original purchaser of the abandoned house.

Tan has however noted that the hope of further assistance to housebuyers such as the Developers Interest Bearing Scheme (DIBS) and further extension of the 50 per cent stamp duty exemption for property valued at below RM400,000 did not materialise.

“Nonetheless, it is a relief that the proposal to increase stamp duty rate to a maximum of four per cent and the bringing forward of duty collection date were not tabled.

“On the whole, there seems to be no hardy measures introduced to prop up the property sector market that is currently facing a downfall,” she said. Manufacturing

With domestic investment activity projected to contribute an estimated 26.7 per cent to gross domestic product (GDP) in 2016, Najib said in his Budget 2016 speech that to further promote reinvestment among existing companies in the manufacturing and agriculture sectors whose Reinvestment Allowance incentive has expired, a new incentive – Special Reinvestment Allowance – will be provided.

“The rate of claim is at 60 per cent of the qualifying capital expenditure and is allowed to be set off against 70 per cent of statutory income from year of assessment 2016 to 2018,” he added.

However, Tan noted that if the aim is to drive growth up to the year 2020 and beyond, the offer of the incentive up to 2018 may not be sufficient to encourage the investments needed to spearhead sustainable economic growth.

“This would, nonetheless, immensely benefit the manufacturing companies that are planning to expand their production capacity or venture into new productions to meet increasing export demands, thanks to the weakened Ringgit,” she said.

Meanwhile, Tan noted that to further encourage companies to increase exports, there is an existing incentive provided to manufacturing and agricultural companies to boost exports whereby tax exemption of 10 per cent and 15 per cent of the value of increased exports is granted on statutory income provided that the goods exported attain at least 30 per cent and 50 per cent value added respectively.

She also noted that to further ease the qualification for this incentive for smaller companies with paid-up capital not exceeding RM2.5 million, the required value added is reduced to 20 per cent and 40 per cent to qualify for the exemption of 10 per cent and 15 per cent of the value of increased exports respectively.

“However, with increase in the minimum wage, the production cost is likely to increase considerably, especially for labour intensive companies,” she said.

Tan added that with competition from countries in the region which offers concessionary low tax rates of five per cent up to a period of eight years (Phillippines) to 10 per cent for five years renewable periods (Singapore) and attractive export tax rebates as high as 17 per cent in China, the incentive offered by Malaysia may not stack favourably in comparison.

Tourism The tourism industry was another beneficiary of Budget 2016, with Najib announcing that to take advantage of the current level of the ringgit and in efforts to attract more tourists, the 100 per cent income tax exemption on statutory income for tour operators will be extended from year of assessment 2016 until 2018.

“The tourism sector has the highest potential to generate economic activities in the current situation.

“For 2016, the government targets 30.5 million tourists, which is expected to contribute RM103 billion to the economy,” he said.

Tan opined that in an industry reeling from air disasters and the bite of GST, perhaps the incentive would encourage tour operators to promote tourism to Malaysia.

She added that the implementation of E-Visa in 2016 for China, India, Myanmar, Nepal, Sri Lanka, US and Canada is also another aim to attract more tourists from those countries.

Agriculture

Budget 2016 has also allocated RM5.3 billion to the Ministry of Agriculture and Agro-based Industry, with a list of programmes to grow the industry.

Tan underlined some of the key highlights for the programmes which included that companies in food production will see the due date for applying for the 100 per cent tax exemption incentive and deduction of investment cost be extended from December 31, 2015 to December 31, 2020.

Tan underlined some of the key highlights for the programmes which included that companies in food production will see the due date for applying for the 100 per cent tax exemption incentive and deduction of investment cost be extended from December 31, 2015 to December 31, 2020.

She also highlighted on the qualifying food production projects which has been widened to include rearing deer, cultivation of mushroom, coconut, seaweed, honey bees and stingless honey bees and planting animal feed crops as determined by the Ministry of Agriculture and Agro-Based Industry.

“The incentive extension is much needed to encourage investment, both domestic and abroad, for the sector to upscale and upgrade its technology to help the country reduce food import and to promote export of agriculture produce,” she said.

GST exempted airfares, construction of new airport in Sarawak garner neutral views

Analysts were generally neutral on the Budget 2016 announcement that air transportation services for passengers within and between Sabah, Sarawak and Labuan for economy class under the Rural Air Services are to be determined as an exempt supply.

“Obviously, this particular measure aims in helping frequent travelers within these areas in GST savings but we do not think this will stimulate air travel demand significantly,” TA Research said.

On the other hand, while MIDF Research was unsure of how the measure will be implemented, i.e. in the classification of a rural resident, the research arm viewed the move as slightly positive as it encourages rural folk to travel more by air and less by land or sea transport.

Meanwhile, Budget 2016 also allocated a sum of RM42 million for the construction of Mukah Airport, Sarawak as well as the upgrading of airports in Kuantan and Kota Bharu.

MIDF Research noted that the allocation complements the previous RM200 million allocation for the construction of Mukah airport to replace the old airport.