For Malaysian consumers, the last couple of years have been a mercurial ride with the implementation of the Goods and Services Tax (GST) and the subsequent effects of it as well as other global and domestic events which have rippled through prices of goods and services.

For Malaysian consumers, the last couple of years have been a mercurial ride with the implementation of the Goods and Services Tax (GST) and the subsequent effects of it as well as other global and domestic events which have rippled through prices of goods and services.

As cost of goods and services gradually increases, most consumers have cut down their spending, to save on essentials.

Softening consumer confidence have also taken a toll on businesses. In particular, the retail sector was affected more significantly by lower consumer confidence.

Nevertheless, at the start of 2016, statistics and reports have shown that consumer confidence in Malaysia are slowly recovering and there are signs of of it stabilising.

According to Nielsen Global Survey of Consumer Confidence and Spending Intentions, the Malaysian consumer confidence remain stable at the start of the first quarter of 2016 with 79 percentage points (pp), dipping one point from previous quarter).

Globally, the report showed that Malaysia held on to its ranking as 36 most confident country in the first quarter (1Q) 2016 (unchanged from last quarter). Of note, the average global consumer confidence is 98 pp (one pp from previous quarter). Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism.

However, while there are signs pointing towards improvements in consumer sentiments in Malaysia, analysts and industry observers are still cautiously optimistic on consumer trends.

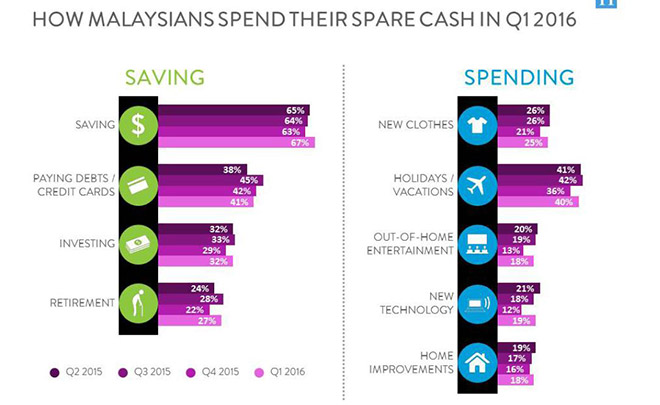

SOURCE: Nielsen Global Survey of Consumer Confidence and Spending Intentions 1Q16

Richard Hall, country manager of Nielsen Malaysia, pointed out in a statement, “With no real changes in the economic outlook, Malaysians’ confidence remains low and we see that this trend will continue to be the case until the pressure on the ringgit ease.

“Only when the pressure of the ringgit improves, can consumers start to feel the burden of their day-to-day spending lessen.”

Nielsen noted that while the nation’s fiscal status (52 per cent compared to 50 per cent in prior quarter) continues to top the list of major concerns among Malaysian consumers, nearly a quarter of the respondents have cited that job security is now their second top worry (22 per cent).

“Recessionary sentiments among Malaysians continue to remain high (84 per cent, unchanged from last quarter) with only one in five respondents feeling positive that the country will be out of an economic recession in the coming 12 months (22 per cent, unchanged from prior quarter),” the survey reported.

The survey also revealed that consumers in Malaysia would continue to reduce household spending even when economic conditions would improve with nearly nine in 10 Malaysian consumers changing their spending habits in the past year to improve saving (88 per cent).

It said, the top three areas where consumers in Malaysia would continue to cut back even when economic conditions do improve are spending less on new clothes (65 per cent), reducing out of home entertainment (56 per cent) and switching to cheaper grocery brands (51 per cent).

“Despite the fact that none of the economic key performance indexes (KPI) indicate that the country is in a recession, consumers continue to believe that the current situation and the future for the country is not positive.

“To change this attitude will require a step change in the current environment,” Hall observed.

Affin Hwang Investment Bank Bhd’s research arm (Affin Hwang Capital) in a recent report highlighted the main themes affecting consumerism include the implementation of GST and the weakened ringgit against the US dollar.

“While the consumer sentiment is at its all-time low with consumers mainly worried about the higher costs of living, income levels and the economy, several macroeconomic indicators are pointing towards an improvement,” it pointed out.

“Consumers have been hit by higher costs of living, with headline inflation spiking to a high of 4.2 per cent year-on-year (y-o-y) as of February 2016.

“Both Malaysian Institute of Economic Research (MIER) and Nielsen surveys highlight job security and income worries as key concerns among consumers, in addition to the current state of the economy,” it said.

In a separate report, the research arm of TA Securities Holdings Bhd (TA Securities) expected consumer sentiment to remain weak in 2Q and continue to remain flattish throughout the year.

However, it pointed out that consumer sentiment level, according to MIER, have rebounded by 9.1 points, suggesting that consumers have adjusted their spending pattern to take into account the impact of GST their purchasing activities.

“Coupled with financial aids given by the government through BR1M, reduction in employees’ EPF contribution, and increase in minimum wage for private and public sectors workers that will be implemented on July 1 this year, could lessen the impact of demand slowdown,” it added.

Grocery retail retains growth despite headwinds

A closer look into the consumer sector shows that while consumer sentiments is expected to remain subdued in the near-term, Malaysian consumers’ purchasing power is improving in certain categories.

According to Nielsen, consumer purchasing power in the Fast Moving Consumer Goods (FMCG) category gained traction in 1Q of 2016 versus the same quarter in the prior year (4.7 per cent).

It added, all FMCG super categories registered a healthier growth lead by beverage (8.8 per cent), grocery (4.3 per cent), household (3.9 per cent), health & wellness (2.7 per cent), snack & confectionary (two per cent) and personal care (1.7 per cent).

“In spite of the FMCG industry having a strong start to last year due to the GST introduction in April 2015, we have been pleasantly surprised to see the majority of categories still in growth, with the modern trade leading the way.

“While there has negative sentiments surrounding the increasing cost of living, consumers still need to buy groceries and it looks like they are not necessarily down trading their purchasing decisions,” Hall noted.

In Malaysia, while hypermarkets still dominate the general FMCG or grocery markets, there are growth opportunities for convenience stores given that demand still remains strong for FMCG or grocery goods.

In a report, the research arm of DBS Bank Ltd (DBS Group Research) pointed out, “There is room for Malaysia to grow its convenience stores as the number of convenience stores per one million total population lags behind Indonesia, Singapore and Thailand.

“However, it leads Asean-5 in supermarket and hypermarket outlets-to-population ratio. Among the three main modern grocery retail formats, convenience stores registered the fastest growth from 2009 to 2014 at 17 per cent compounded annual growth rate (CAGR),” it said.

It also noted that convenient stores offer products and services that are within reach of consumers compared to supermarkets and hypermarkets.

“The layout of many Malaysia towns tends to be spaced out and it is common for people to commute in cars. As such, there are many big box hypermarket developments in Malaysia.

“Hypermarkets are seen as a convenient place with a wide selection of products for consumers to visit. Supermarkets in suburban neighbourhoods play the role of supplementing hypermarkets, while convenience stores offer 24-hour service.

It also pointed out that generally, purchasing habits for consumers in Asia have also shifted with convenience as a key factor in their purchasing habits.

“Formats penetrate Asean food consumption in different manners. Supermarkets will always be a key feature in malls located in densely populated cities.

“Convenience stores are strong in penetrating every corner of cities and in obscure locations outside them. Hypermarkets are capable of capturing consumption in more spaced-out locations with high automobile accessibility.

“With modern and traditional grocery retailers situated in cities and neighbourhoods, it is convenient for consumers to pick up grocery items physically and even on the move,” it said.

Convenience store retailers are likely to sustain growth, given their aggressive outlet expansion to meet demand for convenience, DBS Group Research observed.

With that, BizHive takes a look at some of Malaysia’s top convenience store retailers.

7-Eleven the ‘go-to’ convenience store

Since its listing on Bursa Malaysia in 2014, 7-Eleven Malaysia Bhd (SEM) has grown by leaps and bound across the nation.

With a market share of 82 per cent of the standalone convenience store segment as of March 2014, SEM, which manages the 7-Eleven convenience store chain in Malaysia, is the largest convenience store operator in the nation.

As of Dec 31, 2015, SEM has a total of 1,944 stores serving more than 900,000 customers per day. According to its 2015 Annual Report, 1,793 or 92.2 per cent of its stores are corporate-owned while 7.8 per cent are operated by franchises.

“Sales and profits both delievered impressive results despite the difficult retail market environment which was significantly impacted by the introduction of GST for the first time on April 1, 2015.

“On top of this, consumer confidence was measured at a 10-year low level in 3Q15 which also subsequently impact consumers spending behaviour,” said Shalet Marian, independent none-executive/chairman of SEM, in her chairman’s statement from its 2015 Annual Report.

“Despite the earlier mentioned headwinds in the the total FMCG retail market in 2015, the company has recorded a strong six per cent growth rate in total sales compared to the previous year.

“Total sales amounted to RM2.006 billion although our same store sales showed marginal decline of 3.6 per cent as a result of the GST impact on sales values.”

This year, according to previous news report, SEM expects to spend between RM85 million and RM90 million as part of its expansion plan which includes the opening of 200 new stores this year.

SEM chief executive officer Gary Brown was quoted as saying that this expansion would see more outlets in Klang Valley, the east coast, as well as Penang, Johor and Melaka.

“We will continue to invest in new stores and building our network. The investment also included refurbishment of our existing 200 stores this year,” he said to reporters after the group’s AGM.

He was quoted as saying that the company had also set aside major capital expenditure to continue to upgrade its new information technology (IT) system.

“The new IT system project which started in 2014 costing RM66 million is expected for completion by the middle of this year,” said Brown.

Marian added, “Our plan is to continue to bring 7-Eleven true convenience to more and more customers in Malaysia and as such we expect to expand our store network by approximately 200 new stores in 2016.”

In 2015, SEM had opened 199 new stores nationwide. As at December 31, 2015, the group has total cash reserves of RM126 million.

Meanwhile, on SEM’s performance in 1Q16, the research arm of Maybank Investment Bank Bhd (Maybank IB Research) noted that its results were in line with expectations but the research house remains cautious of its earnings outlook.

“We continue to expect new store openings and better contribution from its refurbished stores to help drive growth.

“As a recap, for 2016 and beyond, we understand that SEM targets to open 200 stores per annum. Nonetheless, we remain cautious on its near term earnings as it will be facing some near term headwinds such as the minimum wage hike come July 1, 2016.

“In the longer term however, we expect SEM to eventually pass the higher cost through to consumers via higher merchandise prices,” it opined.

Aside from that, recently, SEM had signed a memorandum of understanding with Brahim’s SATS Food Services Sdn Bhd (BSFS), a 51 per cent owned subsidiary of Brahim’s Holdings Bhd (BHB).

This will expose Brahim’s to a wider market via SEM’s close to 2,000 stores network all across Malaysia, which is in line with the objective of the strategic partnership between BHB and SATS Ltd (SATS) to venture into non-airline business in Malaysia.

Analysts believe that this is a synergistic partnership as it could benefit both parties which are currently faced but headwinds in the consumer sector.

“We understand that some convenience store players domestically has been facing some supply chain issues (such as product quality, consistency and choices) mainly due to dependence on multiple fresh food suppliers and scale and reach of the existing food suppliers.

“Therefore, collaboration with a sizeable party could benefit SEM in the longer term in terms of cost efficiencies and consistency of product quality/choices while not having to move away from its core competence of managing convenience stores.

“To note that fresh food and services as a percentage of merchandise sales has been fairly stable, at est. 10 per cent,” Maybank IB Research opined.

Under this MoU, BSFS is expected to provide packaged ready to eat (RTE) meals such as panini sandwiches, the ever popular nasi lemak and fried rice that would be branded under 7-Eleven’s proprietary food service brand of ‘Fresh to Go’.

Looking ahead, Marian said, “Despite the current uncertainty and consumer confidence issues which impact our customers and their spending behaviour, I am confident about the growth prospects of our company as we are resilient and have positioned ourselves to maintain our market leadership position not just in 2016 but for the years beyond.”

Bison: Malaysia’s largest home-grown retailer

Incorporated in 2013 as Prempac Sdn Bhd and converted into a public limited company in 2015, Bison Consolidated Sdn Bhd (Bison) was successfully listed on Bursa Malaysia earlier this year in March.

The research arm of CIMB Investment Bank Bhd (CIMB Research) cited Bison as Malaysia’s largest home-grown convenience store operator and has an estimated total market share of 8.6 per cent in 2015, with up to 255 outlets (including eight, WHSmith outlets).

Through its subsidiaries, the group provides unique offerings under its main trade name ‘myNews.com’ a press and convenience retailing business.

According to its initial public offering (IPO) prospectus, Bison also operates other outlets under the trade names of ‘newsplus’ ‘MAGBiT’, and THE FRONT PAGE’ as well as under the trade name of ‘WHSmith’ through its join venture with WH Smith Travel, an indirect wholly-owned subsidiary of UK-based WH Smith Plc.

While it was incorporated in 2013, Bison’s conception can be tracked back to 1996 with the establishment of Bison’s first newsstand outlet under the brand name ‘MAGBiT’.

CIMB Research highlighted that over the last few years, Bison has been registering positive and consistent revenue and core net profit growth, with a two-year compounded annual growth rate (CAGR) of 17.4 per cent and 7.5 per cent, respectively.

“The double-digit revenue growth was mainly driven by higher merchandise sales, consumer services and advertising and promotion, which were boosted by the growth in the number of stores for the group,” it added.

The research team also noted that for the past three years, Bison?s gross profit margin has expanded from 33.3 per cent in FY13 to 34.2 per cent in FY15.

“The consistently better margins can be attributed to the increase in revenue from its consumer services as well as its advertising and promotion revenue, which carry no cost components due to its nature as fee income,” it said.

In Malaysia, the retail convenience store sector has been viewed as largely underpenetrated.

According to a study by Smith Zander, Malaysia’s retail convenience store penetration rate is 135 stores per million people, far below that of more developed countries in the Asian region, such as Singapore (162 stores/million people), Hong Kong (190 stores/million people), Japan (407 stores/million people), Taiwan (419 stores/million people) and South Korea (485 stores/million people).

As such, CIMB Research believes that this industry still has plenty of potential to play catch-up.

“Given Bison’s established and well-known presence in the domestic retail convenience store industry, management believes that the group is well positioned to capture the significant growth opportunities available,” it added.

“With an estimated market share of 8.6 per cent (in terms of total number of outlets in 2015), Bison is the second-largest retail convenience store industry player in Malaysia.

“Even though the retail convenience store scene remains highly competitive, we are not overly concerned as Bison has an extensive and strategic store network compared to the smaller players, which mostly hold less than one per cent of the market share (based on the latest publicly-available data collated by Smith Zander),” it commented.

While Bison, like every other retailer, faces headwinds such as weak consumer sentiments, the research team said the group would be able to withstand these challenges as most of its earnings are derived from its merchandise sales which are mostly generated from food and beverages and small ticket items.

It also noted that the group could benefit from its commission-based income from consumer services and advertising and promotions.

It further pointed out that despite the overall weaker market conditions, Bison had managed to generate a healthy net profit growth of 7.4 and 7.5 per cent y-o-y in FY14 and FY15, respectively.

Overall, CIMB Research forecast Bison to deliver a two-year profit CAGR of 31.1 per cent against 25.5 per cent revenue CAGR, based on the group’s net profit of RM13.5 million recorded in FY15.

“We are forecasting for turnover to be fuelled by a conservative SSSG of 1.4 per cent over the next two years (in line with the historical three-year SSSG CAGR of 1.4 per cent) on the back of the group’s expansion plans for its outlets and increased income from its advertising and promotion as well as consumer services.

“Our SSSG assumption has also factored in the potentially softer consumer spending backdrop amid concerns of mounting prices and a gloomier job outlook.

“We highlight that despite the implementation of GST in April 2015 and rising living costs, the group still managed to chalk up commendable 19.3 per cent y-o-y growth for its FY15 revenue.”

FamilyMart enters the fray

The FamilyMart brand of convenience store, owned and founded by Japanese-based FamilyMart Co Ltd, has over 17,540 stores in seven countries worldwide, as at March 31, 2016.

Ranked as the second largest convenience store chain in the world, the convenience store focuses on retailing convenience products, with emphasis on ‘nakashoku’ or ready-to-eat/take-out food and beverages.

Earlier this year, FamilyMart as well as QL Resources Bhd’s (QL Resources) wholly owned subsidiary, Maxincome Resources Sdn Bhd have announced earlier this year that they will be bringing in the popular brand into Malaysia to serve the rising demand of consumers here.

To note, Maxincome Resources has signed an area franchise agreement with FamilyMart which grants QL Resources via Maxincome Resources, the exclusive master franchisee rights to develop and operate FamilyMart convenience stores in Malaysia for 20 years, renewable for subsequent periods at the option of the Master Franchisee.

With this agreement, QL Resources anticipates to open the first FamilyMart in Malaysia by December 2016.

“FamilyMart Co Ltd’s philosophy and values resonate with QL Resources’ mission of providing nourishing agro-based products for the benefit of all. Their emphasis of delivering quality food is also a value that QL Resources, as a food company values and sees synergy in.

“In addition to this synergistic effect, this expansion is a long-term investment which also opens up bigger growth opportunities in the consumer market for the group. It fits into our strategy of strengthening and expanding integration of the group’s value chain,” said QL Resources.

Basing their target on the track record of FamilyMart stores in other countries, QL Resources aims to have 300 FamilyMart stores in Malaysia in five years.

This development came as a surprise for analysts as the convenience store market in Malaysia has thriving competition with the presence of the dominant 7-Eleven chain as well as Bison’s retail convenience stores.

However, analysts believe QL Resources’ foray into the convenience store sector as well as its experience as a food producer makes this franchise beneficial for the company.

AllianceDBS Research Sdn Bhd (AllianceDBS) in a recent report, highlighted that the focus on read-to-eat food and beverage might bring synergistic benefits to QL Resources’ surimi-based products, snack foods, and processed poultry product businesses.

“The strong FamilyMart brand name is also a positive factor – it already has a strong presence in neighbouring country Thailand with circa 1,200 stores. This venture will lengthen the value chain of QL Resources’ agro-food operations, and offers the chance to deliver another steady cash generation business if QL Resources manages to secure strategic locations for its outlets,” it opined.

The research arm of Public Investment Bank Bhd (PublicInvest Research) also believed that through this convenience store concept, QL Resources would have the direct channel to consumers versus its current reach mainly to distributors.

“With its manufacturing capabilities to support the food service industry coupled with product development, we believe QL Resources’ food brands can grow further on the platform of FamilyMart and potentially to other markets with FamilyMart’s presence,” it commented.

The research team also pointed out that through reviews, the hroup had identified key factors that reveal more emphasis on lifestyle and quality preferences whilst having the convenience factor.

These include consumer trends which sees rising importance in product quality and convenience, the rise in urbanisation to 80 to 85 per cent by 2027, young demographics with the median age at 27 to 28 years, Malaysia’s target of a GNI per capita of US$15,690 by 2020 and the 11th Malaysia Plan which aims to strengthen infrastructure thus the expenditure on public transport would serve only to create convenient store business opportunities.

Overall, it said, “The FamilyMart contributions will only begin to bear fruit in the longer-term due to its initial expected six to seven year gestation period. In the medium term however, this move would only serve to enhance its branding recognition which could boost sales for its products.”

AllianceDBS Research also believed that the earnings impact on FY16 to FY17F would likely be negligible given the expected number of store openings in the near term and the necessary gestation period.

All in, there is a global drive towards convenience channels in Asia with more consumers opting for an easier and more convenient way to shop for their groceries.

As the consumer sector slowly begins to stabilise from the support of the government and Malaysia’s recovering economy, the retail convenience store sector would likely see more room for growth in the country.