In recent years, the concept of Islamic finance as well as its principles are quickly gaining recognition across the globe, with more financial institutions and corporations adopting the idea into their systems.

In recent years, the concept of Islamic finance as well as its principles are quickly gaining recognition across the globe, with more financial institutions and corporations adopting the idea into their systems.

Islamic finance, which banks on syariah principles or Islamic rules that promotes responsible risk sharing, has been attracting greater attention in the wake of the recent financial crisis, as evidenced by the rise in syariah-compliant transactions in the global market.

World Bank coined Islamic finance, through its core principles, as advocating for the just, fair, and equitable distribution of income and wealth during the production cycle and provides mechanisms for redistribution to address any imbalances that may occur.

“Islamic finance emerged as an effective tool for financing development worldwide, including in non-Muslim countries. Major financial markets are discovering solid evidence that Islamic finance has already been mainstreamed within the global financial system – and that it has the potential to help address the challenges of ending extreme poverty and boosting shared prosperity.

“Islamic finance is equity-based, asset-backed, ethical, sustainable, environmentally- and socially-responsible finance. It promotes risk sharing, connects the financial sector with the real economy, and emphasizes financial inclusion and social welfare,” it said in an overview of the Global Islamic Finance Development.

According to Thomson Reuters’ 2016/2017 ‘State Of The Global Islamic Economy’ report, the exisiting Islamic Finance market stood at an estimated US$2 trillion in assets in 2015 and of this US$2 trillion, Islamic banking was responsible for US$1.451 trillion, the Takaful (insurance) sector for US$38 billion, sukuk (bonds) outstanding for US$342 billion, Islamic funds for US$66 billion, and other financial institutions for US$106 billion.

“Total Islamic finance assets are expected to reach US$3.5 trillion by 2021, a compounded annual growth rate (CAGR) of 12 per cent, with Islamic banking responsible for most of this growth, and projected to reach US$2.7 trillion in assets by 2021,” it added.

A niche market with unlimited opportunities

The Islamic finance sector has a growth rate of between 10 to 12 per cent annually in the past decade is gaining prominence at many fronts, including its ability to meet the unique demands of the modern economy.

In his keynote address at The 13th Kuala Lumpur Islamic Finance Forum 2016 (KLIFF) ‘Islamic Finance – Future Trend’ held in November last year, Bank Negara Malaysia deputy governor Abdul Rasheed Ghaffour highlighted that the sukuk market in particular, has produced a dynamic stream of cutting edge products with an appeal that transcends beyond borders and beliefs.

“It has a wide geographical spread, with global sukuk outstanding domiciled in over 20 countries, and an investor base that spans from Europe to the Middle East and Asia, thus allowing greater diversication of exposures and risks,” he said.

“In the last few years, we have witnessed increasing sovereign sukuk issuances by non-Muslim jurisdictions to meet the varying motivations of its issuers. In 2015, at least 13 jurisdictions have tapped the global sovereign sukuk market.

“Issuances by the UK and Hong Kong, are testimonies that the sukuk has come of age,” he added, hence, highlighting the growing demand for financial tools in line with Islamic finance.

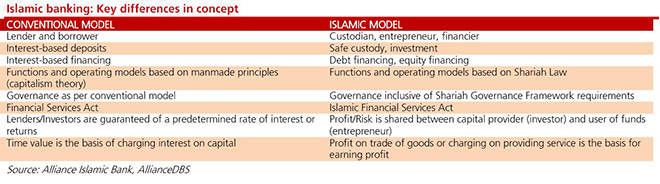

Furthermore, in its recent industry focus report on Islamic banks, AllianceDBS Research Sdn Bhd (AllianceDBS Research) pointed out that there are many opportunities in the sector especially given that many Muslim-majority countries’ financial industries are underserved.

While World Bank observed that the low banking penetration rate is attributable to insufficient money to use an account, whereas the expensiveness of financial service comes in second as the most frequently cited barrier, AllianceDBS Research believed that the growing population and lack of a proper financial system still presents opportunities for the Islamic finance industry to grow.

It noted that the banking penetration–defined as percentage of adults with an account at a formal financial institution – remained low within the Organisation of Islamic Cooperation (OIC) member countries and the Muslim population as a whole, with an average of around 32 and 29 per cent, compared with the global average of 62 per cent.

“Only seven per cent of adults in OIC countries cited religious reasons to resisting financial services. Hence, we believe Muslims do not reject conventional finance solely due to religious reasons.

“Nonetheless, in an environment of homogeneous pricing (between conventional and Islamic banking products), in our opinion, Muslims will have a natural bias to Islamic banking products given the ability to fulfil their religious duties concurrently,” it opined.

The research team also noted that there is a fast growing Muslim population and the Islamic economies also represented about 9.5 per cent of the global gross domestic product (GDP) in 2014.

It further pointed out that the values implemented in Islamic Finance may also appeal to non-Muslims given the risk-sharing and ethical nature of its business model.

“In our view, two factors – pricing and awareness – remain the key determinants to favourable take-up by the non-Muslim market.

“Given the slight incentives offered by Islamic products (lower late payment charges, ceiling rates), we believe that with sufficient education on Islamic banking products, there are non-Muslim consumers that would be agreeable to adopting Islamic banking products,” it said.

For Malaysia, as the global leader in Islamic Finance, the industry presents immense opportunities for the country’s economy.

With its aim to be a global Islamic finance hub, Malaysia still has a long way to go. Nevertheless, the country is steadily making progress in the industry with the introduction of new Islamic Finance products.

With that, BizHive Weekly explores developments in the Islamic finance industry in Malaysia.

Malaysia still a market leader in Islamic finance

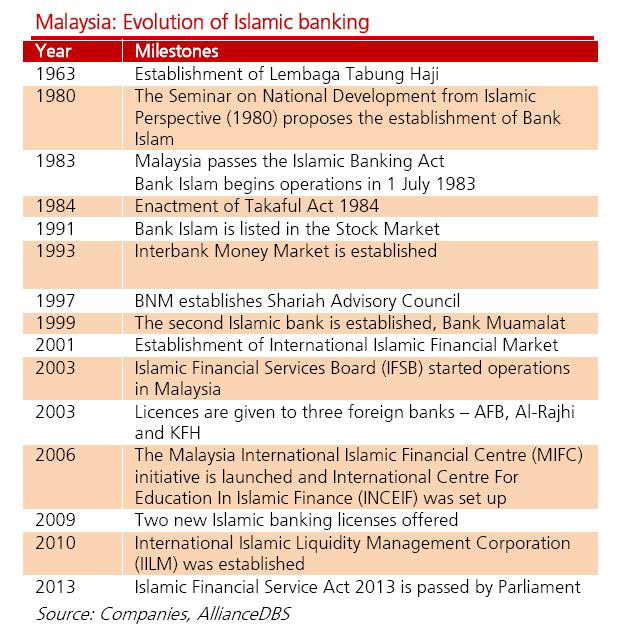

Malaysia has retained a consistent global sukuk market share of more than 50 per cent over the last 10 years, sustaining its position as the overall market leader in the Islamic finance sector.

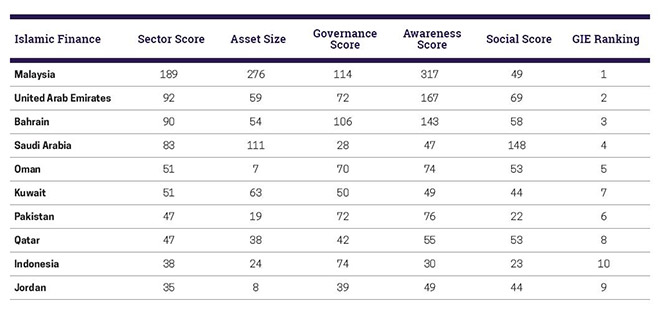

According to Thomson Reuters, the sector continues to be dominated by Malaysia, the United Arab Emirates (UAE) and Bahrain, who have set up leading ecosystems to ensure that the industry thrives.

“Malaysia once again leads the indicator ranking, establishing itself as the global hub for Islamic Finance. This is mainly due to the country having a large Islamic Finance asset base, a large number of Islamic Finance institutions and funds, in addition to having the strongest regulatory framework and highest awareness score of all countries,” it said in its ‘State of the Global Islamic Economy’ 2016/2017 report.

Although Malaysia ranks third by Islamic banking assets, AllianceDBS Research noted that Malaysia’s runaway success in the sukuk market boosted its global position by finance assets to the top of the table.

“The roadmap to success was not without a great deal of effort. Malaysia’s competitive advantage in the sector was driven by strong government support, which brought about among others, regulatory changes, tax incentives and expanded educational resources to promote growth in the industry.

“To take advantage of this strong footing gained, the government has set the targets for the industry to achieve by 2020. This includes increasing the global share of Islamic banking assets from eight per cent in 2009 to 13 per cent in 2020, increasing the global share of takaful (insurance based on Islamic principles) contribution from 11 per cent in 2009 to 20 per cent in 2020, increasing Islamic financing’s share of total financing in Malaysia from 29 per cent in 2010 to 40 per cent in 2020, and propelling at least one Islamic financial institution to become one of the global top 10 players by asset size by 2020,” it said.

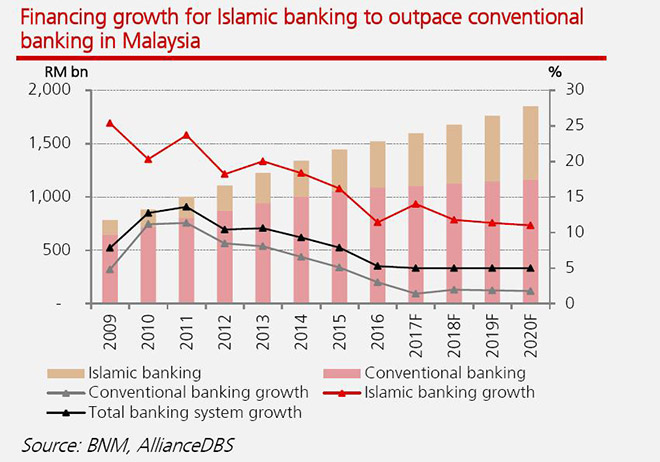

The research team believed that Malaysia’s Islamic Finance industry will continue to outpace conventional banks’ loan growth, driven by the regulatory push to fortify domestic Islamic banking entities to enhance the country’s global competitiveness.

“To that end, we envisage Islamic financing growth to reach a four-year compounded annual growth rate (CAGR) of 12 per cent from the financial year 2016 (FY16) to FY20 forecast, as opposed to two per cent for conventional banking loan growth.

“This is underpinned by the assumption that system loan growth stands at a four-year CAGR of five per cent and the proportion of Islamic financing to the total system grows from 29 per cent currently to 37 per cent in 2020F (note that BNM’s target is 40 per cent),” it opined.

Nevertheless, while the research team remained optimistic on Islamic Finance outpacing conventional banks, it pointed out that the sector has limited room to grow without substantially increasing financial inclusion.

“Given that seven out of the eight major banks in Malaysia have yet to reach BNM’s targeted Islamic financing to total loan proportion of 40 per cent, we believe there is still room for Islamic financing growth to continue outpacing conventional loan growth.

“However, we feel that an increase in financial inclusion would have to materialise for further boost in growth,” it said.

Islamic banking a growing industry

The Islamic banking industry is beginning to show signs of exponential growth and opportunities in Malaysia.

Nevertheless, the country’s Islamic banking sector still faces many challenges ahead.

AllianceDBS Research noted, “There is indeed sufficient demand, from the large and fast-growing Muslim population and sizeable Islamic economies to justify the need for Islamic banking, but for the industry to enter into the attractive growth stage, the foundations of the industry need to be further strengthened.

SOURCE: Thomson Reuters

“The challenges that are crucial for the industry to address include harmonising differences in syariah compliance across jurisdictions, establishing an even playing field, strengthening the resources (human capital, technology, liquidity management tools) and promoting Islamic banking literacy to the public.”

Looking ahead, a new wave of mergers and acquisition (M&A) activities in the Islamic banking space is plausible, although timing remains the key risk, the research team said.

“Potential M&A candidates include MBSB (whose appeal lies in its lucrative personal financing business and sizeable Islamic banking assets) and unlisted MUAMALAT (from a long awaited pare down in ownership by its largest shareholder, DRB). Albeit indirect, Bursa Malaysia is also a proxy to growth in Islamic banking as transactions on its commodity trading platform, Bursa Suq al-Sila (BSAS), are expected to increase in conjunction with Islamic financing growth,” it opined.

“Undeniably, Malaysia has pioneered plenty of Islamic banking initiatives on the global stage, which have deepened the country’s knowledge and expertise. The country is a natural candidate to lead the industry to the next stage, especially with the strong support of regulators,” the research team added.

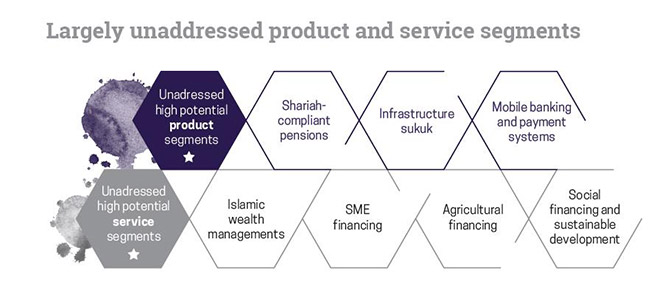

Nevertheless, it pointed out that product innovation would be the transformative factor for the industry, as it enables the Islamic banks to step up their game against its conventional counterparts.

“In that vein, we believe developments in this space are a crucial factor to monitor in identifying the next growth cycle for the industry,” it added.

Investments in line with syariah

Beyond the banking industry, Malaysia has maintained its position in the global sukuk arena as at end-2016, with 41.1 per cent of total sukuk issuance (compared with 48 per cent as at end-2015)

In a statement, the ratings agency RAM Ratings highlighted, “Despite a slight decline and the weaker ringgit, sukuk originated from Malaysia still summed up to US$29.9 billion as at end-2016 (US$30.4 billion as at end-2015).

“Greater sukuk issuance in non-core markets also augmented the global sukuk base to US$72.9 billion at year-end (US$63.4 billion as at end-2015) – with issues from Turkey (US$5 billion), Pakistan (US$4.8 billion) and Bangladesh (US$1.1 billion) featuring prominently.

“A total of US$18.2 billion of global sukuk was issued in the fourth quarter of 2016 (4Q16), bringing the full-year issuance to US$72.9 billion as at end-December,” it said.

“Last year, global sukuk issuance exceeded RAM’s projection of US$55 billion to US$65 billion,” said RAM’s head of Islamic Finance Ruslena Ramli.

As for investments on the bourse, Bursa Malayia Bhd (Bursa Malaysia) had recently launched a new platform to cater to the growing demand of syariah-compliant stocks and syariah investments.

The Bursa Malaysia-i is the world’s first end-to-end integrated Islamic securities exchange platform that offers investors the choice to invest and trade syariah-compliant products via a syariah-compliant platform.

Bursa Malaysia-i incorporates the full range of Shariah-compliant exchange-related services including listing, trading, clearing, settlement and depository services.

“The launching of Bursa Malaysia-i is a culmination of Bursa Malaysia’s longstanding commitment to making Malaysia a comprehensive Islamic investing hub that offers various Islamic financial market instruments. Continuous effort and support from various stakeholders such as Islamic Participating Organisations (Islamic POs), Regulators, Public Listed Companies, Investment Banks, syariah Advisers and Islamic Fund Managers are essential to further develop and mainstream the Bursa Malaysia syariah-compliant platform,” Minister of Finance II Datuk Johari said during the launch of the platform.

A leg up in ESG efforts

Earlier last year, Malaysia made headways in the Islamic Finance market by introducing the world’s first syariah-compliant pension fund; ‘Simpanan Syariah’, which was later launched with a total of RM59.03 billion taken up by 635,037 members as at January 2017.

The scheme is an alternative to the conventional Employment Provision Fund (EPF) for contributors who are interested in converting their savings to a fully compliant syariah status.

EPF had allocated up to RM100 million to the scheme, which is approximately 15 per cent of EPF’s total investment asset of RM681.71 billion as at end of March 2016.

According to RFI Foundation’s chief executive officer (CEO) Blake Goud in an interview with Thomson Reuters for its ‘State of the Global Islamic Economy’ report, one of the overlooked areas in Islamic finance is in the asset management space, particularly pension funds.

“The decision by Malaysia’s EPF to offer a syariah-compliant option which will represent US$25 billion in assets is a huge catalyst for the sector.

“In addition to being a large addition to assets (as of 2014, Islamic funds held US$56 billion in assets), the EPF move aligns Islamic investment more with trends in socially responsible investment.

“Earlier this year, EPF said all of its assets met standard environmental, social and governance (ESG) criteria and now the syariah-compliant EPF option represents perhaps the largest collection of assets to incorporate Islamic and ESG approaches,” he commented.

The report also pointed out that although Malaysia witnessed a slight decline in reported Islamic financial institution assets in 2015 (US$414 billion), impacted by the country’s economic slowdown and Bank Negara Malaysia’s policy to cut back on short-term sukuk issuances, it’s introduction to a pension scheme and the IPO of a Malaysian Company, DagangHalal should help Malaysia contribute to the growth in Islamic Finance’s total global projected assets to US$3.5 trillion by 2021.

With that in mind, RAM Ratings had also pointed out that Malaysia’s leadership in Islamic finance as a catalyst for environmental, social and governance (ESG)-driven investment.

“Malaysia has been leading the charge in Islamic finance for several years. The government has supported this development side-by-side with conventional finance. Malaysia now has the ecosystem needed to support the growth of Islamic finance: it has pension funds and institutional investors creating the demand for sukuk, a steady stream of corporate, infrastructure and Islamic financial institutions issuers creating the supply, a robust backbone of regulations, capable and innovative legal, Shariah and banking professionals and domestic credit rating agencies. To see a similar growth trajectory for ESG/responsible investment, the government needs to follow a similar path to that which has led to Malaysia’s leadership position in Islamic finance,” observed RAM Ratings chief executive officer Foo Su Yin.

Malaysia’s bourse to support growth of Islamic finance

As Malaysia’s market trading platform, Bursa Malaysia Bhd (Bursa Malaysia) is also an indirect beneficiary to the rise in Islamic Finance and the growth of Islamic banking as transactions on its commodity trading platform, Bursa Suq al-Sila (BSAS) is expected to increase in line with the growth of Islamic financing.

SOURCE: Thomson Reuters

AllianceDBS Research highlighted this in a recent report and pointed out that BSAS’ global accreditation implies a potential to grow alongside global growth in Islamic financing rather than just domestically.

“We expect BSAS contribution to remain small, but view the diversification in revenue base a boon to its earnings profile,” it opined.

Of note, BSAS serves as the trading platform for Islamic financial institutions to trade commodities. Islamic financial institutions use BSAS to facilitate liquidity management, risk management in Islamic financial market and Islamic financial product offerings.

“The syariah contract pertinent to the transactions performed in BSAS is the murabahah contract, where commodities (in this case) are sold at cost plus profit, on deferred payment basis. Islamic financial institutions locally as well as globally can participate in BSAS.

“Bursa Malaysia earns trading fee for transactions performed on BSAS. A charge of RM3 is imposed per contract worth RM1 million if it is settled within four days. A charge of RM10 and RM15 is imposed if it takes five to 21 days and more than 22 days, respectively. Hence, BSAS revenue typically moves in tandem with the average daily value traded on BSAS. However, the quantum may differ slightly, according to the average blended trading fee charged,” the research team explained.

“With the increasing prevalence of Islamic banking, more transactions are expected be performed under BSAS, increasing the average daily value traded on BSAS. Assuming an average blended rate of RM4.50 per contract, every RM225 billion worth of transaction would add RM1m to BSAS revenue. Evidently, BSAS have grown over the years, as ADV continues to grow from strength to strength sequentially.

“As of end-of the financial year 2016 (FY16), ADV stood at RM16 billion, growing by more than three-fold in the last three years.

“This was largely driven domestically, particularly in 2015 when the Islamic Financial Services Act was enacted, which resulted in higher conversion of deposits to murabahah. Foreign ADV has also grown gradually, albeit at a slow pace. The number of participants has also grown by 59 per cent to 124 participants as of end-FY16 (from 78 participants in 1Q14),” AllianceDBS Research said.

Nevertheless, it noted that while Islamic financing is expected to continue outpacing conventional financing, it believed this momentum would persist but BSAS would remain a small contributor to Bursa Malaysia’s overall earnings given the low charges imposed on BSAS transactions.

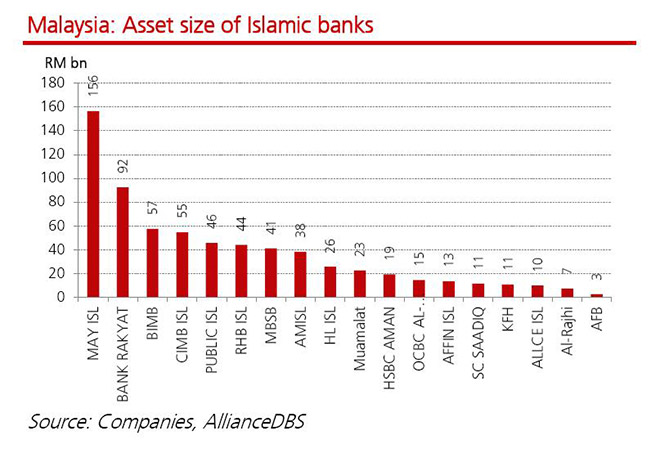

BIMB leads Malaysia’s Islamic banking sector

Aside from Bursa Malaysia, AllianceDBS Research believed that BIMB Holdings Bhd (BIMB) is the main proxy to ride on the superior growth in Islamic financing.

“Apart from being the only Bursa-listed syariah-compliant financial institution, BIMB’s deep-rooted expertise and experience in the industry positions it as the prime candidate to lead the market in product innovation.

“Thus far, investment accounts are the only new product launched, but we see potential for more to come, thanks to regulatory push to move towards the risk-sharing model (vs risk transfer model). The successful deployment of new products could potentially increase financial inclusion, leading to further growth,” it explained.

As BIMB is the oldest Islamic bank in Malaysia, it opined BIMB is primed to ride on the Islamic finance’s expected growth spurt.

“Furthermore, with its deep-rooted expertise and rich experience in the sector, we believe BIMB is poised to be the market leader in product innovation of Islamic banking offerings. This was evident when the Investment Account was first introduced, as BIMB took the lead in providing consumer education on the product. Further aiding this is the support from government-linked companies (GLCs), whose personnel serve as an avenue for BIMB to roll out salary deduction schemes for personal financing,” it said.

Islamic business aside, it added, BIMB’s superior financial metrics in growth, liquidity and asset quality make it a force to be reckoned with in the Malaysian banking space.

“BIMB has an arsenal of tools to lean on to weather the current soft operating environment – a niche in Islamic banking (which supports financing growth momentum), high CASA ratio and liquid balance sheet (to stave off net financing margin compression) as well as high financing loss coverage (to buffer against potential deterioration in asset quality),” it added.

Conclusion

The Islamic Finance industry is entering its prime stage with several potentially profitable segments still largely underserved across products and services.

Nevertheless, product innovation is still key to attract more consumers, investors as well as investments into this age-old financial system.

“For Islamic finance, we have witnessed its increasing recognition and widespread appreciation. The future however requires greater impact by Islamic finance to truly realise its potential in providing solutions to the problems faced by society.

“Domestically, we are beyond half way of our Financial Sector Blueprint. While certain targets have been met, more tangible outcomes are required from the industry to meet the targeted 40 per cent market share by 2020.

“Of importance is the need for the industry to be driven by clear objectives and targets that leverage on the key growth areas that have been deliberated. “Reflect on existing strengths; and build new capabilities to create new engines of growth within the industry. Seize various growth opportunities. Continuously reinvent, re-energise and re-anchor the industry”.

“We can therefore successfully reap the immense dividends of the future,” said BNM deputy governor Abdul Rasheed Ghaffour.