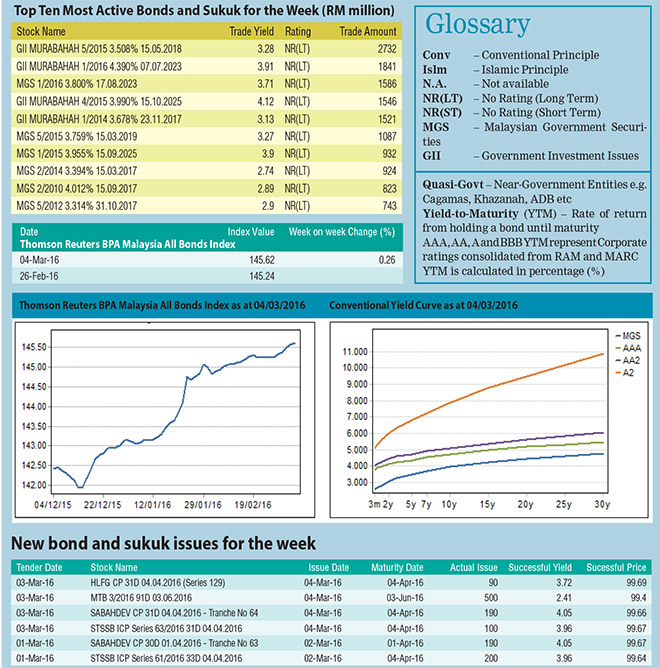

The TR BPAM All Bond Index recorded a gain of 0.26 per cent this week, closed at 145.62 compared to 145.24 last week. Over the week, sovereign bond yields were on bullish trend with one-year to 10-year regions closed lower by up to 13bps as a result of ringgit appreciation.

The TR BPAM All Bond Index recorded a gain of 0.26 per cent this week, closed at 145.62 compared to 145.24 last week. Over the week, sovereign bond yields were on bullish trend with one-year to 10-year regions closed lower by up to 13bps as a result of ringgit appreciation.

Ringgit versus US dollar had strengthened by 2.2 per cent this week to 4.1200 from 4.2115 last Friday on the back of stronger oil prices as a number of major oil producers such as Russia and Saudi Arabia have signalled that they may reach a deal to limit the oil production by later this month. The positive sentiment on oil prices is further supported by the US data that released on Wednesday, which indicated that their oil production fell to its lowest level since November. This data has raised the hope that the oil prices may have bottomed out.

On the international front, the People’s Bank of China announced a cut to the reserve requirement ratio by 50 basis points on Monday. This implied that an estimated 685 billion yuan (US$105 billion) of cash will be injected into the economy and it would help to cushion its economic slowdown amid poor stock market performance and currency depreciation.

The total trade amount of the top 10 most actively traded bonds decreased by 18.6 per cent this week to RM13.74 billion, compared to RM16.88 billion last week. GII papers gained heavy interest this week with four out of the top five actively traded bonds were GII papers. The three-year benchmark GII topped the list with RM2.73 billion changed hands.

On February 26, 2016, RAM Ratings has reaffirmed the AA2 rating of Bright Focus Bhd’s Sukuk Musharakah of up to RM1.35 billion in Nominal Value (2014/2031) but the outlook of the rating was revised to negative from stable. The negative outlook will be placed until the Group is able to display a longer and consistent track record of financial discipline.

On March 2, 2016, MARC has revised its outlook on Alam Maritim Resources Bhd’s AIS Sukuk Ijarah Medium-Term Notes rating to negative from stable. The negative outlook reflects the rating agency’s increased concerns on Alam Maritim’s weakening business prospects arising from the continued decline in its order book and the increasing challenges in winning new contracts in the current tough environment for offshore support vessel providers in particular and for the oil and gas industry in general.