KUCHING: Researchers with Maybank Investment Bank Bhd recently upgraded the oil and gas (O&G) sector to positive, believing the sector to be on a recovery path admist an improving risk-reward outlook.

KUCHING: Researchers with Maybank Investment Bank Bhd recently upgraded the oil and gas (O&G) sector to positive, believing the sector to be on a recovery path admist an improving risk-reward outlook.

It opined that the sector has bottomed and foresees two major growth catalysts in the near term.

They are the Organisation of Petroleum Exporting Countries (OPEC) and non-OPEC move to cut output which will accelerate the demand-supply rebalancing of the oil market and multiple benefits to Malaysia’s O&G in the event Saudi Aramco’s plan to invest a 50 per cent stake in Petroleum Nasional Bhd’s (Petronas) Refinery and Petrochemical Integrated Development (RAPID) at Pengerang, Johor.

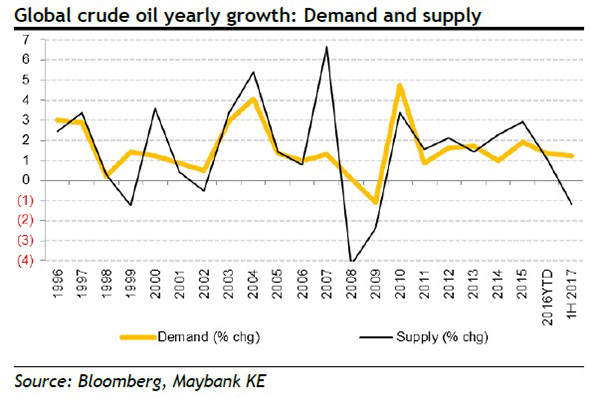

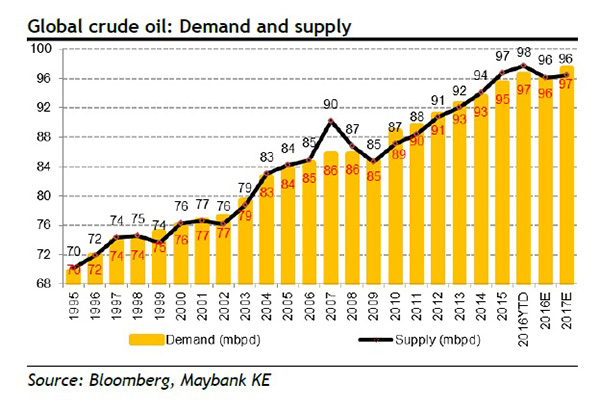

Elaborating further, Maybank IB Research believed the joint agreement by member of OPEC and several non-OPEC producers to cut oil output by 1.8 million barrels per day from January 2017 for six months reflects a major statement to a stabilising oil market.

“The output cut will lead to a start of a cyclical recovery adding that the cut, which equates to 1.5 years of global consumption growth if properly executed will accelerate the rebalancing of the demand-supply equation of the crude oil market,” it said in a note yesterday.

The research firm further pointed out that the move will kick-start the capital expenditure (capex) growth of oil companies and support firmer oil prices.

For 2017, Maybank IB Research has forecasts the crude oil price to average at US$55 per barrel.

Besides that, the research firm said it did not rule out the possibility of the global crude oil market reaching a balance by the second half of 2017 (2H17) ahead of the projected 2018, supported by firmer oil price outlook.

Apart from that, Maybank IB Research noted Petronas is set to make a final investment decision (FID) to bring in Saudi Aramco as its partner for the RAPID project and other related facilities at Pengerang, Johor.

It observed speculation is rife that Petronas will offer a 50 per cent stake in the project for US$21 billion with the partnership expected to be set up by the first quarter of 2017 (1Q17).

The research firm viewed the move positively and opined that in the even the deal go through, it would be a major catalyst to Malaysia’s O&G sector.

For Petronas, the research firm believed the move will enable the state oil corporation the ability to realise value from its RAPID investment.

Maybank IB Research recalled that RAPID, a US$27 billion investment, has been Petronas’ core capex focus over the past few years.

The research firm also believed the investment by Saudi Aramco will enable greater deployment of domestic capex and higher activities.

It opined that the proceeds could be deployed to other domestic O&G capex programme for instance upstream exploration and production, which have been constrained by its RAPID commitment.

Maybank IB Research noted that a higher domestic capex programme by Petronas would eventually translate to higher activity and that would benefit the local service providers across the board.

The research firm also believed the cash injection would ease Petronas’ cash flows, strengthen its balance sheet and enable it to meet its dividend commitment to the government.

Based on Maybank IB Research observation, it opined that the O&G sector has responded to the low oil price with much focus on cash preservation and cost reduction.

The research firm noted that the operating expenditure (opex) for the O&G sector was much leaner currently as the sector re-bases its business at the US$40-50 per barrel level.

Besides that, the research firm also observed that the day rates and utilisation of services assets have bottomed and were at their trough.

On top of that, it noted the number of enquiries was rising and the tenders pipeline has started to pick up.

Thus, it opined that those signs reinforce its view of a recovery in motion although the speed of the recovery remains a grey area at present.

Domestically, it opined that the Malaysia’s O&G sector will get an immediate re-rating all across the board should Saudi Aramco’s investment of a stake in Petronas’ RAPID materialise.

Operationally, the research firm pointed out that the state of business varies across the O&G value chain, depending on their business mix as well as operational and financial capabilities.

From an earnings perspective, Maybank IB Research forecasts that poor 4Q16 and 2017 results have already been well anticipated and priced in.

The focus, the research firm believed should be on 2018 onwards.

Valuations-wise, Maybank IB Research observed that most stocks have de-rated and much of their values lost, making that a good time to bottom fish.

The research firm highlighted that the O&G sector offers pockets of trading opportunity on cyclical, thematic and valuation plays in 2017.