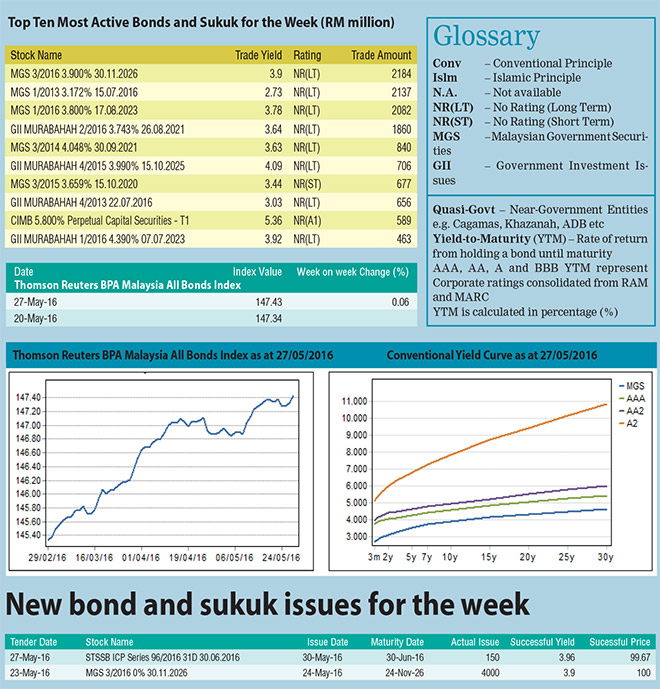

The Index has gained 0.06 per cent over the week to close at 147.43 on the back of a flattening MGS yield curve. The market was undecided on the next course of action as demonstrated by the movement in both currency and sovereign bond market.

The Index has gained 0.06 per cent over the week to close at 147.43 on the back of a flattening MGS yield curve. The market was undecided on the next course of action as demonstrated by the movement in both currency and sovereign bond market.

In the first half of the week, talks about potential Fed’s rate hike in June caused the Ringgit to weaken against US dollar coupled with the increase in MGS yields.

However, the Ringgit strengthened in the second half of the week as crude oil prices recovered and reached US$50 per barrel. The Ringgit ended the week at 4.0810 against the US dollar despite closing at 4.1230 on Tuesday.

Top 10 most active bonds:

The total trade volume of the top 10 most active bonds slashed by 22.4 per cent to only RM9 billion from RM11.6 billion registered last week. The new 10.5-year MGS maturing on November 30, 2026 topped the list with RM2.5 billion of trades transacted.

Sovereign bond action:

On May 23, 2016, BNM announced the tender result for the new issue of 10.5-year benchmark MGS maturing on November 30, 2026.

The tender of this RM4 billion benchmark MGS closed with highest, average, and lowest yield of 3.910, 3.900, and 3.878 per cent respectively with bid-to-cover ratio of 2.193x. On May 26, 2016, BNM announced the tender details for the new issue 5.5-year MGS maturing on November 30, 2021 with an issuance size of RM4 billion. The tender will be closed on May 30, 2016 and the issue date is the day after.

New Issuance(s):

On May 23, 2016, Sabah Development Bank Bhd issued a one-year bond with a coupon rate of 4.743 per cent. This RM100 million worth of bond is rated AA1 with stable outlook by RAM Ratings.

On May 25, 2016, both CIMB Bank Bhd and CIMB Group Holdings Bhd issued a perpetual-non-call-five-year Tier 1 capital securities with issuance size of RM1 billion each. Both are rated A1 with stable outlook by RAM Ratings and carry a coupon rate of 5.8 per cent.

DRB-Hicom Bhd issued a three-year RM30 million IMTN with a profit rate of 5.300 per cent. The IMTN is rated AA-IS with negative outlook by MARC.

On May 26, 2016, Cendana Sejati Sdn Bhd issued an eight-year RM10 million IMTN with a profit rate of 5.9 per cent.

The IMTN is rated AA1 with stable outlook by RAM Ratings. On May 27, 2016, Perbadanan Kemajuan Negeri Selangor issued a two-year RM100 million IMTN with profit rate of 4.6 per cent. The IMTN is rated AA3 with stable outlook by RAM Ratings.