A slew of data released. On the local front, the Monetary Policy Committee (MPC) meeting chaired by Datuk Muhammad Ibrahim for the first time announced to maintain the benchmark overnight policy rate at 3.25 per cent.

A slew of data released. On the local front, the Monetary Policy Committee (MPC) meeting chaired by Datuk Muhammad Ibrahim for the first time announced to maintain the benchmark overnight policy rate at 3.25 per cent.

According to the Monetary Policy statement, the economy is expected to expand by four to 4.5 per cent in 2016, and inflation is expected to trend lower for the rest of the year due to the low energy and commodity prices and the generally subdued global inflation. Besides, the financial system continues to be sound, with improved liquidity in the domestic financial system, continued orderly functioning of the financial and foreign exchange markets, and financial institutions operating with strong capital and liquidity buffers.

Besides that, the Department of Statistics Malaysia released the CPI for the month of April 2016 on Friday, which the index increased at a more moderate pace of 2.1 per cent compared to 2.6 per cent in March. The increase in CPI is contributed by the index for Alcoholic Beverages & Tobacco (20.1 per cent), Food & Non-Alcoholic Beverages (4.2 per cent), Restaurants & Hotels (2.7 per cent), Housing, Water, Electricity, Gas & Other Fuels (2.6 per cent), Miscellaneous Goods & Services (2.6 per cent) and Furnishing, Household Equipment & Routine Household Maintenance (2.6 per cent).

On the international front, the US Labor Department announced on Tuesday that US CPI jumped 0.4 per cent in April, the largest one-month increase since February 2013. Coupled with the release of FOMC minutes in April on Wednesday, said it would be appropriate for the committee to increase interest rates in June if data continued to show signs of improvement, market players perceived a higher possibility of US rate hike in the coming FOMC meeting in June.

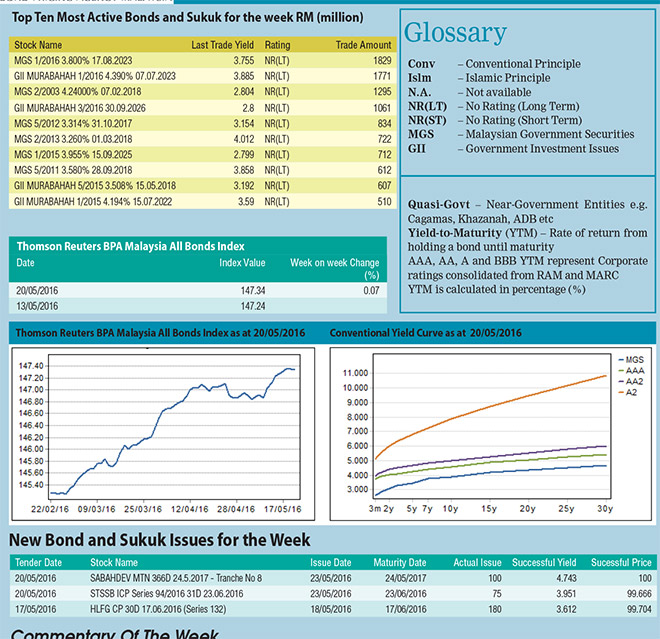

Nonetheless, the ringgit bond market did not react much to the data released this week. The Thomson Reuters BPAM All Bond Index closed the week with a minor gain of 0.07 per cent to 147.34, compared to 147.24 last Friday.

The total trade volume of the top 10 most active bonds increased by 16.6 per cent this week to RM11.60 billion compared to RM9.95 billion last week. The 7-year benchmark MGS maturing in July 2023 topped the list with RM2.1 billion changed hands.

On May 19, 2016, Bank Negara Malaysia announced the tender details for the new issue of 10.5-year benchmark MGS maturing on November 30, 2026. The tender of this RM4 billion benchmark MGS will be closed on May 23, 2016.

On May 16, 2016, Sabah Development Bank Bhd issued a one-year bond with a coupon rate of 4.753 per cent. This RM110 million worth of bond is rated AA1 with stable outlook by RAM Ratings.

On May 20, 2016, UEM Sunrise Bhd issued a seven-year sukuk with an issuance size of RM500 million. The sukuk carries a profit rate of five per cent and is rated AA- IS with stable outlook by MARC.