The rubber sector has continuously been under the speckle of optimism thanks to steady demand for rubber products across the board.

The rubber sector has continuously been under the speckle of optimism thanks to steady demand for rubber products across the board.

For Malaysia, rubber production is one of the pillars of the agricultural segment, coming up close to the fast-growing palm oil production sector.

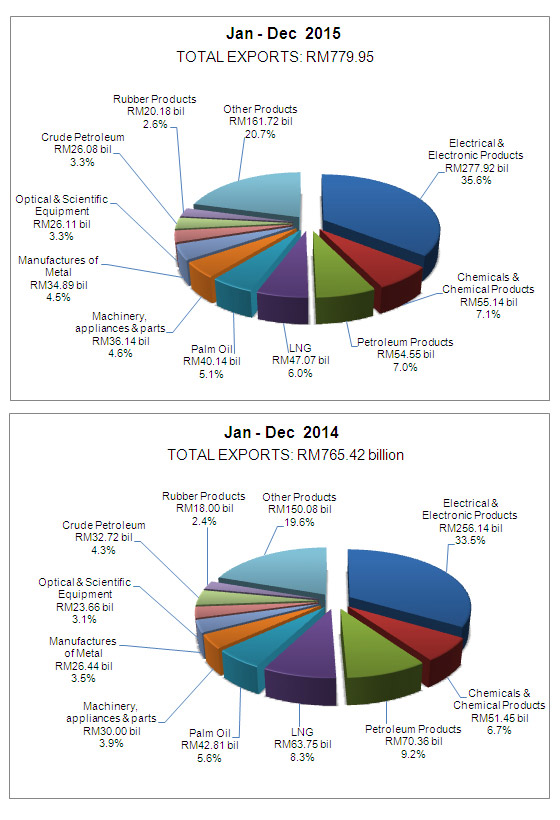

According to Malaysia’s Department of Statistics, the exports of rubber products amounted to RM20.18 billion or 2.6 per cent of Malaysia’s total exports of RM779.95 billion last year, an increase from RM18 billion reported in the previous year.

“The rubber cultivation industry or the upstream sector became a major raw material supplier to two value-added resource-based industries. With this development, the competitiveness of the rubber industry as a whole has been greatly enhanced,” said the Malaysian Rubber Board (MRB)

“Malaysia is globally renowned for its high quality and competitively priced rubber products. Malaysian rubber products manufacturers comprise multinationals and joint ventures from various countries including the US, Europe, and Japan as well as locally-owned enterprises.

“These companies supply a whole range of rubber products including medical gloves, automotive components, hoses, and structural bearings,” the Malaysian Rubber Export Promotion Council (MREPC) said in its industry overview of the rubber sector.

To note, under the rubber industry, there are four major sectors which include latex industry, foam, rubber thread and dry rubber industries.

The latex industry, which consists of products such as rubber gloves, in particular, has been growing by leaps and bounds as demand continues to remain strong, driven by the resilient healthcare sectors.

In fact, the sharp increase in exports in 2015 was mainly attributed to the solid performance of the rubber gloves sector.

According to MREPC, the rubber gloves sector was the largest export revenue generator for the Malaysian rubber product industry, representing 73 per cent of the Malaysia’s total exports of rubber products in 2015.

“Demand for rubber medical products, particularly gloves, has been increasing over the years. However, competition from lower cost producing countries could be challenging, especially in emerging markets where price is a major factor,” said Low Yoke Kiew, chief executive officer of MREPC in a statement.

Source: Department of Statistics, Malaysia

The outlook for rubber product exports remains positive with most growth expected to take place in the developing economies of Asia, Africa and Middle East as incomes rise and expenditure on healthcare and hygiene increases.

“The Malaysian rubber product industry particularly the rubber medical products sub-sector is well-placed to take advantage of growing demand, thanks to competitive pricing, and increasing capacity, with manufacturers having the capability to meet stringent market requirements,” MPREC said.

The council also highlighted that revenue from glove exports increased by 22.4 per cent year-on-year to reach an all-time high of RM13.1 billion in 2015.

Aside from that, tyres, hoses, latex threads and condoms also contributed significantly to Malaysia’s total export of rubber products in 2015, with double-digit export growth of between 13.6 per cent and 32.4 per cent year-on-year in terms of value.

Export values increased by 21.8 per cent in the second half of 2015 compared to the corresponding period in 2014.

Overall, exports to most regions recorded double-digit growth in 2015 when compared to 2014. Exports for rubber gloves, in particular, is expected to increase to a record high of RM14.3 billion this year, up 14 per cent, from RM13.1 billion last year, said the Malaysian Rubber Glove Manufacturers Association (MARGMA).

“The global demand for rubber gloves is still strong driven by the healthcare sectors. Estimated global demand this year is 212.2 billion gloves, which means 6,728 gloves are used every second.

“We expect the industry to remain resilient with annual growth estimated at least between eight and 10 per cent,” he said at a press conference here,” MARGMA president Denis Low told press at the signing of Memorandum of Understanding between MARGMA, the Malaysian Rubber Export Promotion Council and major partners/exhibitors, for the 8th International Rubber Glove Conference & Exhibition in September this year.

As demand rises and expectations of an increase in production spread across the market, most major rubber product manufacturers are taking steps to expand their production rate to meet this growing demand.

However, while market and producers are optimistic of the demand for products from the rubber sector, this year, the performance of the rubber sector was snagged by unexpected macro and domestic headwinds.

Analysts and market observers have raised concerns on a possibility of an oversupply due to the expansions while its mainly US dollar-denominated exports and lower-than-expected average selling prices (ASP) have affected most major rubber producers’ earnings.

Will the rubber sector sustain its resilient performance or will it fall under weight of a possible oversupply and the rising ASP pressure?

Balancing the supply-demand equilibrium

In the first quarter of 2016 (1Q16), the rubber industry displayed sequentially weaker performance despite recording healthy untilisation rates.

According to the research arm of Maybank Investment Bank Bhd (Maybank IB Research), the sector’s net profit fell 21 per cent quarter-on-quarter (q-o-q) but rose 39 per cent year-on-year (y-o-y) on the rising nitrile competition and the passing through of US dollar/ringgit benefits.

“In 1Q16, sector’s average earnings before interest, depreciation and amortisation (EBITDA) margin weakened sequentially to 22 per cent (down 0.9 percentage points q-o-q, an increase of 2.2 percentage points y-o-y) while returns of equity (ROE) fell to 17 per cent (down 4.4 percentage points q-o-q, an increase of 1.1 percentage points q-o-q).

“Amongst the worst deliveries were Hartalega Holdings Bhd (Hartalega), with the biggest drop in EBITDA margin (down 2.2 percentage points q-o-q, an increase of 0.9 percentage points y-o-y), and Supermax Corporation Bhd (Supermax), with the biggest drop in ROE (down eight percentage points q-o-q, down three percentage points y-o-y),” the research team said.

Analysts believe that as glove makers increase their capacity in nitrile butadiene rubber (NBR) gloves, the pricing competition could intensify which could lead to short term margin compression for glove makers as the incoming supply of gloves is currently pacing ahead of global demand growth.

CIMB Investment Bank Bhd’s research arm (CIMB Research) said, “While we expect glove makers to increase NBR gloves prices in the upcoming quarter, we believe this is solely to pass on the extra operating costs (weaker US dollar and higher raw material prices). All in, we foresee margin pressure impacting all glove payers, particularly those with larger production capacities.”

It added, “Taking into account the heightened competition, we also believe that the ease of passing through costs is diminishing. While glove makers were previously able to enjoy passing on costs effectively with only a minor time lag, we believe that the tides may have turned, as supply grows ahead of demand.”

“Glove makers would have to now potentially (to a certain extent) sacrifice margins to absorb some, if not all the additional costs to remain competitive.”

In a case study on the dynamics of global supply and demand, the research team noted that it showed that a supply glut might occur in 2016 to 2017, before demand eventually catches up in 2018.

It further pointed out that there could be a surplus of up 0.3 billion pieces per year in 2016 and three billion pieces per year in 2017.

Nevertheless, Kenanga Investment Bank Bhd’s research arm (Kenanga Research) pointed out that while there are tell-tale signs of a potential oversupply, it appears to be overplayed considering that capacity expansion of the four rubber gloves under coverage are expected to be delayed and staggered.

“Top Glove Corporation Bhd’s (Top Glove) new Lukut, Port Dickson plant is expected to be delayed for three months due to shortage in electricity supply (16 lines totaling 2b pieces).

“Currently Hartalega’s plant 3 will add an estimated of two to three billion pieces each in 2016 and 2017. The plant 4 is only expected to commence commercial production by 4Q17,” it said.

“As such the slower-than-expected ramp-up in new production capacity further reinforces our positive outlook on the sector by allaying concerns on competitive pressure and oversupply issues.

“Separately, from our channel checks, we gather that players’ average utilisation rate is 80 to 85 per cent.

“Furthermore, most glove manufacturers can only run at an average maximum utilisation rate of 90 per cent due to required downtime for maintenance while industry capacity expansions are only coming in progressively throughout over the next two years,” it pointed out.

In a separate note, Maybank IB Research said that while planned new annual capacity in 2H16 is 4.5 billion,the actual capacity could come in below as planned.

“This is due to glove players’ conscious decision in slowing down expansion, following the intense ASP competition in 1H16.

“Additionally, there is also difficulty in the hiring of foreign workers, which will limit the commercialisation of the new production lines. Hence, we expect capacity growth to slow in 2H16,” it said.

For 2017, the research team said the planned capacity growth would have another step-up with 14.7 billion pieces (an increase of 56 per cent y-o-y), leading to potential short-term capacity overhang and intense competition again.

“Nevertheless, we believe glove players are cognizant of the situation and will expand according to the global glove demand, which is expected to grow around seven per cent per annum (or 14 to 15 billion pieces per annum) in 2016 to 2017.

“Total annual capacity was 116.8 billion pieces while plant utilisation averaged 80 per cent in 1H16,” it opined.

Meanwhile, TA Securities Holdings Bhd’s research arm (TA Securities) said that demand is expected to remain strong across the board.

“Being a cost effective barrier against diseases and infections, demand for rubber gloves is expected to continue growing sustainably on the back of a growing and ageing population, increasing healthcare awareness, and heightened healthcare reforms and regulations,” it said.

Furthermore, it noted that in 2015, Malaysia extended its lead against regional peers – Thailand, China & Indonesia – with its share of rubber glove exports to key markets like the US, the largest market for rubber gloves, increasing by seven percentage points to 62 percentage points.

“Amidst the growing demand for rubber gloves and aggressive capacity expansion by manufacturers in Malaysia, this suggests that Malaysia’s market share grew at the expense of sluggish capacity expansion by regional peers.

“Apart from this, we believe that factors such as the weak ringgit and government incentives would continue to be instrumental to uplifting the export competitiveness of rubber glove manufacturers in Malaysia.

“For 2016, the Malaysian Rubber Glove Manufacturers Association estimates Malaysia, Thailand, China, and Indonesia’s global market share at 63, 21, five, and three per cent respectively,” it said.

Rubber manufacturers’ mixed 1Q16

Overall, in 1Q16, rubber products manufacturers recorded a mixed bag of results. TA Securities noted that beyond the prevalent price competition, the sector was pressured into giving heavy discounts to its key customers to facilitate their entry into price sensitive markets (i.e. Eastern Europe).

It also pointed out that the rubber sector underwent a a sharp downward rerating as its price earnings ratio (PER) trended downwards from 26.5-folds at the beginning of the year to 17.5-folds recently, drawing closer towards its five-year average of 16.3-folds.

Nevertheless, it said, “While we concur with the strong PER the market has ascribed to the sector owing to its defensiveness and growth prospects, we also believe that the appeal of the sector has to a certain extent been influenced by its export oriented nature whereby sales are primarily derived in the US dollar.

“When reflecting on the trend of the sector’s PER and US dollar/ringgit, this was apparent particularly during the rally of the US dollar/ringgit in 2015.

Top Glove strengthens position via expansions

As the world’s largest rubber glove manufacturer, Top Glove is looking to solidify its market leadership via expansions to meet global demand for its various products.

TA Securities noted, its target is to enlarge its capacity by circa 10 per cent per annum and align its product mix to global demand of 60 per cent latex gloves and 40 per cent nitrile gloves. As at 3QFY16, it said the group’s product mix composed of 58 per cent latex, 32 per cent nitrile, eight per cent vinyl, and two per cent surgical.

Its current expansion is primarily focused on nitrile gloves and expected to enlarge the group’s capacity by 7.8 billion gloves per annum (an increase of 17.5 per cent) to 52.4 billion gloves/annum by FY17.

“Nonetheless, the business environment remained challenging on several fronts. Competition continued

to intensify in the nitrile glove segment, as major industry players continued to expand their capacity to leverage the ever-growing demand.

“We also had to contend with the rise in the cost of chemicals and an upward revision in the natural gas tariff.

“However, quality and cost efficiency enhancements via automation, computerisation and technology transformation initiatives which the group embarked on served to mitigate the impact of these headwinds,” said Top Glove’s chairman Tan Sri Dr Lim Wee and managing director Chai Lee Kim Meow in the group’s 2015 annual report.

Looking ahead, they highlighted that the group is setting its sights on becoming the world’s largest nitrile glove manufacturer.

“This will now be our top priority, one which we believe we are well-placed to achieve in view of our significantly improved nitrile competency,” they said.

Kossan stays resilient

For Kossan Rubber Industries Bhd (Kossan), analysts expect the group to sustain its strong earnings visibility.

TA Securities noted the group has in place a sustainable capacity expansion plan to keep its robust earnings growth momentum going for the next five to six years.

Furthermore, it pointed out that Kossan’s plants have consistently been operating at utilisation rates of above 80 per cent.

“Signifying strong reception for its products, current capacity is insufficient to cater to rising orders. For FY16/FY17, we foresee earnings growth of 15.6 and 12.5 per cent,” it said.

It also pointed out that the group has proven its capability in rebounding from on-going cost hikes such as the minimum wage implementation in January 2013 and natural gas hikes.

Hartalega rides out rough patch

Hartalega had generally surprised the market by recording weaker-than-expected 4QFY16 results due to various factors including depreciating US dollar/ringgit, natural gas hike, and gestation costs from the Next Generation Integrated Glove Manufacturing Complex (NGC), and heavy discounts given to its key customers.

However, analysts believe that the group is bound to see a gradual recovery from its recent downfall owing to several proactive measures it had recently undertaken.

TA Securities explained that to alleviate concerns on pressure at the top line, Hartalega has implemented higher ASPs from 1QFY17 to partially pass through the effects of the depreciating US dollar/ringgit and natural gas hike in January 2016.

It also noted that to diversify its customer concentration risk, Hartalega has also ramped up its sales force. The commissioning of Plant 3 and 4 has also been deferred from 2Q16 to 4Q16 and this could help cool off the prevalent price competition.

Supermax overcomes hiccups

While still focused on its core business in glove manufacturing, Supermax has been making progress with its contact lens venture which it embarked on since 2015.

“The group is now waiting for its contact lens manufacturing plant in Sungai Buloh, Selangor to obtain the necessary International Organisation for Standardisation certifications and Food and Drug Administration approvals.

“Thus far, except for the group’s intention to invest RM100 million in high-end technology manufacturing of contact lens, financials on the contact lens venture remain scarce.

“We note though that management only expects earnings contribution from the contact lens segment to be significant in the longer term,” TA Securities said.

For its gloves segment, the research team noted that currently, the group has two massive capacity expansion projects in the pipeline.

However, it said despite the groups ambitious expansion plans, it is conservative on its capacity growth assumptions as the group’s expansion has consistently been marred by disruptions stemming from

infrastructure issues.

Karex’s near to medium term earnings growth intact

On Karex Bhd (Karex), analysts believe that the group is capable of retaining its near to medium earnings growth.

In addition, TA Securities highlighted that as there are not many manufacturers aggressively expanding their operations, the group is in an advantageous position to capitalise on the robust growth in demand.

It noted that global demand for condoms currently stands at approximately 30 billion pieces per annum.

It added, driven by a growing population and increasing education on safe sex, it is projected to grow at a compounded annual growth rate (CAGR) of 10 per cent and reach 44 billion pieces per annum by 2020.

Softer margins ahead, but resilience still present

The rubber sector is expected to report an overall softer 1H16 but analysts expect that the sector would gradually recover after 2Q16.

TA Securities opined that in 2H16, barring any volatility in the US dollar/ringgit and raw material prices, the sector’s earnings is expected to to emerge stronger than 1H16 against the backdrop of the sustained growth in demand for rubber gloves, tapering price competition, and gradual pass through of cost hikes endured in 1H16.

“Positively, the weak ringgit and local investment incentives would continue to bode well for the export competitiveness of rubber glove manufacturers in Malaysia,” it said.

Nevertheless, it pointed out that ongoing cost hikes such as the increase in minimum wage and biannual natural gas price would take effect in 2H16. However, it believed believe that their impact on earnings would be minimal as manufacturers had ample time to renegotiate for higher selling prices with customers to pass through the minimum wage hike, which was announced earlier in October 2015, and the recently announced six per cent natural gas tariff hike at the end June 2016 is relatively mild.

Aside from that, TA Securities said that while issues on foreign labour shortage are still benign, it could be a cost dampener if it worsens.

Meanwhile, Maybank IB Research is still less optimistic on the sector due the overall cost hikes that continue to beleaguer the sector. However, it pegged a benign view on the prospects of 2H16 for the rubber sector.

It noted that while the total impact to the glove players from these hikes on an annual basis are minimal at less than two per cent of their net profits, the ever-rising costs would continue to weaken their margins over the years.

Additionally, it said hiring of new foreign labour has also become increasingly more difficult and glove players have to resort to hiring short-term contract workers at a higher wages to fill the vacancies, adding onto the overall cost inflation to the glove manufacturers.

“The next minimum wage review will take place three years later in 2019. As for the gas tariff, it will be reviewed bi-annually and it will likely increase over the next two to three years given that it is still below the market price; latest gas price is 23 per cent below Bintulu’s LNG FOB price of around RM35 per mmbtu presently.

“In light of these structural cost hikes, glove players will have to continue to strive to increase their operational efficiencies/reduce headcounts at their factories by ploughing capital into machineries.

“For 2H16, we expect the overall cost rise to be benign as the fall in latex cost/rise in nitrile glove ASP would be enough to counter the higher structural costs,” it commented.

On latex cost, it expected latex prices to be lower in 3Q compared with 2Q.

It explained, “In 2Q16, latex price strengthened by 25 per cent q-o-q and 19 per cent y-o-y. Given that latex accounts for approximately 45 per cent of the operating cost for latex gloves, latex gloves margin should have been affected in 2Q16 (upcoming results releases by the glove-makers should confirm this).

“In July 2016, the latex price has softened again, falling by approximately eight per cent from 2Q16 and is also six per cent lower y-o-y.

“We think the softer latex price should sustain into most of 2H16 which will more than offset for the higher minimum wage and gas costs, and also provide some buffer to the slight weakness in US dollar/ringgit.”

For 2017, it is expected that the latex price could stay benign, considering the ample supply from the new plantations in Thailand and slow economic growth.

As for the price of NBR, it said, despite the spike in oil price in 2Q16 (an increase of 36 per cent q-o-q, down 20 per cent y-o-y), NBR price was relatively stable, hovering at around US$0.90 per kg in 2Q16 (an increase of six per cent q-o-q, down 14 per cent y-o-y).

“Stacking against the higher nitrile glove ASP (an increase of five per cent in May 2016), overall margin for nitrile glove could be flattish in 3Q16 after taking into the consideration of the higher minimum wage and gas cost,” it added.

For 2017, the research arm expected NBR price to stay benign due to the supply surplus of the NBR capacity.

Overall, in the near term, Maybank IB Research opined, “For 3Q16, we expect glove players’ earnings to improve q-o-q (but still weaker y-o-y due to forex-fuelled high base).

“This is premised on the easing of nitrile glove competition. Nitrile glove price was raised by around five per cent in May 2016 and will be reflected in earnings in 3Q16 when goods are delivered, a softer latex cost.

“In July 2016, latex cost is around eight per cent lower than 2Q16. Both of these positive factors should more than offset for the higher minimum wage and gas cost implemented in Jul 2016.”

TA Securities expect a stronger 2H for the rubber sector, barring any volatility in the US dollar/ringgit and raw material prices.

It explained that this is against the backdrop of the sustained growth in demand for rubber gloves and tapering price competition.

Nevertheless, it said considering the softer growth expected from the sector, its sector PER multiple remains unchanged at 18-folds.