TR BPAM All Bond index closed lower at 150.453 point from 151.114 point last week, marking a 0.437 per cent loss as the US Treasury market extended losses on the back of heightened expectation of a March rate hike by the Federal Reserve of US (the Fed).

TR BPAM All Bond index closed lower at 150.453 point from 151.114 point last week, marking a 0.437 per cent loss as the US Treasury market extended losses on the back of heightened expectation of a March rate hike by the Federal Reserve of US (the Fed).

The MGS segment saw yields increased by 11 to 17 bps across the board taking cue from the rising US Treasury yields. Similarly, yields climbed by three to six bps across all tenures in corporate segment over the week.

The ringgit, however, remained firm at the range of 4.44 to 4.45 despite the US rate hike speculations.

On March 2, 2017, Bank Negara Malaysia (BNM) in its March Monetary Policy Committee (MPC) meeting decided to keep the Overnight Policy Rate (OPR) unchanged at three per cent.

In the MPC statement, BNM noted a higher global economic growth projection for 2017 on the back of improving economic conditions in both advanced and emerging economies as evidenced by recovery in global trade.

Headline inflation, on the other hand, is expected to be higher in 2017, underpinned by rising global oil prices.

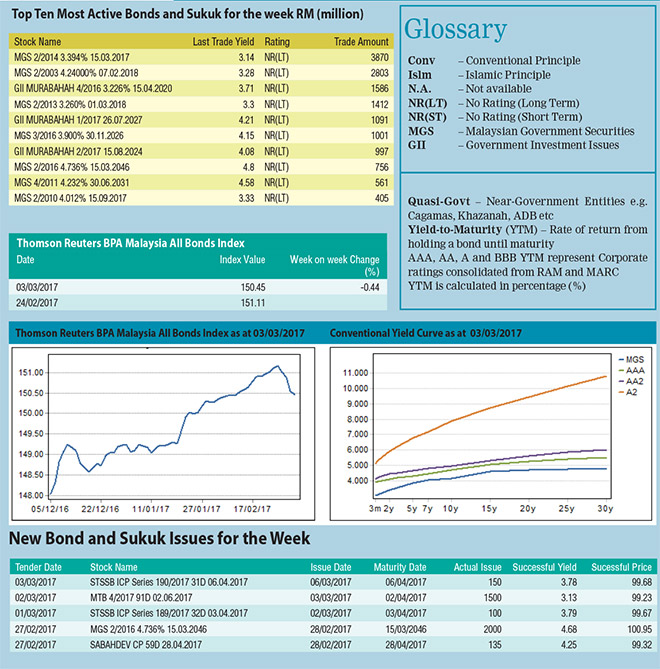

Top 10 most active bonds:

The total trade volume of the top 10 most actively traded bonds increased to RM14.5 billion from RM10.7 billion last week.

Short term off-the-run MGS maturing in March 2017 and February 2018 topped the list with a combined trade volume of RM6.7 billion.

Sovereign bond action:

On February 23, 2017, BNM announced the reopening auction details for RM2 billion of the 30-year benchmark MGS maturing on 15 March 2046.

The tender closed on February 27, 2017 with a strong bid-to-cover ratio of 2.562. The lowest, average and highest yield came in at 4.66, 4.676 and 4.686 per cent respectively.

New issuance(s):

On February 27, 2017, Cagamas Bhd issued a one-year floating rate note amounted to RM300 million, of which the floating coupon rate was determined based on a 5bps spread on the three-month Kuala Lumpur Interbank Offered Rate (KLIBOR).

The medium term note (“MTN”) is rated AAA with a stable outlook by RAM Ratings and MARC.

On March 2, 2017, Bank Pembangunan Malaysia Bhd issued three tranches of Islamic Medium Term Note (IMTN) with secondary notes maturing in 2022, 2027 and 2032 with a total issue size of RM1.5 billion.

The IMTNs carry profit rates ranging from 4.28 to 4.98 per cent and are rated AAA with stable outlook by RAM Ratings.