Trading activities in the ringgit bond market remained muted in this holiday shortened-week as most market players are away for the Hari Raya holidays.

Trading activities in the ringgit bond market remained muted in this holiday shortened-week as most market players are away for the Hari Raya holidays.

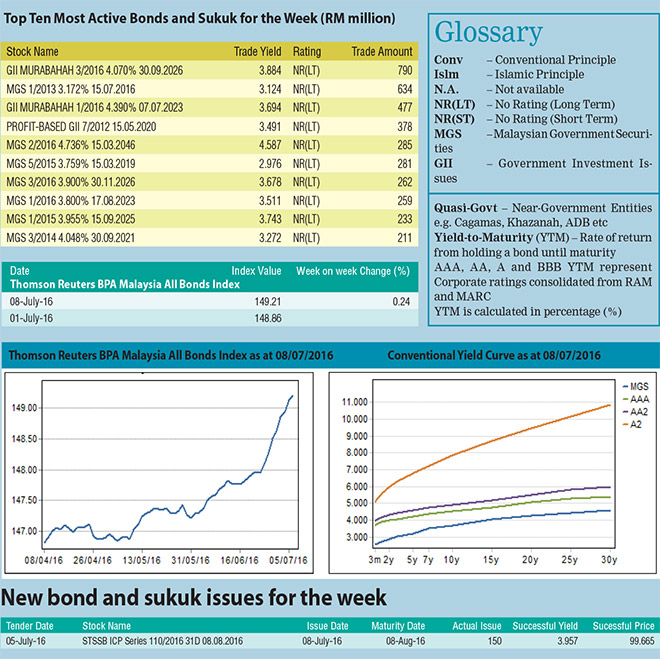

The MGS yield curve shifted lower by one to nine bps across the board amid thinner trading volume. As a result, the Thomson Reuters BPAM All Bond Index gained 0.24 per cent to end the week at 149.21.

Over in the US, better-than-expected ADP employment data and unemployment claims data released on Thursday relieved fears of a job market slowdown which was triggered by a dismal May non-farm payroll (NFP) data released back in June. Nevertheless, all eyes will be on Friday’s release of June NFP which would provide further insights on the condition of the US job market.

Top 10 most active bonds:

On a holiday shortened week, the total trade volume of the top 10 most active bonds dwindled to a mere RM3.8 billion from RM25.0 billion transacted last week.

For the second consecutive week, the 10-year benchmark MGII maturing in September 2026 and short-dated MGS maturing in July 2016 topped the list with traded volume of RM790 million and RM634 million respectively.

Rating Action(s):

On July 4, 2016, RAM Ratings had placed the AA2 claims-paying ability ratings of Hong Leong Assurance Bhd (HLA) and the AA3 rating of its RM500 million Subordinated Notes Programme (2013/2025) on Rating Watch, with a developing outlook.

This was triggered following the approval obtained by HLA Holdings Sdn Bhd (HLA Holdings) and Hong Leong Financial Group Berhad from Bank Negara Malaysia to commence negotiations for the divestment of HLA Holdings’s equity interest in HLA and Hong Leong MSIG Takaful Bhd.

Meanwhile, the developing outlook is premised on the lack of details of the proposed divestment at this juncture and RAM Ratings will assess the impact of this development when more information are available.