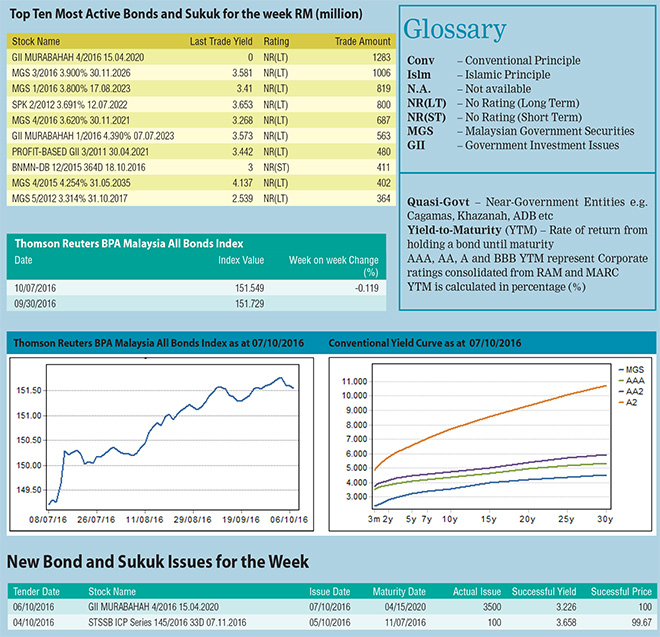

The Index shed 0.119 per cent over the week to close at 151.549 from 151.729 point last week amid weak market sentiments. The MGS yields inched higher by three to eight basis points (bps) across all tenures except for seven-year which saw its yield eased by one bp.

The Index shed 0.119 per cent over the week to close at 151.549 from 151.729 point last week amid weak market sentiments. The MGS yields inched higher by three to eight basis points (bps) across all tenures except for seven-year which saw its yield eased by one bp.

On October 7, Department of Statistics Malaysia released better-than-expected external trade data on the back of higher exports in palm oil and electrical and electronic (E&E) products.

Total trade for month of August 2016 expanded by 7.5 per cent from the previous month with a total trade value of RM126.7 billion.

On a month-on-month basis, exports rose RM7.7 billion from RM 59.9 billion whereas imports increased by RM1.1 billion from RM57.9 billion. Trade surplus more than tripled to RM 8.5 billion from the previous month but registered a drop of RM1.7 billion or 16.9 per cent when compared with the previous year.

On the global front, the International Monetary Fund (IMF) has further downgraded its forecast of global growth for 2016 from 3.2 per cent announced in April to 3.1 per cent citing Brexit and weaker-than-expected growth in the US.

Top 10 most active bonds:

Market remained muted over the week with the total trade volume for the top 10 most actively traded bonds dropped slightly from RM6.9 billion transacted last week to RM6.8 billion. The newly issued 3-year benchmark MGII (GII MURABAHAH 4/2016 15.04.2020) garnered the most attention with a total trade amount of RM1.3 billion.

Sovereign bond auction:

On October 4, 2016, BNM announced the tender details for the new three-year benchmark MGII maturing on April 15, 2020 with an issue amount of RM3.5 billion.

The tender closed on October 6, 2016 with a decent bid-to-cover ratio of 2.066 times.

The highest, average and lowest yields came in at 3.238, 3.226 and 3.2 per cent respectively. The sukuk was issued on October 7, 2016.

New Issuance(s):

On October 4, 2016 2016, UMW Holdings Bhd issued four tranches (three-year, five-year, seven-year and 10-year) of Islamic Medium Term Notes (IMTNs) amounted to RM700 million with profit rates of 4.82, 5.02, 5.12, 5.22 per cent respectively.

The IMTNs are rated AA2 with a stable outlook by RAM Ratings.