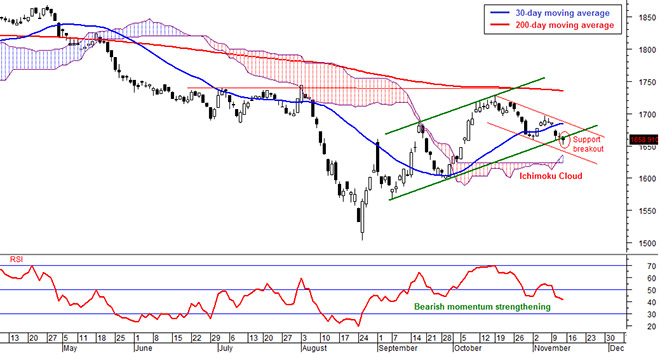

Daily FBM KLCI chart as at November 13, 2015 using Next VIEW Advisor Professional

The market declined last week on weak ringgit and decline in crude oil and crude palm oil prices. The declined erased gains made two weeks ago when the FBM KLCI rebounded from the support level at 1,659 points. The index is currently at this level. The FBM KLCI fell 1.6 per cent in a week to 1,658.91 points.

The ringgit weakened from RM4.30 to a US dollar two weeks ago to RM4.38 last Friday.21

Trading volume declined last week as investors shy away from an uncertain market. The average daily trading volume in the past one week declined from 2.5 billion shares two weeks ago to 2.3 billion.

The average trading value declined from RM2.2 billion to RM2.1 billion. Smaller capped stocks continued to dominate the top volume table in the past one week.

Weak ringgit continued to spur foreign selling. Net selling (From Monday to Thursday last week) from foreign institutions was RM393 million while net buying from local institution and retail were RM328 million and RM65 million respectively.

In the FBM KLCI, decliners pounced gainers 13 to two. Top gainers for the week were IOI Petronas Dagangan Bhd (1.1 per cent in a week), IHH Healthcare Bhd (1.1) and Westports Holdings Bhd (0.9 per cent).

Top decliners were Hong Leong Financial Group Bhd (7.8 per cent), Genting Bhd (6.2 per cent) and Sapurakencana Petroleum Bhd (4.5 per cent).

Markets in Asia ended up mixed. China’s Shanghai Stock Exchange Composite declined marginally from last week to 3,581.7 points last Friday.

Hong Kong’s Hang Seng Index fell 2.0 per cent in a week to 22,396.14 points. Singapore’s Straits Times declined 2.8 per cent to 2,925.68 points. However, Japan’s Nikkei 225 index increased 1.7 per cent in a week to 19,596.91 points.

After weeks of increases, the US and European markets started to pull back.

On Thursday, the US Dow Jones Industrial Average fell 2.3 per cent in a week to 17,448.07 points. Germany’s DAX Index declined 0.9 per cent to 10,782.63 points and London’s FTSE100 fell 2.7 per cent in a week to 6,189.58 points.

The US dollar Index futures rose continued to increase to fresh three-month high while gold retreated to a near 5-year low.

The index increased from 98 points from last week to 99 points last Thursday.

COMEX gold price fell to fresh three-month low and near a five-year low after declining 1.7 per cent in a week to US$1,084.50 ounce.

WTI crude plunged 9.4 per cent in a week to US$41.60 per barrel, the lowest on two-and-a-half months, on glut worries. Crude palm oil in Bursa Malaysia declined 1.6 per cent in a week to RM2,286 per metric ton.

After climbing above the short term 30-day moving average two weeks ago, the FBM KLCI failed to rally and declined below this average once again.

The second break below the moving average indicates a bearish sentiment. However, the index is still above the Ichimoku Cloud indicator and this indicates that the trend is still bullish.

The thickening cloud indicates that strong support but a breakout below the support level of the cloud at 1,614 points could indicate a bearish trend.

The momentum indicators indicate a bearish market sentiment. The RSI and Momentum Oscillator indicators declined below their mid-levels and the MACD indicator continued to fall below its trigger line.

Furthermore, the index is fell below the bottom band of the Bollinger Bands indicator and this indicates that the bearish momentum is picking up pace.

Technical indicators showed that the market is set to trend lower.

The bearish global market performance and weak commodities prices are bearish catalysts for the equity market. Henceforth, we expect the FBM KLCI to be sluggish and decline this week.

Based on the Fibonacci expansion from the downward movement since mid-May, the index may fall to 1,630 points and find support at this level.

The above commentary is solely used for educational purposes and is the contributor’s point of view using technical al analysis. The commentary should not be construed as an investment advice or any form of recommendation. Should you need investment advice, please consult a licensed investment advisor.