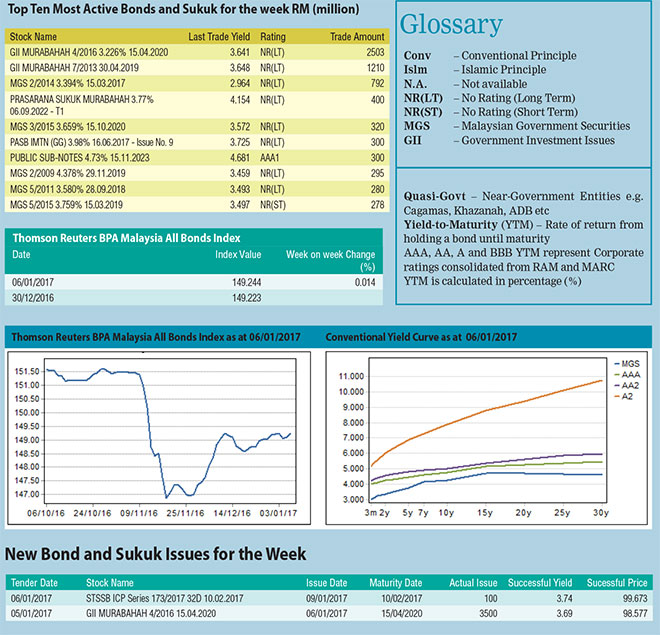

The ringgit weakened to 4.4985 against the US dollar on Tuesday following the release of a better than expected US ISM manufacturing data. The bleak sentiment did not improve on Thursday as a hawkish FOMC minutes from December’s FOMC meeting points to more rate hikes this year on the back of optimism over growth and inflation prospects. However, the ringgit managed to recover losses towards the end of the week to close at 4.4755 from 4.486 a week ago amid recovery in crude oil prices. As a result, the performance in the ringgit bond market was mixed as the Thomson Reuters BPAM All Bond Index saw a marginal increase of 0.01 per cent from 149.223 point in the previous week to settle at 149.244 point.

The ringgit weakened to 4.4985 against the US dollar on Tuesday following the release of a better than expected US ISM manufacturing data. The bleak sentiment did not improve on Thursday as a hawkish FOMC minutes from December’s FOMC meeting points to more rate hikes this year on the back of optimism over growth and inflation prospects. However, the ringgit managed to recover losses towards the end of the week to close at 4.4755 from 4.486 a week ago amid recovery in crude oil prices. As a result, the performance in the ringgit bond market was mixed as the Thomson Reuters BPAM All Bond Index saw a marginal increase of 0.01 per cent from 149.223 point in the previous week to settle at 149.244 point.

On January 6, 2017, Department of Statistics Malaysia released the external trade statistics for the month of November 2016. On a year-on-year basis, exports rose by 7.8 per cent to RM72.8 billion while imports grew 11.2 per cent to RM63.8 billion. As a result, trade surplus dropped to RM9.0 billion from RM10.2 billion a year ago due to higher than expected imports.

On the same day, Bank Negara Malaysia reported that the international reserves stood at US$94.6 billion as at December 31, 2016 as compared to US$95.3 billion a year ago. The reserves position are sufficient to finance 8.8 months of retained imports and 1.3 times coverage for short-term external debt.

The trade volume for the top 10 most actively traded bonds increased by RM5.1 billion to RM6.7 billion compare to the RM1.6 billion last week. The three-year MGII paper, maturing on April 15, 2020, topped the list with RM2.5 billion traded.

On January 3, 2017, Bank Negara Malaysia announced the tender details for the reopening of the 3-year benchmark MGII maturing on April 15, 2020 with an issue amount of RM3.5 billion. The tender closed on January 5, 2017 with a decent bid-to-cover ratio of 1.789 times. The highest, average and lowest yields came in at 3.7, 3.69 and 3.657 per cent respectively.

On January 4, 2017, RAM Ratings revised the outlook on Golden Assets International Finance Limited’s (Golden Assets) RM5 billion Islamic MTN Programme (2012/2027) A1(s) rating to stable from negative. Golden Assets is a funding conduit of Golden Agri-Resources Ltd (GAR or the Group). The revision of the outlook is premised on GAR’s stabilised debt level after the expansion of its downstream capacity was completed as well as expectations of progressive debt reduction in view of reduced capex needs going forward. The Group’s adjusted funds from operations debt cover (FFODC) (after adjusting for readily marketable inventories (RMI) and refundable taxes) is estimated to stay above 0.15 times under stressed scenario, as its debt level is projected to decline gradually to about US$2.5 billion over the next few years.