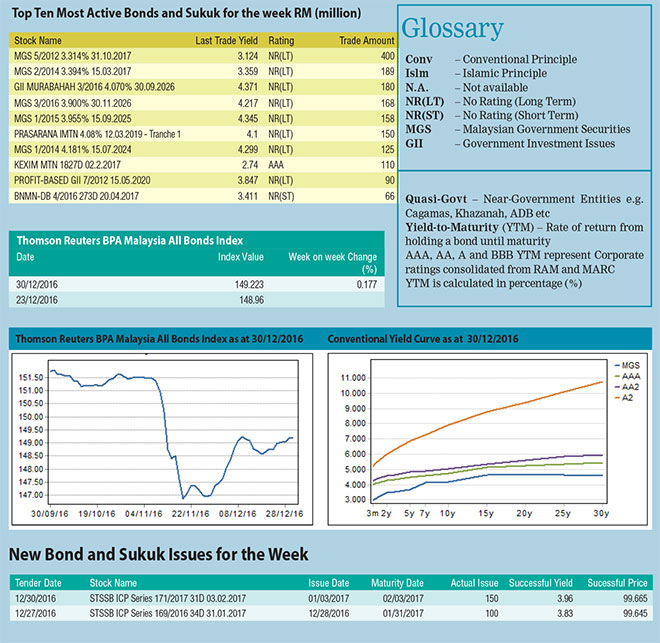

The Index gained 0.177 per cent to close at 149.223 point on the back of light trading over the week as most of the market players were still on holidays.

The Index gained 0.177 per cent to close at 149.223 point on the back of light trading over the week as most of the market players were still on holidays.

MGS ended the week mixed with their movement contained within 2bps from three-year curve point onwards.

However, corporate yield curves mostly came down attributed to year-end window dressing activities.

Top 10 most active bonds:

The total trade volume for the top 10 most actively traded bonds dropped substantially to a mere RM1.6 billion from RM4.2 billion due to holiday-shortened week.

Short-tenured MGS maturing on October 31, 2017 topped the list with RM400 million traded.

New Issuance(s):

On December 27, 2016, APM Automotive Holdings Bhd issued a one-year Islamic Medium Term Notes (IMTN) amounted to RM5 million with a profit rate of 4.95 per cent.

The IMTN is rated AA2 with a stable outlook by RAM Ratings.

Premium Commerce Bhd issued five tranches of Class A notes totalled RM204 million and one tranche of Class B notes amounted to RM5 million.

The coupon rates of Class A notes range from 4.45 to 5.12 per cent with tenures of one year to eight years while the coupon rate of the Class B notes is 5.47 per cent with tenure of eight years.

The Class A notes and the Class B notes are rated AAA/stable and AA2/stable respectively by RAM Ratings.

Sunway Bhd issued a RM170 million 3.5-year MTN with coupon rate of 4.75 per cent.

The MTN is rated AA- with a stable outlook by MARC.

Sunway Treasury Sukuk Sdn Bhd issued a 5.5-year sukuk worth RM100 million with profit rate of 4.9 per cent. The sukuk is rated AA-IS(CG) with a stable outlook by MARC.

On December 30, 2016, AmBank Islamic Bhd and AMMB Holdings Bhd issued a 10-non call-five-year subordinated sukuk and subordinated notes respectively. The profit rate and coupon rate are both fixed at 5.5 per cent.

AmBank Islamic sukuk is rated AA3/stable while the AMMB Holdings notes is rated A1/stable by RAM Ratings.