KUCHING: RAM Rating Services Sdn Bhd (RAM Rating) indicated that the credit metrics of Association of Southeast Asian Nations’ (Asean) leading corporates have stayed robust following the global financial crisis in 2008/09.

Between 2008 and 2011, the revenue of the 20 featured companies charted a compounded annual growth rate of almost 13 per cent while their mean margin on operating profit before interest and tax clocked in at close to 20 per cent, it stated in its special research paper yesterday.

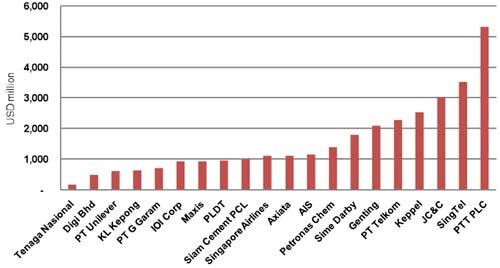

The research featured the region’s top cooporations from five Asean countries which were involved in more than 10 broad industries – three from Indonesia, nine from Malaysia, one from the Philippines, four from Singapore and three from Thailand.

“We also observe that seven of the 20 corporates recorded consistent year-on-year (y-o-y) improvements in pre-tax profit over the same period,” said the rating agency.

“On top of that, most of them have conservative capital structures, complemented by robust cashflow-generating aptitudes. These favourable financials are underscored by their entrenched market positions.”

The majority of the 20 Asean corporates are also dominant regional or global players in their respective industries. In most cases, these entities could lay claim to established proprietary brands of sturdy track records that encourage recurring sales.

RAM Rating further said many of the corporate were increasingly operating in more than one country, thus providing a buffer against adverse events in any particular market.

“Their strength lies not merely in diversity, but the fact that they are typically successful in every line of business they are engaged in. Meanwhile, underlying market conditions and population demographics tend to support their longer-term revenue growth prospects,” it said.

Going forward, the corporates’ strong business profiles were further supported by relatively stable profit margins, which were above the various industry averages. The operating profit before interest and tax (OPBIT) and pre-tax margins had clocked in at a respective 19.3 per cent and 18.7 per cent for the past four years.

Notably, the OPBIT margins of telecommunication companies had regularly exceeded the 30 per cent mark. “With moderate price competition and lean cost structures, their earnings are relatively resilient in the fact of economic cyclicality,” said RAM Rating.

On the other hand, players in the aviation, chemicals and plantation sectors exhibited more volatile earnings. The operating performances of the companies ilsted were more exposed to the price volatility of their inputs or products; the major commodities that influence profitability were oil and gas, along with crude palm oil.

“Looking ahead, the leading corporates have little time to rest on their laurels given the emergence of new competitors amid fast-changing business trends. With market liberalisation, future operating conditions may not be as favourable to the incumbent leaders,” it highlighted.

Technological-wise, most of the leading corporates had sizable capital-expenditure programmes, to enable them to keep abreast of technological updates or changes in consumer preferences. “Regardless of the circumstances, high investment costs would tend to elevate debt levels,” it added.

It was reported that the debt loads of the leading corporates had been rising in the last four fiscal years, particularly so in the last year, which meant their balance sheets had remained fairly sturdy.

The average gearing ratio stood at between 0.5 and 0.6 times for the same period while retained earnings had climbed higher on the back of strong profit performances.

Looking at the cashflow, RAM Rating said five of the 20 corporates recorded funds from operations debt cover (FFODC) ratios of above one time in their latest full fiscal years, with another eight companies registering ratios of more than 0.5 times.

The median FFODC ratio for the last four fiscal years came up to 0.6 times while the median operating cashflow debt coverage (OCFDC) ratio stood at an equally commendable 0.5 times.

The nine companies from Malaysia were Axiata Group Bhd, DiGi.Com Bhd, Genting Bhd, IOI Corporation Bhd, Kuala Lumpur Kepong Bhd, Maxis Bhd, Petronas Chemicals Group Bhd, Sime Darby Bhd and Tenaga Nasional Bhd.