Malaysian palm oil futures posted for the strongest annual gain since 2010 and closed at 3,106 as crude palm oil market underpinned by weaker ringgit and tight supplies boost market bullish sentiment for 2016.

Malaysian palm oil futures posted for the strongest annual gain since 2010 and closed at 3,106 as crude palm oil market underpinned by weaker ringgit and tight supplies boost market bullish sentiment for 2016.

Crude palm oil futures (FCPO) benchmark March 2016 contract settled at 3,109 on Friday, up 49 points or 1.6 per cent from 3,060 last Friday.

Trading volume decreased to 116,877 contracts from 130,921 contracts from last Monday to Thursday.

Open interest based decreased to 606,701 contracts from 786,039 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during December 1 to 25 fell 5.6 per cent to 845,441 tonnes compared with 895,625 tonnes during November 1 to 25.

Socete Generale de Surveillance’s (SGS) report showed that Malaysia’s palm oil exports during December 1 to 25 fell 7.5 per cent to 827,347 tonnes compared with 895,077 tonnes during November 1 to 25.

Overall, demand strengthened simultaneously from Europe, India and China. Spot ringgit fell to 4.4845 ahead of the public holiday on Friday as worries about US President-elect Donald Trump’s stance on trade weighed on the currencies of export-dependent countries in Asia.

Indonesia’s trade ministry said on Wednesday that Indonesia would set its crude palm oil (CPO) export tax at US$3 per tonne in January, after keeping the tax at zero for two months, as the reference price would rise above the threshold for adjustment.

On Monday, Bursa Malaysia Derivatives market closed on December 26, 2016 due to Christmas Day.

On Tuesday, the market rose for the second consecutive day, tracking rival oils on Dalian and CBOT gains as well as stronger energy market boost vegetable oil markets sentiment.

On Wednesday, the crude palm oil market rose for third consecutive day on Wednesday, underpinned by weaker ringgit and stronger energy price boost vegetable oil markets sentiment.

On Thursday, the price fell after three sessions of gains, tracking rival oil markets losses and year-end profit taking.

On Friday, the market rose ahead public holiday and posted for the strongest annual gain since 2010, underpinned by weaker ringgit and tight supplies boost market bullish sentiment for 2016.

Technical analysis

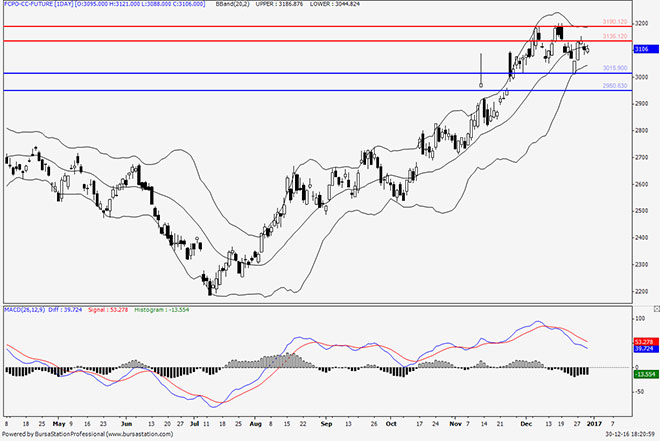

According to the weekly FCPO chart, weekly candlestick opened higher as Bollinger Bands continued moving upwards, providing a long term uptrend indication.

By the end of the week, market closed higher as the MACD histogram value showed decreasing sign which could indicate reducing buying momentum.

On Monday, Bursa Malaysia Derivatives market closed on December 26, 2016 due to the Christmas Holiday.

On Tuesday, the price rose as the market broke the middle Bollinger Band which could provide a bullish signal for the current market in the short term. A second consecutive daily ‘Marubozu’ candlestick could indicate further buying momentum.

On Wednesday, the price rose while the Bollinger Bands range showed signs of narrowing which could provide an indication that price volatility is slowing down.

On Thursday, the price fell while the Bollinger Bands traded sideways which could indicate that the current market stayed at sideways condition. Market closed below middle band again which potentially indicated that the price will be significantly weak in the short term.

On Friday, the price rose while market remained under pressure while middle band should be monitored closely to provide further indication on the next direction of the market in the short term.

In the coming week, the price has potential to range between 3,190 and 3,015.

Resistance lines would be placed at 3,190 and 3,135, support lines would be positioned at 3,015 and 2,950, these levels would be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report released on December 31, 2016 and January 3, 2017.

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.