Malaysian palm oil futures closed nearly unchanged as a result of consensus expecting a flat February inventory.

Malaysian palm oil futures closed nearly unchanged as a result of consensus expecting a flat February inventory.

Crude palm oil futures (FCPO) benchmark in May 2017 settled at 2,863 on Friday, gaining 59 points or 0.21 per cent from 2,804 last Friday.

Trading volume reduced to 256,194 contracts from 339,729 contracts from last Monday to Thursday.

Open interest based declined to 861,761 contracts from 870,220 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during February fell 14 per cent to 1.008 million metric tonne (MT) from 1.17 million MT shipped during January.

Societe Generale de Surveillance (SGS) reported that exports of Malaysian palm oil product export for February fell 12 per cent to 1.019 million tonnes from 1.157 million tonnes shipped during January.

Spot ringgit declined due to the heightened prospects of an interest rate hike by the Federal Reserve (Fed) this month.

The MPOB data showed a 7.6 per cent decline in end-stocks to 1.54 million tonnes while output for January fell 13.4 per cent from December to 1.28 million tonnes.

Exports rose 1.2 per cent to 1.28 million tonnes.

On Monday, palm oil futures fell on Monday after hitting a near one-week high as traders were sold on expectations of rising output and weakening export demand..

On Tuesday, palm oil futures climbed, tracking stronger soyoil prices after hitting its lowest level in nearly four months earlier in the day.

On Wednesday, the market jumped to a one-week high on Wednesday, supported by strong gains in Chicago Board of Trade soyoil, though market sentiment remained cautious ahead of an industry conference in Kuala Lumpur this coming week.

On Thursday, Malaysian palm oil futures hit a near two-week high due to a technical rebound as soyoil widen.

On Friday, Malaysian palm oil futures closed nearly unchanged on forecasts that February inventory levels could remain flat.

Technical analysis

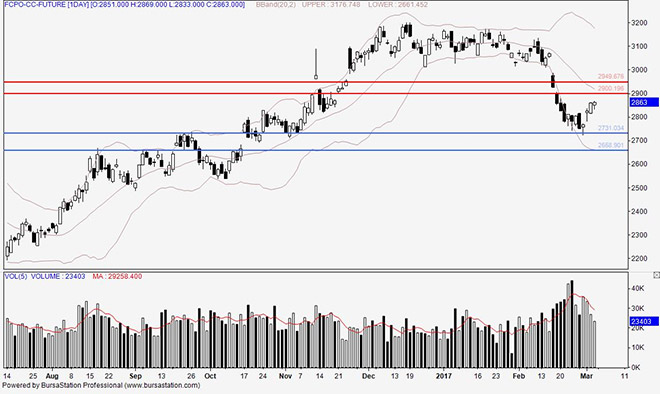

According to the weekly FCPO chart, candlesticks reached a new low at 2,723 but managed to recover losses to close higher during the last three trading days.

On Monday, the market fell sharply during the last trading hour and approached the previous market’s low of 2,743, which could help determine whether the current support could form a strong bottom and stage a rebound.

On Tuesday, the market fell deeper and fell sharply until 2,723 but it managed to rebound above the observed price level of 2,740, strengthening the potential for the market to climb higher and rebound from the bottom.

On Wednesday, the market opened a gap up, supporting the previous speculation of market staging for a strong rebound.

On Thursday, the market climbed higher but it prepared for retracement to happen on next candlestick.

On Friday, the market fell slightly but managed to cover losses, possibly for another retracement on next candlestick. In the coming week, market might retrace for first few candlestick but rebound during the end of the week.

Resistance lines will be placed at 2,949 and 2,900, support lines will be positioned at 2,731 and 2,658.

These levels will be observed in the coming week.

Major fundamental news this coming week

MPOB and ITS & SGS report released on March 10 (Friday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.