As the concept of halal grows increasingly attractive to Muslims and non-Muslims alike, the industry has grown into a powerful market force, with increasing demand across the globe in recent years.

No longer is ‘halal’ viewed solely a religious obligation or observance for Muslims, but a new engine to drive the economy.

According to Thomson Reuters in its ‘State of the global Islamic economy report 2015/2016’ report which was commissioned by Dubai Chamber of Commerce, the global halal market is expected to increase exponentially to US$2.6 trillion by 2020.

“This forms the potential market universe for the core halal product and services categories. With a consumer base of predominantly young 1.7 billion Muslims around the world, growing at two times the rate of the global population, the Islamic economy is one of the fastest growing markets in the world,” it pointed out.

In the food and beverage sector, the report noted that many food economists perceive that the halal food industry would become a major market force in the near future.

The report noted that currently, Islam is now the fastest growing religion in the world thus fuelling a global demand for halal products.

It also pointed out that there is an increasing trend of consuming halal products for ethical and safety reason by non-Muslim consumers.

From Asia to Europe, the halal food sector is becoming a major source of growth in both the Islamic and the global economy.

As demand for halal products grow, the halal food segment’s momentum is expanding across the food supply chain worldwide.

Thomson Reuters in its report, estimated that the Muslim food expenditure is expected to meteorite to a US$1,585 billion market by 2020 and will account for 16.9 per cent of global expenditure.

Based on its observation of the food market in 2014, Thomson Reuters noted that the collective global Muslim food and beverage (F&B) market is larger than the F&B consumption of the top geographical markets in 2014, such as China (US$797.8 billion), US (US$741.2 billion), Japan (US$367.3 billion), and India (US$335.7 billion).

Geographically, it noted that 16 per cent of Muslim food consumption is in non-Organisation of Islamic Coorporation (OIC) member countries.

“The 58 mostly-Muslim majority countries of the world represent more than US$7 trillion GDP (current) in 2014, a 1.7 billion population growing at a faster pace than the global population and some of the fastest-growing global economies that stretch from Indonesia in the east to Turkey in the west with the Arabian Gulf states at their centre.

“Their influence stretches beyond Muslim-majority countries as more than 350 million Muslims reside as minorities in many nations, with largely affluent ones living in the West and large populations residing in the emerging nations of India, China, and Russia.

“All over the world, this fast growing and relatively young population of Muslims is increasingly asserting its faith-based sensitivities in the marketplace to products as varied as food, banking, and finance extending all the way to fashion, cosmetics, travel and healthcare,” the report said.

In the Asia Pacific region, more countries are encouraging businesses to adopt and venture into the halal industry by ensuring their facilities are halal and more.

Recently, South Korea had expressed its intention to venture into the halal market by producing more halal South Korean food products, in partnership with Malaysia, while reports have noted that Chinese halal markets are growing at 10 per cent annually.

With this significant rise in demand for halal products, this opens a vast amount of opportunities for countries with a well-established halal industry to ride on this new trend in the market.

Chief executive officer of the Halal Industry Development Corporation Sdn Bhd (HDC), Datuk Seri Jamil Bidin had commented, “The global halal market is indeed thriving with huge potential and untapped opportunities.

“This rapidly growing industry is currently estimated to be worth RM8.4 trillion annually, comprising both the food and nonfood sectors.

“The halal food sector alone is worth almost RM2.5 trillion, and is also one of the fastest growing segments in the global food industry.”

BMI Research in a recent report, had also highlighted that global demand for halal processed food is expected to soar over the next five years, driven by rising awareness, a rapid growth in the Muslim population and rising disposable incomes in majority Muslim countries.

It also pointed out that countries such as Malaysia hold huge potential to become regional hubs for halal food production.

BizHive Weekly explores this niche industry that is quickly becoming new driving force in the food industry.

Malaysia as a halal hub

From its financial institutions to its pharmaceutical industry, Malaysia’s halal industry is well known through out the globe.

Malaysia’s economic position and social standing has allowed the country to thrive in the development of its Islamic economy.

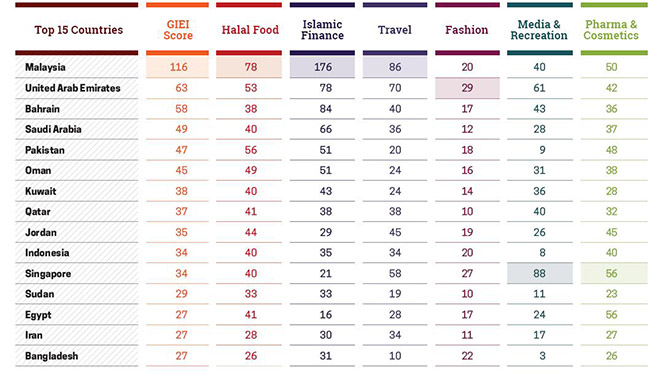

According to Thomson Reuters in its ‘State of the global Islamic economy report 2015/2016’ report, Malaysia leads by a large margin under the Global Islamic Indicator (GIEI) and hence, the country has the most developed Islamic economic system.

“It tops three of the six sub-sector indicators including the higher weighted Islamic Finance and halal food sectors. Malaysia’s Islamic Finance global industry leadership with the most mature governance and a high asset-base gives it the biggest margin lead compared to the other five sector categories.

“Its leadership in the halal food space globally makes Malaysia a pioneer and continues to lead with the best global halal standards, regulations and more importantly a compliance management process.

“It also has a strong halal travel ecosystem by virtue of the high number of Muslim visitors and a very high level of awareness among the industry on halal travel,” the report explained.

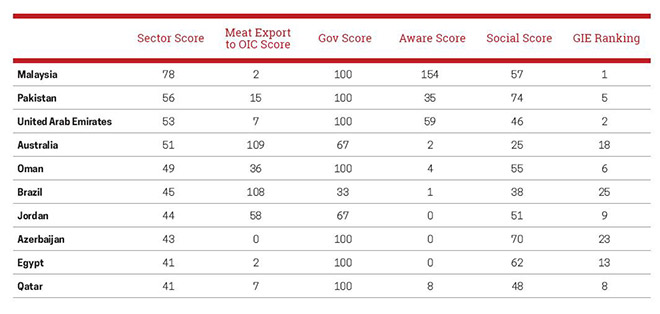

It also pointed out that Malaysia leads in the halal food indicator, along with Pakistan and the United Arab Emirates (UAE). The indicator ranking focuses on the health of the halal food ecosystem in a country, relative to its size and its related social considerations.

“Malaysia a well-recognised pioneer in the halal food space, leads the ranking with a healthy halal food ecosystem.

“While its meat exports to Organisation of Islamic Coorporation (OIC) nations relative to its size ranks low, Malaysia does have healthy overall food exports to OIC.

“The strong awareness through media coverage and events coupled with its market leading regulations and compliance processes make Malaysia the most developed halal food economy,” the report explained.

Ministry of International Trade and Industry (MITI) Minister Datuk Seri Mustapa Mohamed said the halal industry would continue to be driven by the growing Muslim population and consumer purchasing power.

“Malaysia’s export of halal products has been growing steadily by between RM4 billion and RM5 billion annually and Malaysia is also strong in Islamic Finance,” he recently told the press.

According to Malaysia External Trade Development Corporation (Matrade), in 2015, the country’s halal export reached RM42 billion, accounting for 5.4 per cent of Malaysia’s total exports.

The halal industry has also been listed as one of the many focus points under the 11th Malaysia Plan (11MP).

Under the 11MP, the halal industry will adopt strategic approaches to further develop the industry as a source of competitive advantage and catalyst for growth, encourage innovation and creativity anchored

on Islamic principles and values, as well as being pragmatic in implementing development strategies.

Institutional and regulatory reforms will be undertaken to increase the efficiency and effectiveness relevant agencies governing the halal industry while a business-friendly ecosystem and greater collaboration between agencies related to halal certification and auditing processes will be enhanced.

Under the plan, the government also plans to incentivised local industry players to obtain halal certifications to increase the halal offerings in the domestic market and position Malaysia as a global halal hub.

In addition, the halal services industry will be further intensified through the development of a regional centre that is equipped with an e-trading platform to link local halal suppliers to the global supply chain. Growth in the industry will be catalysed through innovation and research and development.

Halal Parks to boost halal industry

Among one of the major infrastructures being planned and developed to facilitate the growth of Malaysia’s halal industry is the ‘halal parks’.

These facilities, according to Halal Industry Development Corporation (HDC), are communities of halal-oriented businesses built on a common property where they are provided with infrastructure and service support.

According to HDC, currently there are 21 halal parks nationwide while 13 halal parks hold the HALMAS status.

A total of 18 multinational companies and 110 SMEs are currently participating in halal parks while total investments in halal parks have gone up more than RM8.07 billion.

In Sarawak, under Sarawak Corridor of Renewable Energy (SCORE) programme, Tanjung Manis has been selected as one of the growth nodes of the state with plans of making it an industrial port city and a halal hub.

In 2010, Tanjung Manis was appointed an accreditation from HALMAS, making it qualified under HDC to be certified as a ‘halal park’ and as such, qualifies for incentives and assistance by HDC.

Spanning over 80,000 hectares at the mouth of the Rajang river in the south, the park is said to be the biggest halal hub in the region.

Efforts in pushing the development of Tanjung Manis Halal Hub is still ongoing. However, with the start of the second phase of SCORE, Tanjung Manis Halal Hub is set to be the focus of the development.

This was disclosed recently by Second Resource Planning and Environment Minister Datuk Amar Awang Tengah Ali Hasan, who said the focus of the second phase of SCORE would be on Tanjung Manis Halal Hub.

“The Tanjung Manis Halal Hub, I believe, is the biggest halal hub in the region and is the best place

for investment as it has various opportunities from agriculture, livestock, fisheries and many others,” he told reporters.

He added that with the halal industry now estimated to be worth more than US$3 trillion worldwide, a potential awaits keen investors at Tanjung Manis.

Sabah explores halal hub potentials

Further up north, Sabah is also intensifying its halal industry with plans of making Lahad Datu Palm Oil Industrial Cluster (POIC Lahad Datu) a halal park which rides on the readily available palm oil and marine-based product industries.

POIC Lahad Datu had recently been awarded the Halmas certificate by the Halal Development Corp of Malaysia, the only one in Sabah.

News reports have noted that Lahad Datu is located in a Muslim majority region of the Brunei, Indonesia, Malaysia, Philippines and East Asean Growth Area (BIMP-EAGA), which has a market of more than 60 million people.

According to Datuk Dr Pang Teck Wai, the chief executive officer of state-owned POIC Sabah Sdn Bhd, the POIC’s focus was industrialising Sabah and developing appropriate and comprehensive infrastructure to attract foreign direct investments (FDIs).

“This is the key to taking Sabah’s manufacturing to a higher position in the state economy. In order to shift Sabah’s manufacturing sector towards an industrial state, we need FDIs which provide the technology and capital,” he was reported as saying.

POIC Lahad Datu noted that to date, it boasts a set of port infrastructure unseen elsewhere in Sabah. It has in operation a barge landing terminal, a dry bulk terminal and a liquid terminal.

Looking East, Asia takes a dip in the halal market

In the Asian region, more countries are opening its markets to new industries. With more free trade agreements (FTAs) being forged regionally, the potential for halal market to expand has grown rapidly these past few years.

In China particularly, there has been a huge demand for halal products and a rising interest in the overall halal market.

According to news reports, there are over 20 million Muslims in China and the number is projected to grow to over 30 million by 2030.

In Thomson Reuters’ report, China’s Muslim market has been reported to have grown to US$798 billion in 2014.

The country is also looking its halal capabilities by partnering with well-developed halal markets such as Malaysia.

This presents a huge opportunity for Malaysia’s businesses as according to Department of Statistics, Malaysia’s trade with China has increased by 11.1 per cent to RM230.89 billion. It is also Malaysia’s largest trading partner.

With 11 laboratories to conduct testing and analysis of halal products and a certification by Jakim which is recognised and well accepted worldwide, Malaysian halal-products has the potential to flourish in other countries such as China.

This rising demand can also be seen across other countries in East Asia, where the halal market is not as developed as Southeast Asia.

As Japan prepares to host the Olympic Games in 2020, the country is expected to draw an influx of Muslim visitors to Japan.

However, as the country is known for its limited availability of halal facilities and food products, Japan has been reported to be seeking countries with more experience in the halal industry, to meet the gastronomical demand of the incoming rise in visitors.

In the run up to the 2020 Summer Games, the country has also been reported to be seeking halal certifications in Southeast Asian countries as well as the Middle East.

According to Matrade, Malaysia’s exports of processed foodstuff to Japan in 2014 has increase 32.7 per cent RM620.3 million in 2014 from RM467.4 million in 2013. It ntoed thatJapan’s food sector is estimated to be worth RM736 billion (US$225 billion) in which 60 per cent are imported.

For South Korea, the country is looking to cooperate with the Department of Islamic Development Malaysia (Jakim) to venture into producing more South Korean halal food products to expand its market in Muslim countries.

South Korean Ambassador to Malaysia, Cho Byungjae, was quoted by Bernama as saying that Malaysia is the ideal platform to spearhead South Korea’s vision to expand its halal food market, given that Malaysia is said to be the global hub for halal food industry.

“We believe Korea and Malaysia can forge a very good partnership in this area (halal industry). With Korea’s manufacturing capability and with Malaysia moving ahead in this sector, if we can combine these two factors, I think we have a huge potential for further expansion.

“We are trying to go into the halal market and Malaysia is a very important market for our agriculture and food products…We want to penetrate countries in West Asia,” he told Bernama.

Across the globe, the European region also shows signs of adapting to the halal market. According to BMI Research, there is a fastgrowing Muslim population in Western Europe which could create strong demand for halal goods and services across consumer industries.

“Sustained migration flows from majority Muslim countries to Western Europe, combined with the favourable demographic dynamics of Muslim populations in Europe, will create strong demand for halal goods and services, which are growing from a low base in the region.

“Food will remain the most developed segment, but other segments such as Islamic clothing and financial products will also see growing interest,” it highlighted.

Challenges in the halal industry

While investment and business opportunities are abundant in the halal industry worldwide, like all industries, headwinds still remain in this niche sector.

A prominent challenge in the halal industry lies in the apparent lack of a unified halal certification and standard worldwide.

The halal certification process can be complex and opinions of ‘halal’ for governments and organisations differ in various countries.

Furthermore, the lack of awareness on the proper term of ‘halal’ in several non-Muslim countries further complicate the process in ensuring a standardised ‘halal’ system in the global halal food industry.

This lack of a unified certification and standard worldwide has caused difficulties for businesses and investors to attain market access into the halal industry as the certifications vary in every country.

Thomson Reuters in its report, pointed out, “There is ongoing confusion surrounding halal standards, primarily because they are being produced by so many different government-linked organisations; private organisations and independent halal certification bodies (HCB); national standards bodies, regional bodies such as Asean, GSO and the European Unione; and international bodies such as SMIIC/OIC initiative.

“The challenge for manufacturers is to determine which standard will actually provide market access, and in too many cases multiple certificates are necessary for exporters.”

(SOURCE: Thomson Reuters)

(SOURCE: Thomson Reuters)

Aside from that, the absence of any viable international schemes to accredit HCBs has long been a problem for the halal industry

According to Thomson Reuters, the majority of halal food is being produced in non-Muslim majority countries, and is certified by independent HCBs that operate with little regulatory oversight.

Aside from that, the report highlighted that another challenge in the halal industry is the difficulty in obtaining shariah-compliant funding in the supply chain. It explained that companies wishing to scale or to vertically integrate their supply chain face challenges in obtaining shariah-compliant funding.

Nevertheless, various developments in the halal industry has paved the way to overcome these issues.

Malaysia, for example, has taken the lead role in harmonising and modernising the halal food certification within the Asean region.

The HDC also coordinates the development of the halal food industry by developing halal standards and certifications.

It also takes a proactive role in promoting the halal food sector as well as consulting and supporting halal food producers.

Besides that, Thomson Reuters noted that for each region, leading standardisation bodies are taking steps to synchronise halal standards such as OIC’S SMIIC which aims to have a unified halal standard within OIC countries, and the European Committee for Standardisation (CEN) which is trying to have a unified standard for Europe.

“If these steps are successful within the next few years, though there won’t be a unified global standard, at least there will be a limited number of regional standards,” it said.

Current accreditation initiatives, such as being developed by SMIIC, GSO and ESMA are also all moves in the right direction, more coordination between the accreditation bodies is needed to avoid unnecessary duplication or competition, the report said.

In the supply chain, there is a rise in investment opportunities in the halal food chain integration.

As demand rises and more companies adopt the halal market, financing vertical integration of the supply chain, from slaughterhouses to distributors is an investment opportunity that should provide lucrative returns for the investors as well as develop strong companies in this space, Thomson Reuters observed.

Overall, there are still plenty of areas in the halal food industry that can be developed and can be seen as areas of opportunities for investors and businesses.

The halal food industry is vibrant and is rapidly becoming a mainstream sector across the world, despite uncertainties in its regulatory frame

works.