Malaysian palm oil futures closed on Monday and Wednesday due to public holiday, causing market to track foreign market movement which created several gaps after each holiday causing confusion due to rapid change of market direction.

Malaysian palm oil futures closed on Monday and Wednesday due to public holiday, causing market to track foreign market movement which created several gaps after each holiday causing confusion due to rapid change of market direction.

Crude palm oil futures (FCPO) benchmark April 2016 contract settled at 3,055 on Friday, dropped 16 points or 0.5 per cent from 3,071 last Friday.

Trading volume decrease to 96,238 contracts from 163,935 contracts from last Monday to Thursday.

Open interest based decrease to 380,025 contracts from 755,693 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during January 1 to 31 rose 8.1 per cent to 1.175 million tonnes compared with 1.087 million tonnes during December 1 to 31.

Socete Generale de Surveillance (SGS) reported that exports of Malaysian palm oil products for January 1 to 31 rose 4.3 per cent to 1.157 million tonnes from 1.11 million tonnes shipped during December 1 to 31.

Analyst Dorab Mistry told during industry event that Malaysian palm oil prices could fall by about a fifth to RM2,500 per tonne in June or July.

Spot ringgit closed lower against the US dollar as the greenback recovered from its weakest level against other major currencies since November last year while investor digesting recent policy statement from US.

The MPOB data showed a surprise rise in end-stocks to 1.67 million tonnes as output fell more than forecast, down 6.4 per cent from November to 1.47 million tonnes.

Exports, however, fell 7.5 per cent in December from a month earlier.

On Monday, market closed due to Chinese New Year public holidays.

On Tuesday, market declined and hit their lowest in five weeks as they tracked a subdued soybean market after the Lunar New Year holidays.

On Wednesday, market closed due to Federal Territory Holiday.

On Thursday, Malaysian palm oil futures gained on data showing lower production and improved exports.

On Friday, Malaysian palm oil edged down on Friday, tracking vegetable oil futures on the Dalian Commodity Exchange, which reopened after the Lunar New Year holidays.

Technical analysis

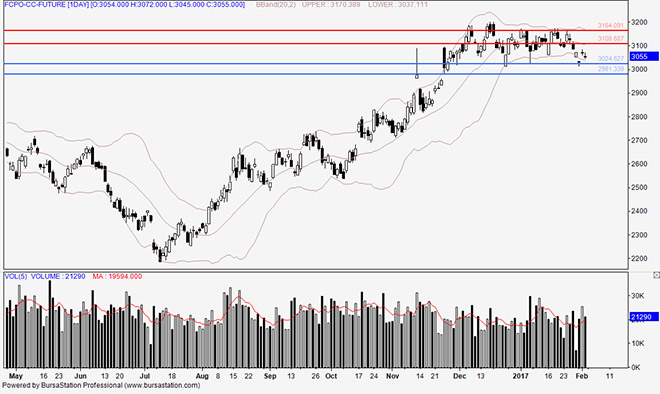

According to the weekly FCPO chart, candlesticks tested the bottom of the sideway trend near to 3,010 but failed to go beyond this range, with multiple gaps created throughout the week.

This has resulted into difficulty in identifying the market’s direction.

On Monday, the market closed due to the Chinese New Year public holidays. On Tuesday, market fell deeper for the day. There was an increased confidence that market would be able to break out from sideway price range, potentially reaching 2,900.

On Wednesday, the market closed due to Federal Territory Holiday.

On Thursday, the market opened a gap and remained bullish for the day, causing uncertainties on the market’s direction.

On Friday, the candlesticks fell slightly, leaving the market direction uncertain, despite showing higher chances to heading downwards.

In the coming week, the price has potential to range between 2,981 and 3,081.

Resistance lines will be placed at 3,108 and 3,164, support lines will be positioned at 3,024 and 2,981, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS & MPOB report released on February 10 (Friday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.