Malaysian palm oil futures posted their biggest weekly gain since mid-August and closed at 2,675 as supported by expectation of lower output and weaker ringgit. Crude palm oil futures (FCPO) benchmark December 2016 contract settled at 2,676 on Friday, up 84 points or 3.2 per cent from 2,592 last Friday.

Malaysian palm oil futures posted their biggest weekly gain since mid-August and closed at 2,675 as supported by expectation of lower output and weaker ringgit. Crude palm oil futures (FCPO) benchmark December 2016 contract settled at 2,676 on Friday, up 84 points or 3.2 per cent from 2,592 last Friday.

Trading volume increased to 213,345 contracts from 176,139 contracts from last Monday to Thursday.

Open interest based increased to 770,554 contracts from 632,182 contracts from last Monday to Thursday. Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during September 1 to 20 fell 11 per cent to 914,264 tonnes compared with 1.027 million tonnes during August 1 to 20.

Socete Generale de Surveillance’s (SGS) report showed that Malaysia’s palm oil exports during September 1 to 20 fell 12 per cent to 917,288 tonnes compared with 1.045 million tonnes during August 1 to 20.

Overall, demand significantly decreased from India, China and Europe Union. Spot ringgit recovered losses and strengthened to 4.11 after after Federal Reserve trimmed its long-term interest rate expectations.

Leading industry analyst, Dorab Mistry, said on Friday that crude palm oil prices are expected to drop around 19 per cent from current levels to RM2,200 (US$534) per tonne over the next two months as production recovers in the new oil year,

Leading edible oil analyst, Thomas Mielke, said on Friday that Malaysian crude palm oil prices are expected to jump to RM3,000 (US$728.86) a tonne by the October-December quarter, the highest in four years, as an El Nino weather event curbs yields.

On Monday, the price rose and recorded their biggest daily gains in more than two weeks as supported by tracking rival oil markets gains and weaker ringgit.

On Tuesday, the price posted rose to their highest in five months as supported by strength in rival oil markets.

On Wednesday, crude palm oil market fell from their highest in five months as traders booked profit and weak export outlook.

On Thursday, the price rose to five-month high as supported by expectation of lower output and bullish palm outlook from leading analyst.

On Friday, the price fell on Friday as tracking rival oil market losses and profit taking, but posted their biggest weekly gain since mid-August.

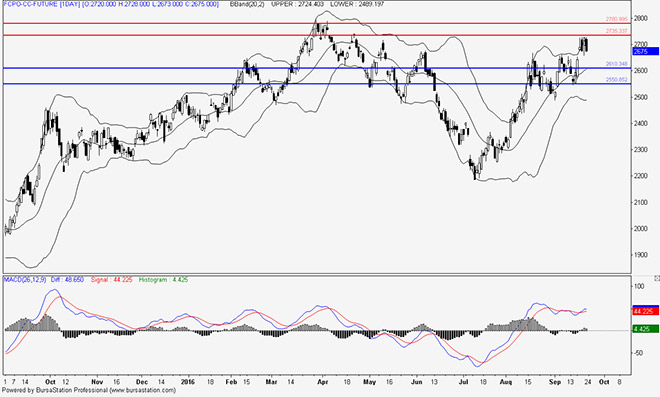

Technical analysis

According to the weekly FCPO chart, the price opened higher as MACD remained stayed above zero line which could signal that continuation of current uptrend. By the end of the week, Bollinger Bands showed expanding sign which could indicate that increasing in current uptrend momentum.

On Monday, the price rose as market attempted to test and supported by the middle Bollinger Band. MACD remained stagnant which could provide possible indecisiveness on the current uptrend momentum.

On Tuesday, the price rose and closed above the upper Bollinger Band which could provide overbought signal for current market. MACD remained stagnant and unable to provide confirmation for current uptrend momentum.

On Wednesday, the price fell as market retrace back and closed below the upper Bollinger Band. MACD remained stagnant and unable to provide confirmation for current uptrend momentum while a potential divergence sign should be monitored closely.

On Thursday, the price closed above the upper Bollinger Band and provide overbought signal and market may potentially limited by the upper Bollinger Band. The Bollinger Bands showed expanding sign which may indicate that price movement momentum could increase in short term.

On Friday, the price fell and limited by the upper Bollinger Band while MACD showed a potential divergence sign which should be monitored closely.

This coming week, the price has potential to range between 2,780 and 2,550.

Resistance lines will be placed at 2,735 and 2,780, support lines will be positioned at 2,610 and 2,550, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report released on September 24 to 26 (Saturday to Monday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.