Malaysian palm oil futures rose and hit two-month high on Friday at 2,453 due to worries over tight physical supplies of tropical oil.

Crude palm oil futures (FCPO) benchmark October 2016 contract settled at 2,523 on Friday, up 117 points or 4.9 per cent from 2,406 last Friday.

Trading volume increased to 207,542 contracts from 161,172 contracts from last Monday to Thursday.

Open interest based decreased to 846,289 contracts from 876,532 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during August 1 to 10 rose 17.8 per cent to 456,481 tonnes compared with 387,589 tonnes during July 1 to 10.

Societe Generale de Surveillance’s (SGS) report showed that Malaysia’s palm oil exports during August 1 to 10 rose 18.1 per cent to 465,743 tonnes compared with 394,215 tonnes during July 1 to 10.

Overall, demand increased from China and Europe Union while demand weakened slightly from India.

Spot ringgit weakening to 4.0260 as worries on Malaysia’s growth pace slid for the fifth straight quarter in April-June.

Malaysian Palm Oil Board (MPOB) said palm oil stocks at the end of last month were down 0.2 per cent from end-June while market had been expecting palm stocks to rise 3.1 per cent.

MPOB’s report showed on Wednesday that palm output rose 3.5 per cent month-on-month to 1.59 million tonnes while exports surged 21 per cent to 1.38 million tonnes.

On Monday, the price rose as stronger performing oversea competing vegetable oil lent support to palm oil market.

On Tuesday, the price rose to highest in two months on Tuesday as tracking rival oils market while profit taking ahead industry regulator report seen capped the gains.

On Wednesday, the price reversed earlier gains and rose to more than two months high on Wednesday as support by unexpectedly better regulator report and tracking soybean oil market gains.

On Thursday, the price retraced back from a two-month high on a market correction and tracking weaker rival oil market. On Friday, the price rose to strongest level since June 13 as tracking rival oil market gains while worries over tight supplies of tropical oil continue lent support to palm oil market.

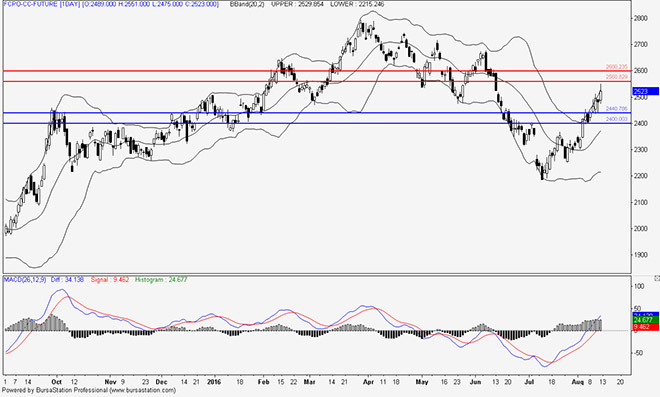

According to the weekly FCPO chart, the price opened above the psychological level at 2,400 and continued to approach the middle Bollinger Band. By the end of the week, the price closed above the middle Bollinger band while MACD histograms continued to show signs of decreasing.

On Monday, the price rose as all Bollinger Band heading upward simultaneously which could provide uptrend signal for current market. MACD line continued to stay above the zero line which could provide short term bullish signal for current market.

On Tuesday, the price attempted to test and limit the upper Bollinger Band and psychological level at 2,500 which could provide significant resistance for the current market.

On Wednesday, the price closed above the upper Bollinger Band and indicated that the current market stayed at overbought condition and price correction might happen.

On Thursday, the price fell and retrace back after the Bollinger Band signaled that the current market stayed at overbought condition while all Bollinger Band remained on an upward trend which might indicate a continuation of the current uptrend.

On Friday, the price rose as the market closed below, limited by the upper Bollinger Band while MACD line continues to stay above the zero line which could indicate a continuation of the current uptrend.

In the coming week, the price has potential to range between 2,440 and 2,560. Resistance lines will be placed at 2,560 and 2,600, support lines will be positioned at 2,440 and 2,400, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report released on August 15 (Monday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.