Owning properties are considered a boon for most people but for Sarawakian Reuben Yap, all was not well as he was struggling to figure out what to do with an unoccupied property he owned — a medium space spread out over four floors, located in the heart of Kuching’s city centre.

While there was no issue with its location or condition, Yap still experienced difficulty finding new renters for the property as it was far too big for many smaller businesses, yet too small and fragmented to be attractive for larger offices or retail spaces.

Thankfully, Yap saw the potential of converting the property into vacation rental units for tourists, and through Airbnb that Yap was able to materialise his idea in a few short clicks.

Yap started off initially renting out one enclosed space in the property part time but in time the desirable location of his property coupled with his surprising talent in hospitality led to his popularity as a host skyrocketing in a few short months.

Soon, Yap and his family found themselves swarmed with notifications inquiring about availability for their property, making Yap Sarawak’s highest rated and most popular host on Airbnb.

Seeing this as a niche market opportunity, Yap’s father, Yap Han Boon, made the decision to expand their business by renovating the property into three separate enclosed vacation rental units, aptly named ‘Kai Joo Suites’.

“Airbnb has allowed us to activate this property and receive good returns,” Yap told BizHive Weekly.

Currently, Yap along with his father and sister, Rhoda Yap, jointly own and manage their three listings of ‘Kai Joo Suites’ on Airbnb, only accepting reservations and bookings via the home-sharing platform.

Of course, it should be noted that Yap and his family have worked things out with the local council regarding their business operations even before starting out as an Airbnb host to ensure compliance with local regulations.

Yap and his family’s success story is a property owner’s dream as there are many unused unused properties and shoplots which could generate income the way Yap did with his property.

From unwanted clothes and knick knacks we unearthed during new year spring cleaning to the rusting cars in our compound, these are all unused items that could bring us some returns.

But why have we all not taken up these opportunities just like what Yap did?

The key issue is convenience and accessibility, even with the rise in popularity of classified advertisement websites such as Mudah.my or Pagoda, many of us still find it a hassle as the issue of pricing and payment still needs to be discussed and arranged in such transactions.

This is a main reason as to why tech start-ups like Uber and Airbnb have seen explosive growth in recent years as they provide platforms for people to obtain or provide services or accommodation at a touch of our fingertips with little worry to the payment of said services and or accommodation.

In fact, for ride-sharing provider Uber, it is infamous for requiring all transactions to be cashless; while Airbnb requires a valid online payment method before any bookings can be made.

This in turn has led to an emergence of a ‘sharing economy’, a term that is most often used to describe the economic and social activity involving peer-to-peer online transactions of goods and services.

A biz model that breaks barriers

Advocates for the sharing economy highlight potential benefits derived from its emergence including the empowerment of ordinary people, contribution towards social capital, and increased efficiency of the utilisation of personal assets.

Being a direct participant of the sharing economy, Yap shared his view on the direction it is taking in Sarawak and agrees with the sentiment, citing, “I am positive about the sharing economy in empowering people to rent out their services and assets with minimal friction and utilising idle resources but am concerned about the power these companies wield.”

Yap is not alone with such concerns as critics of the sharing economy shift have argued that it is “nothing more than a loophole for corporations and individuals alike to abuse by conducting business transactions and activities without having to comply to the relevant industry’s regulations.”

For example, at present, sharing services such as Airbnb or Uber do not have to pay taxes or collect Good Services Tax (GST) from its consumers or guests.

While it is arguable that what they are doing is purely connecting consumers and providers to each other – and should not be subjected to normal regulations – the fact still stands that it is diverting business away from registered business which are subjected to taxes and regulations.

For example, earlier this year, local media reported that the hotel industry had claimed that 5 to 15 per cent of their business has been diverted to their home-sharing counterparts.

This represents a significant loss of our tax income and with target estimates of 2017 GST revenue seeing an increase to RM40 billion from RM38.5 billion, despite, our gross domestic product (GDP) set to only slow down further, it creates a conundrum.

How will we meet these estimates? The answer is clear: Others in the economy will have to bear this additional tax burden.

As a result, this has contributed towards heated regulatory and political battles between sharing economy business operators, such as Uber and Airbnb, affected regular business operators, and local government bodies.

Most notably, the recent controversy regarding Uber’s legal status in Sarawak has been a heated topic that has raised the question, “How should we approach this?”.

Sharing economy here to stay

Despite these issues and concerns however, it seems that the sharing economy is here to stay as according to data derived from a survey conducted by the Pacific Asia Travel Association (PATA) and research agency TCI Research, has indicated we cannot be more receptive of the notion with 78 per cent of us Asia Pacific consumers eager to share or rent our personal resources.

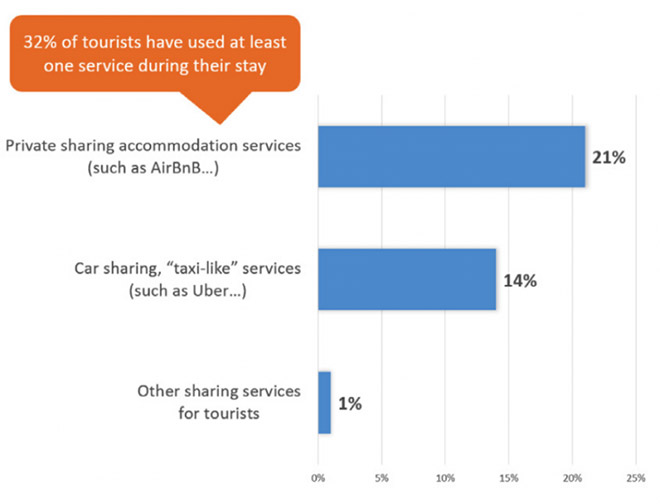

However, it seems the industries to be impacted most by this new business model is the Hospitality and Tourism industries as of the 279 million international travellers from Asia Pacific, 21 per cent have stayed in a shared accommodation while 14 per cent have used a ride sharing service while travelling abroad.

What this strongly indicates is that these sharing services and the sharing economy are here to stay, and as a result, our local industry and government have better adapt to these new market entrants and paradigm shift.

Deputy Chief Minister of the Ministry of Infrastructure Development and Transportation, Tan Sri Amar Dr James Jemut Anak Masing concurred with this sentiment, saying that, “whether we like it or not these services and the sharing economy will start to emerge, and along with it so will a new environment and new set of competitors follow.”

He continued on to advise, “Hence, we better get ready as we cannot stop this kind of competition from coming in, we must prepare ourselves.”

Prepping to share beyond strengths and weaknesses

But how exactly do we prepare ourselves? Masing told BizHive Weekly that to do so, we must be able to look at ourselves and figure out what our strengths and weaknesses are.

While it is clear that building and developing good internal capabilities can contribute greatly to the sustainability of any company, companies should also study external factors such as their competitors and target market to ensure a competitive edge and avoid strategic drift.

Therefore, rather than just blindly engaging in a price war with these sharer-competitors in an attempt to regain market share and consumers, perhaps a different approach maybe more beneficial depending on the industry.

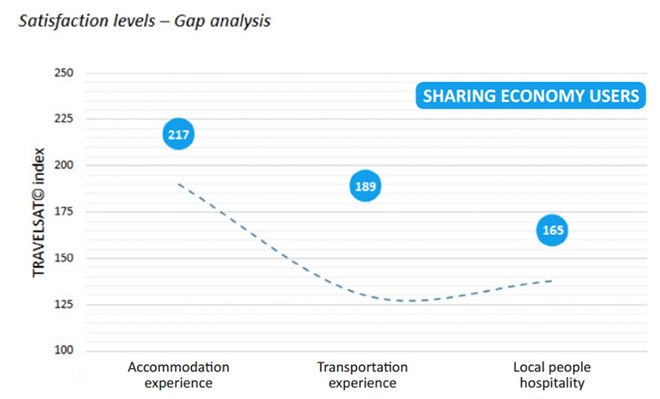

When looking at satisfaction levels, Asia Pacific travellers were noted to be mostly satisfied with their alternative accommodations and ride-sharing experiences, but the gap was much larger in the transportation experience as compared to the Accommodation experience.

What this means is that travellers obtains a higher level of satisfaction from ride-sharing services than they expected to, suggesting that our taxi industry maybe extremely lacking in this regard.

In an interview with BizHive Weekly, Masing alluded to this being the case as he vocally called for the taxi association to “change their mindset including the attitude and the way they treat customers.”

With the advantage of reduced operational costs, ability to offer reduced fares, and now better customer service, ride-sharing is looking to be a huge threat to our local taxi companies.

This threat has not gone unnoticed as Masing continued on to advise the taxi association to adjust to the new environment and new set of competitors.

“You have to be very smart, the Taxi association should tell their members to be effective, not only efficient but cost effective in doing business. Their mindset must change to compete against this new method of transportation,” shared Masing during the interview.

While the satisfaction and expectation gap for the accommodation was not very large, the survey by PATA and TCI Research also revealed a significant number of complaints or negative experiences Asia Pacific travellers experienced with home-sharing services, with 14 per cent of the respondents said they’ve complained, which is four per cent above the average of all types of accommodations combined.

As expectation levels are fairly high for accommodation experience, this suggests that for the hospitality and tourism industries at the very least, a focus on increased customer service may not be the most pragmatic approach, as the Sarawak Central Region Hotel Association has suggested that the main reason that travellers are opting for its sharer-competitors is due to price sensitivity.

Chris KC Kon, Sarawak’s chapter chairman or Malaysian Association of Tour and Travel (MATTA) suggests that one way of recapturing consumers within the hospitality and tourism industry is the introductions of more creative tour packages.

This seems to be reminiscent of hospitality giant, Airbnb’s current strategy, as they’ve recently rolled out a new feature that would offer travellers the opportunity to create customised itineraries for hours or days that brings a more authentic local experience.

However, under our Tourism Industry Act 1992, hosts engaging in this new feature would be in breach of section 5(2) of the act which details that without the application for a valid license, no person shall carry on or operate, or hold himself out as carrying on or operating, a tour operating business; or a travel agency business.

Breaching this section, will subject hosts to section 5(3) which details that they may be liable to a fine not exceeding fifty thousand ringgit or to imprisonment for a term not exceeding five years or to both.

For continuing offenders, a daily fine not exceeding five thousand ringgit for each day the offence continues to be committed will be imposed instead.

Of course it is early days and whether or not hosts engaging in this new Airbnb ‘Trips’ feature will be defined as a tour operating business or travel agency business by local authorities is still up in the air.

In spite of this, this potential upcoming regulatory battle can be seen as an opportunity to the tourism and hospitality industry as it can help them differentiate themselves from its home-sharing competitors.

Regardless of how our hospitality and tourism industries will approach this, it seems that there is an urgency as our Central Region Hotel Association has alluded that many of its members are just surviving due to increase operational costs and increased competition.

More focus on consumers

While we’ve covered some ground on what consumers expect and want, it never hurts to understand more about the consumers we are trying to recapture.

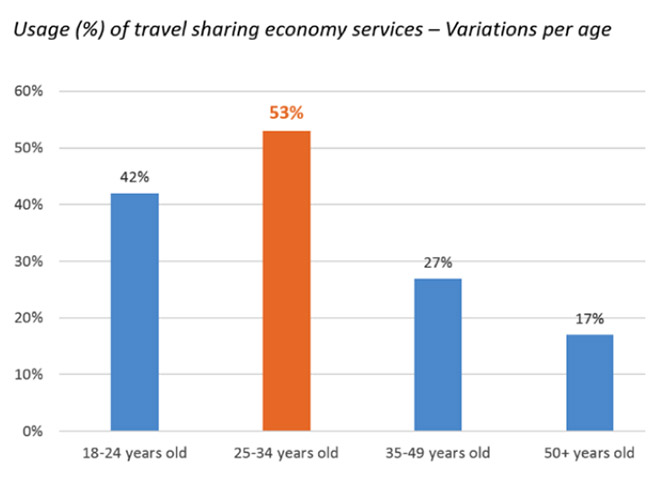

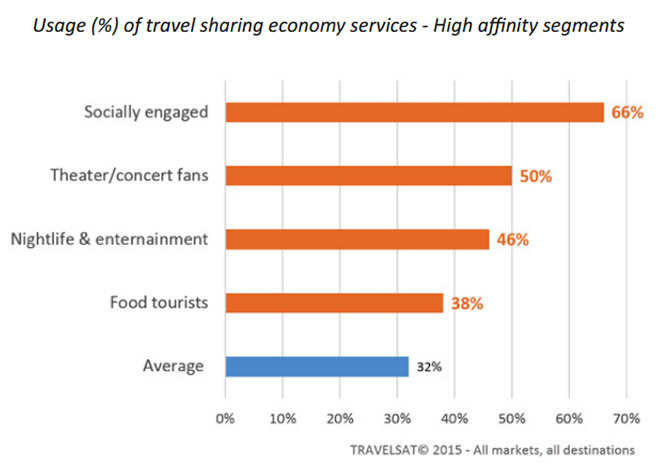

Not surprisingly, PATA and ICT Research’s data highlighted that these regular consumers in of the sharing economy are largely young consumers, with 42 per cent and 53 per cent of Asia Pacific travellers in the respective age groups of 18-24 and 25-34, having used such sharing services.

However, usage reduced with age as within the age groups of 35-49 and over 50, usage was at 27 per cent and 17 per cent, respectively.

The study also showed that nearly one third of travellers using the sharing economy shared photos and information about their travel experiences online, making it one of the most defining characteristics of Asia Pacific travellers using these services.

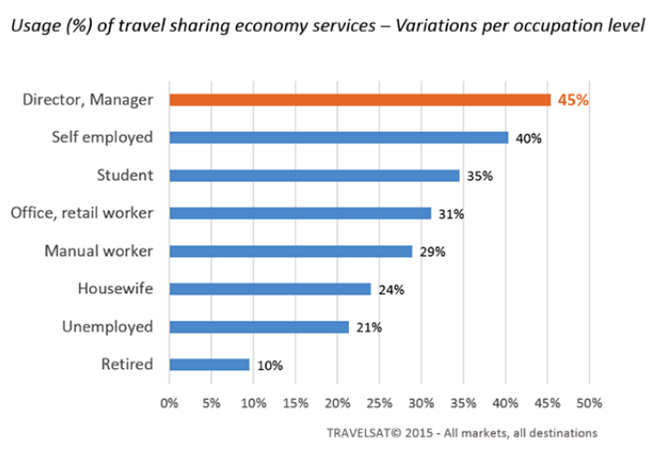

Finally, one surprising fact that was revealed is that a higher number, 45 per cent of Asia Pacific travellers that are high-level directors or managers in their day jobs, were found to be sharing economy users.

Additionally, they were also found to be 38 per cent more sensitive than travellers from other regions to the brand status of the destination. And twice as sensitive to TV news when they choose their destination.

From this, we can gather that the consumer that our local industries are trying to recapture are largely young high powered executives addicted to social media and easily influenced by branding and TV adverts.

Just going of this information alone, it is highly suggestive that marketing and convenience aspect seem to be critical success factors for our local tourism and hospital industry.

Of course it is recommended proper market and consumer analysis be conducted, but this information helps suggest as to what direction our local tourism and hospital industry should take to gear up for the increased competition.

Beware of stranger danger!

‘Follow me… so far away, and who knows where these paths will lead…’ the airy female voice croons accompanied by a playful light melody. This is a lyric from Airbnb’s official theme song, ‘Follow Me’ by Moth and the Flame.

At first glance, the lyric seems innocent but when you factor in the unique service Airbnb provides — a peer-to-peer online marketplace and homestay network that enables people to list or rent short-term lodging in residential properties — it takes on a rather sinister undertone.

While advocates for Airbnb would have you believe that Airbnb’s host and guest rating system is enough to quell such concerns, it is undeniable that the issue of safety for both Airbnb guests and hosts is one that even the hospitality giant is acknowledging.

In an interview with the Adweek, Airbnb’s chief marketing officer (CMO), Jonathan Mildenhall was quoted saying “As a marketer I think it’s really, really important that you lean into the uncomfortable truth.”

Mildenhall’s mindset on the subject matter has led a string of successful advertisement campaigns for Airbnb, with it’s very first international TV campaign, ‘Never a Stranger’, targeted towards helping relief the concerns of ‘stranger danger’ in its users.

This has led to the transformation of Airbnb from a humble start-up company to a hospitality superbrand boasting an estimated valuation of US$30 billion with a 2.3 million room inventory.

For comparison sake, Hilton Worldwide Holdings’ (Hilton) estimated valuation stands at USD$22 billion, while Airbnb’s room inventory is bigger than the combined room inventories of the three largest hotel chains put together, namely, Hilton, Marriott International Inc (Marriott) and InterContinental Hotels Groups PLC (InterContinental).

It is undeniable that Airbnb’s superbrand status has contributed to largely to appealing and capturing its users trust, but Airbnb has taken it one step further with the introduction of its Host Protection Insurance Program that insures hosts up to US$1 million if there are any damages or issues when hosting.

While this is greatly beneficial towards, Airbnb hosts, its users are still left unprotected, as currently Airbnb listings are not subjected to any safety regulation unlike licensed hotels and accommodations.

Yap shared, “I think the only problem is when higher density properties don’t get the requisite approvals and operate on Airbnb instead of going for the appropriate hotel licenses.”

A quick search for listings on Airbnb showcases a few listings within Kuching that are made to look like backpacking hostels offering lower rates than competing local backpackers.

It is not known whether these listing are registered businesses or not as their hosts have declined to comment on their status when BizHive Weekly inquired.

However, if unlicensed, they would be classified as illegal operations said Johnny Wong Sie Lee, chairman of Sarawak Central Region Hotel Association.

Wong likened these operations to the illegal room-for-rents that have plagued our housing and tourism industry, citing that not only, were they cutting heavily into our hospitality industry’s market share and revenue, but they were also a hot bed for safety concerns, such as fire safety.

He argued that current regulations are already sufficient the address the issue at hand, but it was up to local councils to take more efforts in the crackdown of such operations.

Yap agreed with this sentiment, but highlighted that there should not be regulations that are too strict for low density homestay/accommodations where guest expectations are very different than from a hotel.

“As long as the building is still used within its intended limits and with fire safety in mind, there’s little need for extensive regulations beyond the regular licenses you have, for example occupation permit and trading licenses,” he opined to BizHive Weekly.

“Our building is also not being used in a way that would affect fire safety through overcrowding (we are way below the intended capacity) and those should be the primary concerns.

“With hotels that are housing much greater numbers of people with amenities such as pools/gyms/bars/functions rooms etc, then it makes sense that they have to comply with greater regulations to ensure safety,” argued Yap.

Of course, Airbnb has also demonstrated a good nature in accommodating towards local regulations, as you sign up to be a host it reminds you constantly to ensure that you look up local council laws regarding renting to promote compliance with local regulations.

Overall, at this juncture local councils seem rather unfazed by Airbnb but it may only a matter of time until regulatory battle plays out.

On the other end of the spectrum, the controversy regarding Uber’s legal status has been a heated topic as the ride-sharing provider strong-armed its way into Kuching, launching and commencing operations without an application towards the Commercial Vehicle Licensing Board (LKPK), despite warnings from Minister Datuk Nancy Shukri, who oversees Sarawak’s LKPK.

While the Land Public Transport Commission (SPAD) has announced prior to Uber’s launch in Sarawak that the Cabinet had given the go-ahead to regulate ride-sharing services like Uber and Grab, our own LKPK does not come under SPAD’s jurisdiction.

In response to this, Uber continues to maintain is that they’re purely connecting peers to peers to offer a service and that it is not a Taxi company, nor are Uber drivers their employers but rather independent contractors free to work whenever they please or convenient to them.

While this is all true, the fact still stands that it is still diverting business away from our local taxi companies. Additionally, operating a taxi service has costs that are astronomically higher due to the need to follow regulations and pay for licenses and tax; making it very hard to compete against Uber drivers.

Moving forward

Which bring us to our initial question, ‘How do we approach this?’. There are many ways for us to approach this as showcased by the variety of different methods governments around the world have taken in attempt to the regulation for the sharing economy.

For example, in South Australia, its state government worked closely together with Uber operations to review safety guidelines and Uber driver applications in order to ensure a level of quality, assurance, and safety with the drivers and their vehicles.

Additionally, they also imposed a one Australia dollar levy on each Uber ride to compensate taxi licence plate owners and drivers for allowing new entrants into the market. It is expected that this levy will raise about A$80 million over the next decade.

Meanwhile in the tourism industry, the Ministry of Tourism in Jamaica is set to sign an agreement with Airbnb to not only collect taxes from rentals but also to allow the Ministry to review listing in order to maintain the branding of tourism within Jamaica.

These are just some example seen around the world, and while some have proven highly successful as in the case of South Australia, it may not necessarily work for us, so there needs to be a discussion regarding the issue at hand with all affected parties.

Of course there are some concerns that these sharing entities may not cooperate due to the clout they have but in actuality, they have demonstrated a propensity in working with local authorities in working out regulations with Airbnb famously hiring Chris Lehane former political adviser to US president Bill Clinton as their head of global policy and public affairs, to assist cities worldwide in drawing up policies and proposals for the regulation and promotion of responsible home-sharing.

And it’s not only just Airbnb as Uber has also chimed in the conversation noting that in some cases, current regulations do not cover what Uber is about.

“That is the kind of conversation we need to bring the city forward to protect riders, drivers and of course the business. We are still in talks with the regulators. I think the eventual outcome of that we cannot confirm – like the sort of registrations we need,” shared Kenny Choong general manager of Uber Malaysia.

With this in mind, we can only wait for and see what the cooperation between government officials, local councils, local businesses and sharing entities, will yield for us.