Malaysian palm oil futures edged higher on Friday to 2,449, as supported by a weaker ringgit although weak market sentiment marked a second straight weekly loss. Future Crude Palm Oil (FCPO) benchmark August 2016 contract settled at 2,449 on Friday, down 131 points or five per cent from 2,580 last Friday.

Malaysian palm oil futures edged higher on Friday to 2,449, as supported by a weaker ringgit although weak market sentiment marked a second straight weekly loss. Future Crude Palm Oil (FCPO) benchmark August 2016 contract settled at 2,449 on Friday, down 131 points or five per cent from 2,580 last Friday.

Trading volume increased to 227,366 contracts from 215,432 contracts from last Monday to Thursday.

Open interest based decreased to 1.007 million contracts from 1.064 million contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during June 1 to 15 rose 0.5 per cent to 566,212 tonnes compared with 563,172 tonnes during May 1 to 15.

Societe Generale de Surveillance’s (SGS) report showed that Malaysia’s palm oil exports during June 1 to 15 decreased 3.4 per cent to 555,116 tonnes compared with 574,548 tonnes during May 1 to 15.

Overall, demand strengthened from China and Pakistan, while demand weakened drastically from India.

Spot ringgit weakened on Friday to 4.0980, as investors fret about the risk that Britain might vote to leave the European Union in a referendum in the coming week.

A circular on the Malaysian Palm Oil Board website showed on Wednesday that Malaysia, the world’s second-largest palm oil producer after Indonesia, will raise its crude palm oil export tax to six per cent in July from 5.5 per cent in June.

On Monday, the price fell for a sixth consecutive session, as traders foresaw rising output amid slowing demand and tracking rival oil prices.

On Tuesday, the price fell for seventh consecutive day as bearish palm fundamentals and declining rival oils weighed on the market.

On Wednesday, the price hit a four-and-a-half month low, pressured by declining rival oils and the announcement of an increase in crude palm oil export tax.

On Thursday, the price fell and hitting a five-month low and recording a ninth straight day of losses, as concerns of export weakness and a lower energy market continue add pressure to the losses.

On Friday, the price rose and rebound as supported by short covering and weaker ringgit, despite still marked a second straight weekly loss.

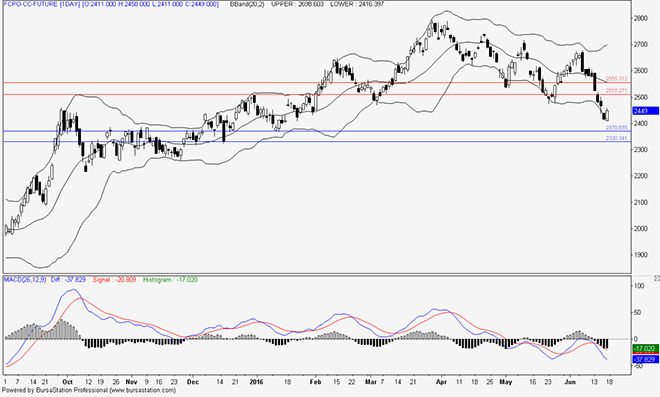

Technical analysis

According to the weekly FCPO chart, the price opened below the middle Bollinger band and attempt to test the lower Bollinger band. By the end of the week, the price closed below the lower Bollinger band while standing above the psychological barrier at 2,400.

On Monday, the price broke and closed below the middle Bollinger band while MACD showed a bearish crossover sign below the zero which could provide bearish signal and market may continue retrace lower.

On Tuesday, the price opened lower and headed towards to the lower Bollinger Band as MACD continue to show a bearish crossover below zero line which indicates that price remained significantly weak.

On Wednesday, the price fell and attempted to test the lower Bollinger Band during the earlier session.

By the later session, the price rebounded after briefly touching the lower Bollinger Band.

MACD remained below the zero line which could indicate that the current price might be temporarily under pressure.

On Thursday, the price opened lower and closed below the lower Bollinger Band which might provide oversold signal for current market.

MACD remained below the zero line which could indicate that current price might be temporarily under pressure.

On Friday, the price opened higher and rebounded after touched the lower Bollinger band. By the later session, price closed above lower Bollinger band which could signal that market stayed away from oversold condition.

In the coming week, the price has potential to range between 2,330 and 2,555. Resistance lines will be placed at 2,510 and 2,555, while support lines will be positioned at 2,370 and 2,330, these levels will be observed in the coming week.

Major fundamental news this coming week

ITS and SGS report released on June 20 (Monday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.