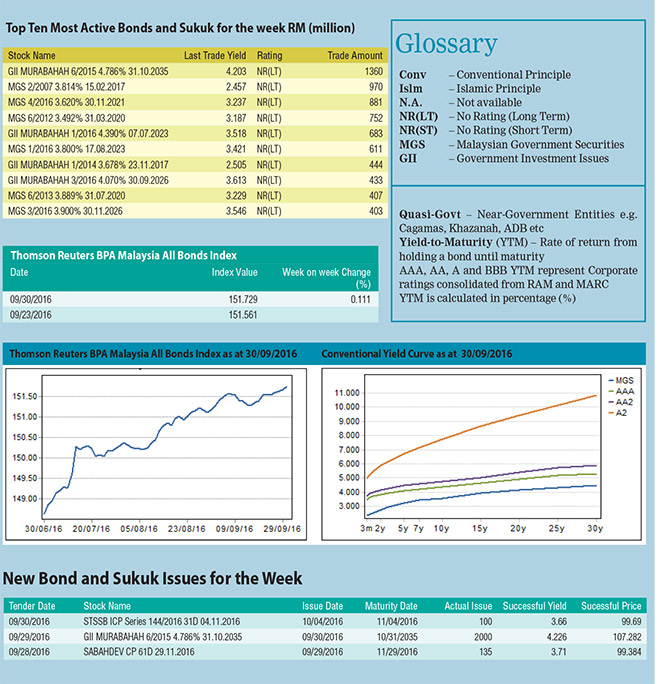

The Index has gained 0.111 per cent to close at 151.729 from 151.561 point last week.

The Index has gained 0.111 per cent to close at 151.729 from 151.561 point last week.

The MGS yields dropped one to two bps between seven-year and 20-year region on the back of a positive news that came out from the Organization of the Petroleum Exporting Countries (OPEC) meeting, in which Saudi Arabia decided to scale back its daily crude oil production in order to shore up the global prices.

As a result, Brent crude oil prices shot up more than five per cent overnight to near US$50 per barrel.

Top 10 most active bonds:

The total trade volume for the top 10 most actively traded bonds decreased to RM6.9 billion from RM10 billion transacted last week.

The reopened 20-year benchmark MGII (GII MURABAHAH 6/2015 4.786 per cent 31.10.2035) topped the list with RM1.4 billion changed hands.

Sovereign bond action:

On September 27, 2016, Bank Negara Malaysia (BNM) announced the tender details for the reopening of the 20-year benchmark MGII maturing on October 31, 2035.

The auction size was RM2 billion. The tender closed on 29 September 2016 with a strong bid-to-cover ratio of 2.890 times.

The highest, average and lowest yields came in at 4.238 per cent, 4.226 per cent and 4.210 per cent respectively.

New Issuance(s):

On September 29, 2016, Al-Dzahab Assets Bhd issued three tranches (three-year, five-year, seven-year) of Class A sukuk amounted to RM120 million with profit rates of 4.70, 5.20, 5.50 per cent respectively.

At the same time, they also issued one tranche of Class B sukuk worth RM35 million maturing on March 28, 2025 with a callable date on September 29, 2023 that comes with a profit rate of 6.80 per cent.

The Class A and Class B sukuk are rated AAA and AA3 respectively with a stable outlook by RAM Ratings.