Malaysian palm oil futures retraced back from their strongest level in four and a half year high and closed at 3,061 as tracking rival oil markets losses and profit taking ahead of public holiday.

Malaysian palm oil futures retraced back from their strongest level in four and a half year high and closed at 3,061 as tracking rival oil markets losses and profit taking ahead of public holiday.

Crude palm oil futures (FCPO) benchmark March 2016 contract settled at 3,060 on Friday, down 101 points or 3.2 per cent from 3,161 last Friday. Trading volume decreased to 130,921 contracts from 177,627 contracts from last Monday to Thursday.

Open interest based increased to 786,039 contracts from 754,352 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during December 1 to 20 fell 14.4 per cent to 629,043 tonnes compared with 734,800 tonnes during November 1 to 20.

Socete Generale de Surveillance (SGS) report showed that Malaysia’s palm oil exports during December 1 to 20 fell 16.9 per cent to 606,937 tonnes compared with 730,257 tonnes during November 1 to 20.

Overall, demand strengthened from Europe and China, while demand remained weakened from India. Spot ringgit stuck around 4.4725 ahead of public holiday on Friday while weak oil, exports, China worries keep ringgit on depreciation path.

Reuters’s survey showed that Indonesia’s crude palm oil output likely rose by 8 per cent in November from a month ago, while exports fell slightly. According to a circular on the Malaysian Palm Oil Board website on Tuesday, Malaysia will raise its crude palm export tax to 7 per cent in January, up from 6 per cent in December.

Trade minister said on Friday that Indonesia will file an appeal after the World Trade Organization (WTO) ruled against its restrictions on food imports from the United States and New Zealand.

On Monday, the crude palm oil market fell after touched a four-and-a-half-year high as market gains capped by profit taking and weaker performing rival oil markets.

On Tuesday, the price fell for third consecutive day as market sentiment weighed by lower demand expectation and tracking weaker performing rival oil markets.

On Wednesday, the market rebounded and ended three-day fall as tracking back of improved sentiment for vegetable oil markets and supported by weaker ringgit.

On Thursday, the crude palm oil market fell as tracking by soybean oil market losses and dragged by profit taking ahead of long weekend.

On Friday, the market fell on Friday as dragged by bearish sentiment of oversea rival oil markets while losses capped by profit taking ahead of long weekend.

Technical Analysis

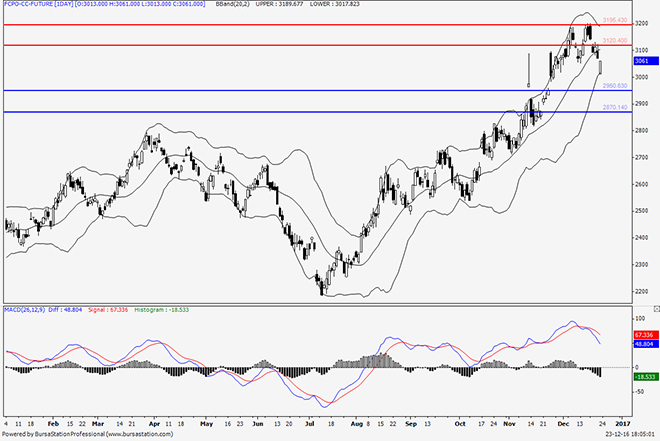

According to the weekly FCPO chart, weekly candlestick opens higher and while the market remained under pressure by upper Bollinger Band. By the end of the week, market closed lower as a weekly bearish ‘engulfing’ candlestick pattern could provide uptrend reversal and correction signal in long term.

On Monday, the price fell as upper Bollinger Band start heading downward which could indicate that current uptrend momentum could decrease while MACD shown a reject bullish crossover sign above zero line which could provide price correction signal in short term.

On Tuesday, the price fell as market continues to approach middle Bollinger Band and MACD remained to show a reject bullish crossover sign above zero line.

On Wednesday, the price rose as market remained supportive above middle Bollinger Band while middle band should be monitored closely to provide further indication on next market trend in short term.

On Thursday, the price broke and closed below middle Bollinger Band which could provide a bearish signal for current market in short term. MACD histograms continue decrease after a reject bullish crossover sign and indicate further presence of selling momentum.

On Friday, the price fell as market remained supported by lower band while Bollinger Bands range shown narrowing sign which indicate that decreasing in price volatility.

In the coming week, the price has potential to range between 3,120 and 2,870.

Resistance lines will be placed at 3,195 and 3,120, support lines will be positioned at 2,950 and 2,870, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report released on December 26 to 27.

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.