Malaysian palm oil futures retrace back after climbing to a two-week high as market book profit ahead cargo surveyor palm oil export report while strong demand for the vegetable oil kept a floor under prices.

Malaysian palm oil futures retrace back after climbing to a two-week high as market book profit ahead cargo surveyor palm oil export report while strong demand for the vegetable oil kept a floor under prices.

Crude palm oil futures (FCPO) benchmark October 2016 contract settled at 2,317 on Friday, up 38 points or 1.6 per cent from 2,279 last Friday.

Trading volume decreased to 169,305 contracts from 173,902 contracts from last Monday to Thursday.

Open interest based decreased to 947,050 contracts from 958,749 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during July 1 to 20 rose 14 per cent to 817,736 tonnes compared with 717,407 tonnes during June 1 to 20.

Societe Generale de Surveillance’s (SGS) report showed that Malaysia’s palm oil exports during July 1 to 20 rose 15 per cent to 820,191 tonnes compared with 711,367 tonnes during June 1 to 20.

Overall, demand strengthened simultaneously from Europe, China and India. Spot ringgit weakened and hit a more than three-week low to 4.0535 as concerns grew over scandal-plagued state fund 1Malaysia Development Berhad (1MDB).

Reuters’s survey showed that Indonesia’s crude palm oil (CPO) output likely rose 12.6 percent in June from May, marking a second month of growth as weather conditions improved although inventories still declined due to a stretch of dry weather.

The latest weather outlook calls for adequate rain and moderate temperatures during the critical period of development for much of the US soybean crop, easing concerns about the La Nina weather phenomenon laying waste to yields.

On Monday, the price rose for the fourth consecutive day, supported by a weaker ringgit and better oversea competing vegetable oil market.

On Tuesday, the price rose and recovered earlier losses on Tuesday, supported by weaker ringgit which making palm oil cheaper for holders of other currencies.

On Wednesday, the price rose and hit two-week high on Wednesday, supported by weaker ringgit and improving palm oil demand outlook.

On Thursday, the price climbing to the highest in more than two weeks on Thursday, tracking oversea competing oil markets gains and underpinned by weaker ringgit. On Friday, the price fell after climbing to a two-week high in the prior session while expectations of strong demand for the vegetable oil kept prices stable.

Technical analysis

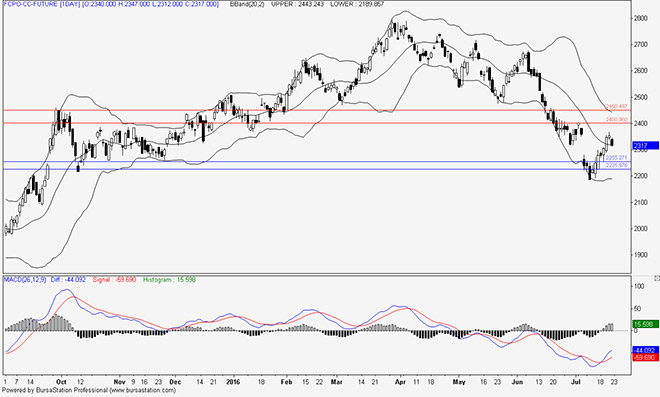

According to the weekly FCPO chart, the price opened above the lower Bollinger Band which might signal the current market would rebound from oversold territory. By the end of the week, a white candlestick emerged after weekly hammer candlestick pattern may indicate further correction for current downtrend.

On Monday, the price rose as the middle and lower Bollinger band showed slow down in heading downward while MACD potentially show a crossover below zero line while MACD histograms continue to show a decreasing sign which could signal slow down in selling momentum.

On Tuesday, the price rose as the middle and lower Bollinger band started moving sideways which might indicate that market might form bottom in short term. MACD showed a crossover sign below zero line while MACD histograms turned positive which could provide correction signal for current downtrend.

On Wednesday, the price closed above the middle Bollinger band and psychological level at RM2,300 which provide a bullish signal for current market. MACD continued to show a crossover sign below zero line which could provide significant correction signal for current downtrend.

On Thursday, the price rose and stayed at the psychological level of RM2,300 as all Bollinger band moved sideways simultaneously. A daily doji candlestick pattern might signal a slow down in the current buying momentum.

On Friday, the price fell after a daily doji candlestick pattern while the middle Bollinger band remained supportive for current palm oil market.

In the coming week, the price has the potential to range between RM2,255 and RM2,400.

Resistance lines will be placed at RM2,400 and RM2,450, support lines will be positioned at RM2,255 and RM2,225, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report on July 25 (Monday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.