The Thomson Reuters BPAM All Bond Index ended the week in the red at 149.217 from 149.244 point last week. The MGS curve bear steepened over the week with five-year and below yields eased by one to six bps while 10-year and above yields increased by four to 10bps.

The Thomson Reuters BPAM All Bond Index ended the week in the red at 149.217 from 149.244 point last week. The MGS curve bear steepened over the week with five-year and below yields eased by one to six bps while 10-year and above yields increased by four to 10bps.

On January 6, 2017, the Bureau of Labor Statistics reported 156,000 job increase in December and headline unemployment edged higher to 4.7 per cent.

The report fell short of expectation and thereby fueled recovery in the US Treasury market. In addition, president elect Donald J. Trump’s press conference on 11 January 2017 failed to stimulate the markets due to a lack of details on a potential stimulus and fiscal policies. Therefore, the Ringgit strengthened from 4.4755 to 4.4625 on the back of dollar weakness while the UST continued its rally throughout the week.

On January 11, 2017, Department of Statistics Malaysia reported that the Index of Industrial Production (IPI) expanded substantially by 6.2 per cent year-on-year in November 2016, on the back of a broad-based increase in all sectors.

Manufacturing sector output increased 6.5 per cent as compared to 4.2 per cent in October 2016, Mining grew 4.7 per cent as opposed to 3.5 per cent in previous month and Electricity expanded by 9.7 per cent following an increase of 6.9 per cent in the previous month.

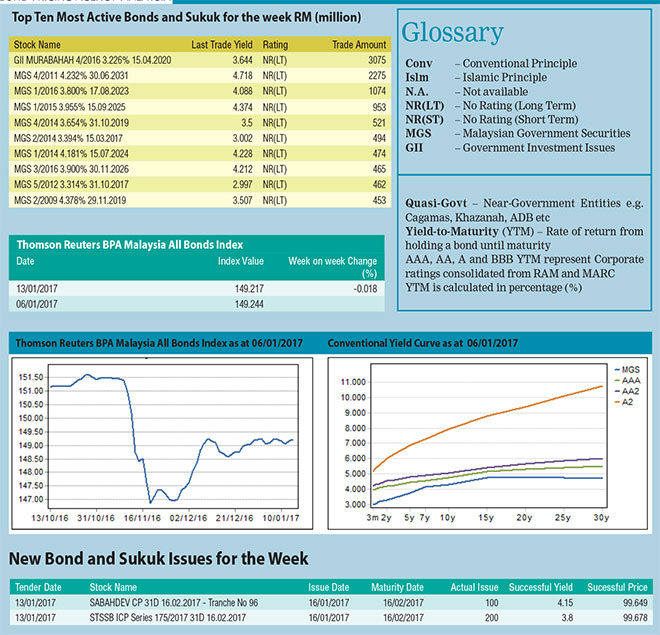

Top 10 most active bonds:

Market activities continued to pick up this week as the trade volume for the top 10 most actively traded bonds increased from RM6.7 billion in the previous week to RM10.2 billion this week.

The three-year MGII paper, maturing on 15 April 2020, remained on the top of the list with RM3.1 billion traded and the 15-year MGS which had a reopening auction this week came in as the second most actively traded bond with a total trade volume of RM2.3billion.

Sovereign bond auction:

On January 10, 2017, Bank Negara Malaysia announced the tender details for the reopening of the 15-year benchmark MGS maturing on June 30, 2031 with an issue amount of RM4 billion.

The tender closed on 12 January 2017 with a strong bid-to-cover ratio of 2.503 times. The highest, average and lowest yields came in at 4.796, 4.786 and 4.773 per cent respectively.

New issuance(s):

On January 13, 2017, Lafarge Cement Sdn Bhd issued two tranches of Islamic Medium Term Notes (IMTNs) maturing in 2018 and 2020 with a total issuance amount of RM280 million.

The IMTNs bear profit rates of 4.4 and 4.8 per cent respectively and are rated AA2 with stable outlook by RAM Ratings.