Malaysian palm oil futures plunge to their lowest in nine months on Friday at 2,238, as tracking losses in competing vegetable oil and crude oil market.

Malaysian palm oil futures plunge to their lowest in nine months on Friday at 2,238, as tracking losses in competing vegetable oil and crude oil market.

Crude palm oil futures (FCPO) benchmark September 2016 contract settled at 2,238 on Friday, down 120 points or five per cent from 2,358 last Friday.

Trading volume decreased to 49,520 contracts from 204,486 contracts from last Monday to Thursday.

Open interest based decreased to 497,234 contracts from 1.01 million contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during June 1 to 30 fell 8.7 per cent to 1.13 million tonnes compared with 1.233 million tonnes during May 1 to 31.

Societe Generale de Surveillance (SGS) report showed that Malaysia’s palm oil exports during June 1 to 30 fell 10.2 per cent to 1.111 million tonnes compared with 792,393 tonnes during May 1 to 31.

Overall, demand strengthened from Europe, while demand remained weakened from India.

Spot ringgit weakened in the holiday-shortened week to 4.03 as traders prefer to keep a low profile ahead of US payrolls risks while most of Malaysia’s government bond prices fell on Friday.

Chinese commodities futures, including palm oil, dropped as investors lowered expectations for stimulus measures to spur economic activity in the world’s biggest consumer of many raw materials.

Reuters’s survey showed that Malaysian crude palm oil inventories likely rose 7.4 per cent to 1.77 million tonnes in June, while exports slumped 6.4 per cent from May.

On Monday, the price rose to a one-week high as bullish in competing vegetable oil boosted market sentimental and short-covering before public holidays.

On Tuesday, the price retrace back from one week high as market book profit ahead public holiday and tracking weakness in rival oil market.

On Wednesday and Thursday, Bursa Malaysia Derivatives market closed due to public holiday.

On Friday, the price fell 5 per cent as tracking losses in crude oil market and on sluggish export demand.

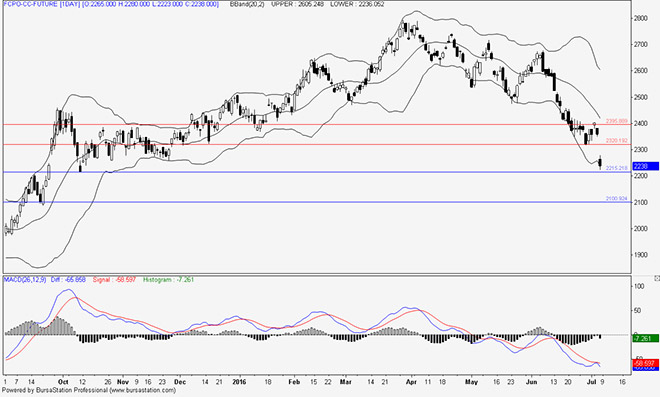

Technical analysis

According to the weekly FCPO chart, the price opened below the psychological barrier at 2,400 as MACD fell below zero line which provided a bearish indication while an expanding Bollinger Band might indicate that there is an increase of selling for current market.

By the end of the week, the price closed below the lower Bollinger band which could signal that current market stayed at an oversold condition.

On Monday, the price rose and closed above the psychological barrier at 2,400 while the middle Bollinger band continued heading downwards which could indicate a continuation of selling.

MACD potentially showed a crossover below zero line which could signal that correction for the current downtrend could happen but price could remained consolidate in the short term.

On Tuesday, the price unable to stand above the psychological barrier at 2,400 as middle and the upper Bollinger band continue to show a downward sign which might provide a sell signal for current market.

On Wednesday and Thursday, Bursa Malaysia Derivatives market closed due to public holiday.

On Friday, the price gap down and fell as all Bollinger band remained heading downward simultaneously while MACD showed a reject crossover sign which could provide bearish sign for current market.

In the coming week, the price has the potential to range between 2,100 and 2,320.

Resistance lines will be placed at 2,320 and 2,395, support lines will be positioned at 2,215 and 2,100, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report released on July 11 (Monday), MPOB report released on July 12 (Tuesday).