Daily FBM KLCI chart as at February 15, 2019.

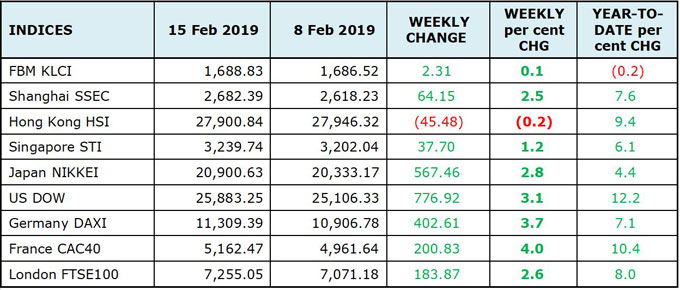

Global markets indices and commodities performances as at February 15.

The local market was directionless last week despite global market indices closing higher. Despite an increase in trading volume, there was no direction. The market is cautious ahead of the GDP data. The benchmark FBM KLCI increased only 0.1 per cent in a week to 1,688.83 points last Friday

After having low volume a week before and after Chinese New Year, market participation has increased last week. The average daily trading volume last week was three billion shares as compared to 1.7 billion in the previous week. The average daily trading value increased to RM2 billion from RM1.5 billion. This indicates more lower-capped stocks were being traded.

Foreign institutions where net sellers last week after weeks of accumulation. For Monday to Thursday last week, net sell from foreign institutions was RM221.9 million. Net buys from local institutions and retail were RM175.4 million and RM46.5 respectively.

In the FBM KLCI, gainers out-paced decliners 16 to 11. The top three gainers were Axiata Group Bhd (5.6 per cent in a week to RM3.94), Dialog Group Bhd (five per cent to RM3.15) and Petronas Dagangan Bhd (1.7 per cent to RM26.56). The top three decliners were Press Metal Aluminium Holdings Bhd (3.3 per cent to RM4.10), AMMB Holdings Bhd (1.6 per cent to RM4.43) and Hartalega Holdings Bhd (1.3 per cent to RM5.43).

Global market performances were bullish. Market indices in Asia closed higher in a week except for Hong Kong which sell marginally lower. Market indices in Europe including UK were strongly bullish. The US market also closed higher.

The US dollar continued strength against major currencies last week. The US dollar Index increased to 96.9 points from 96.6 points. Hence, the Malaysian ringgit was slightly weaker against the US dollar. The ringgit was at RM4.08 per US dollar last Friday as compared to RM4.07 in the previous week.

Price of gold slightly declined but crude oil soared. Price of gold (COMEX) increased marginally at US$1,325.00 an ounce last Friday. Crude oil (Brent) declined 6.9 per cent to US$66.39 per barrel. Crude palm oil (BMD) fell 1.6 per cent in a week to RM2,253 per metric ton last Friday.

The FBM KLCI continued to stay between the immediate support and resistance levels between 1,680 and 1,702 points. This indicates that the market was directionless.

Technically, the FBM KLCI trend is flat as the short term 30-day moving average was flat. The index has climbed above the Ichimoku Cloud indicator. However, the index is above a thin cloud, indicating a weak bullish trend. On a bigger picture, the FBM KLCI remained directionless.

Momentum indicators remained flat. The RSI and Momentum Oscillator continued to stay slightly above their mid-levels and the MACD is below its moving average. This indicates that the market trend is directionless.

As long as the index stays between the immediate support and resistance levels between 1,680 and 1,702 points, the market is directionless.

A breakout above 1,702 points indicates that the bullish trend is set to continue but if it fails to climb above this level, further correction is expected.

The above commentary is solely used for educational purposes and is the contributor’s point of view using technical analysis. The commentary should not be construed as an investment advice or any form of recommendation. Should you need investment advice, please consult a licensed investment advisor.