On Wednesday, US Fed Janet Yellen signaled that it would “make sense” to hike interest rates gradually, in view that the US economy is close to full employment and inflation is moving towards the two per cent goal.

On Wednesday, US Fed Janet Yellen signaled that it would “make sense” to hike interest rates gradually, in view that the US economy is close to full employment and inflation is moving towards the two per cent goal.

This can be further supported by a slew of firm macroeconomic data released during the week.

The December CPI data came in as expected as the index rose 2.1 per cent on a year-on-year basis, and the unemployment claims fell to 234,000 from 249,000 registered a week earlier.

The MGS ended mixed partially owing to the hawkish tone from Fed Yellen’s speech during mid-week.

The MGS curve shed one to 10 bps across all tenures, except for the longer end 25-year and 30-year which saw yields edged higher by approximately 5 to 10 bps.

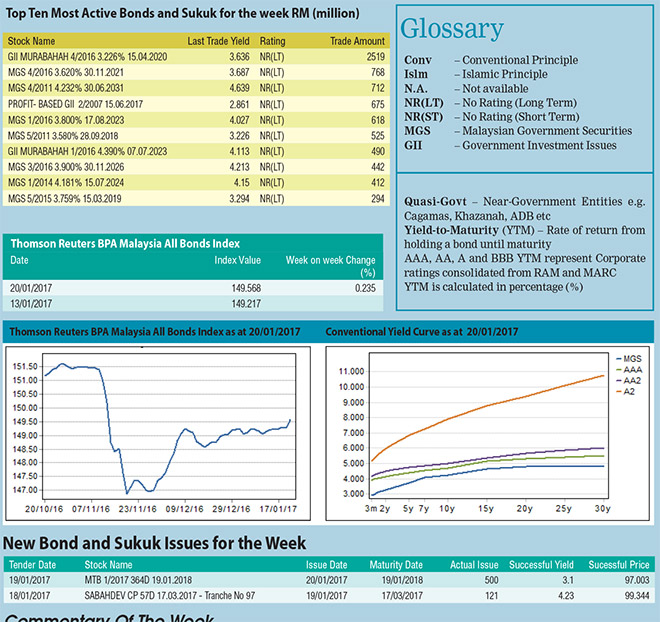

As a result, the Thomson Reuters BPAM All Bond Index posted gains to end the week at 149.568 point from the previous week at 149.217 point. Nevertheless, all eyes will be on Trump’s presidential inauguration speech tonight.

On January 18, 2017, the Department of Statistics reported that the Consumer Price Index (CPI) remained stable at 1.8 per cent year-on-year in December 2016, slightly lower than market consensus at 1.9 per cent.

The increase in the indices by Food & Non-Alcoholic Beverages (3.7 per cent) and Housing, Water, Electricity, Gas & Other Fuels (2.1 per cent) were offset by the decrease in the indices of Communication by 2.6 per cent, Transport (0.6 per cent) and Clothing & Footwear (0.5 per cent).

On Thursday, Bank Negara Malaysia (BNM) decided to leave the Overnight Policy Rate (OPR) unchanged at three per cent, as the overall Malaysian economy remains on track to expand as projected.

The central bank will continue to provide liquidity to support the financial market amid uncertainties in the global economy, policy environment and geopolitical developments which may result in volatility in the regional financial and foreign exchange markets. BNM also highlighted that the headline inflation is expected to average higher in 2017 as opposed to the average of 2.1 per cent last year.

On January 20, 2017, BNM announced that the international reserves fell 0.3 per cent to USD 94.3 billion (RM422.9 billion) as at January 13, 2017 as compared to US$94.6 billion (RM424.2 billion) two weeks ago.

The reserves position is sufficient to finance 8.7 months of retained imports and is 1.3 times the short-term external debt.

The total trade volume of the top 10 most active bonds decreased to RM7.5 billion from RM10.2 billion transacted last week.

The three-year benchmark MGII, maturing on April 15, 2020, topped the list for the week with RM 2.5 billion traded.

On January 17, 2017, Rantau Abang Capital Bhd issued a 15-year Islamic Medium Term Notes (IMTN) amounted to RM1 billion with a profit rate of 5 per cent. The IMTN is rated AAA(s) with a stable outlook by RAM Ratings.