Malaysian palm oil futures closed on Thursday due to public holiday.

Malaysian palm oil futures closed on Thursday due to public holiday.

Malaysian palm oil futures gained from Monday to Wednesday on optimistic expectations of export data, but fell on Friday, dragged down by higher than forecast inventory data from the Malaysian Palm Oil Board.

Crude palm oil futures (FCPO) benchmark April 2016 contract settled at 3,070 on Friday, gained 15 points or 0.5 per cent from 3,055 last Friday.

Trading volume increase to 140,989 contracts from 96,238 contracts from last Monday to Thursday.

Open interest based increase to 587,489 contracts from 380,025 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during February 1 to 10 fell 3.1 per cent to 340,947 tonnes compared with 351,907 tonnes during January 1 to 10.

Socete Generale de Surveillance (SGS) reported that exports of Malaysian palm oil products for February 1 to 10 fell 0.4 per cent to 337,282 tonnes from 1.109 million tonnes shipped during January 1 to 10.

Spot ringgit closed lower against the US dollar after the greenback staged a comeback after US President Donald Trump promised to announce tax reform plans in a few weeks.

The MPOB data showed a 7.6 per cent decline in end-stocks to 1.54 million tonnes while output for January fell 13.4 per cent from December to 1.28 million tonnes. Exports rose 1.2 per cent to 1.28 million tonnes.

On Monday, market edged up as traders anticipate the release of palm oil data to determine the performance of export demand amid poor production.

On Tuesday, the market gained despite falling in the earlier session but managed to recover losses and close in a positive zone.

On Wednesday, the market hit a two-week high on Wednesday, stretching gains into a third session on expectations of a drop in stockpiles amid strong exports by the world’s second-largest producer of the tropical oil.

On Thursday, market closed due to Thaipusam public holiday.

On Friday, Malaysian palm oil, ended three sessions of gains, dragged down by higher than forecast inventory data from the MPOB.

Technical analysis

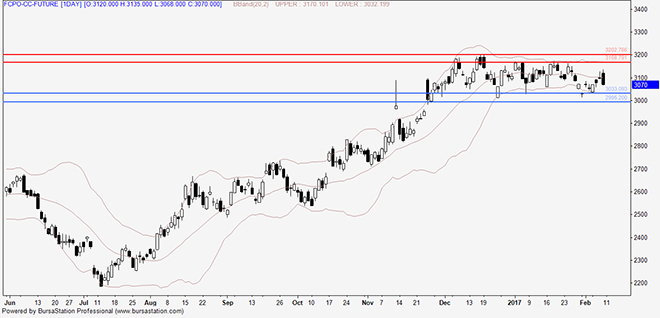

According to the weekly FCPO chart, candlesticks climb higher earlier in the week but retraced during the last trading day, strengthened by speculations of a sideway trend.

On Monday, palm oil futures reversed earlier losses from a bottom of 3,032 but managed to rebound and close in a positive territory. However, it was still lower than the usual traded volume.

On Tuesday, the market climbed and secured a second consecutive session of gains as the market remained buoyant on expectations of tighter supplies.

On Wednesday, the market opened a gap up and reached a new high of 3,127 but retraced sharply to close at an intra-day low of 3,095, raising doubts whether the current market gains are sustainable.

On Thursday, market closed due to Thaipusam public holiday.

On Friday, candlesticks fell and wiped out earlier profit, suggesting continuance of a sideway price range.

In the coming week, the price has the potential to range between 2,981 and 3,081.

Resistance lines will be placed at 3,168 and 3,202, support lines will be positioned at 3,033 and 2,995, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report released on February 15 (Wednesday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.