Hawkish comments by the Fed chairwoman Janet Yellen coupled with improving economic outlook based on data released in the US during the week increases the probability of an imminent interest rate hike in the coming months.

Hawkish comments by the Fed chairwoman Janet Yellen coupled with improving economic outlook based on data released in the US during the week increases the probability of an imminent interest rate hike in the coming months.

These were the catalysts to the strengthening of the US dollar against all major currencies. The Ringgit was not spared either and has depreciated against the US dollar from 4.0810 last Friday to end the week at 4.1455.

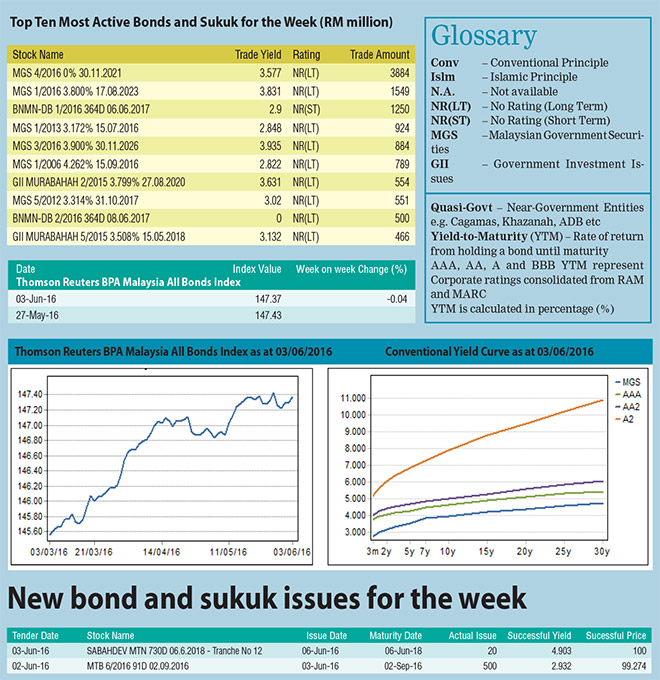

The ringgit’s depreciation against the greenback did not bode well in the ringgit bond market as evident by the upward shift of the MGS yield curve, as yields rose by approximately 1bps to 6bps across all tenures during the week. As a result, the Thomson Reuters BPAM All Bond Index posted losses of 0.04 per cent to close at 147.37.

On Friday, Department of Statistics Malaysia released the external trade statistics for the month of April. On a year-on-year basis, exports rose by 1.6 per cent to RM61.3 billion while imports declined by 2.3 per cent to RM52.3 billion. Trade surplus for April 2016 was recorded at RM9.1 billion, 31.9 per cent higher compared to a year ago.

Over in Europe, the European Central Bank (ECB) has left its main refinancing rate unchanged at zero per cent and deposit rate at 0.4 per cent. The ECB has raised its projections for growth to 1.6 and 1.7 per cent for the next two years. 2016 inflation forecast was also raised to 0.2 per cent from 0.1 per cent, citing factors including base effect of a recent rise in oil prices.

Top 10 most active bonds:

Trading activities in the Ringgit bond market this week was relatively active compared to previous week as the total trade volume of the top 10 most active bonds increased by 26.3 per cent to RM11.4 billion from RM9 billion registered last week. The newly issued 5.5-year MGS maturing on November 30, 2021 topped the list with RM3.9 billion of trades transacted.

Sovereign bond action:

On May 30, 2016, the tender for the new issue 5.5-year MGS maturing on November 30, 2021 closed with a weak bid-to-cover ratio of 1.420 times, the lowest seen this year. The highest, average and lowest yield came in at 3.640, 3.620 and 3.594 per cent respectively.

New Issuance(s):

On May 30, 2016, Mydin Mohamed Holdings Bhd issued a 3.5-year Islamic Medium Term Notes (IMTN) with a profit rate of 4.7 per cent. The RM55 million worth of IMTN is rated AAA(FG) with stable outlook by RAM Ratings. The IMTN is guaranteed by Danajamin Nasional Bhd.