Malaysian palm oil futures hit their highest in more than four years before easing to 3,076 on Friday as profit taking while edible oil markets sentiment continue boosted by a stronger energy market.

Malaysian palm oil futures hit their highest in more than four years before easing to 3,076 on Friday as profit taking while edible oil markets sentiment continue boosted by a stronger energy market.

Crude palm oil futures (FCPO) benchmark February 2016 contract settled at 3,076 on Friday, up 44 points or 1.4 per cent from at 3,076 last Friday.

Trading volume increased to 155,875 contracts from 155,875 contracts from last Monday to Thursday.

Open interest based increased to 756,194 contracts from 756,194 contracts from last Monday to Thursday.

Intertek Testing Services (ITS) reported that exports of Malaysia’s palm oil products during November fell 10.6 per cent to 1.153 million tonnes compared with 1.289 million tonnes during October.

Socete Generale de Surveillance’s (SGS) report showed that Malaysia’s palm oil exports during November fell 12.8 per cent to 1.13 million tonnes compared with 1.296 million tonnes during October.

Overall, demand increased from China while demand weakened simultaneously from European Union and India.

Spot ringgit strengthening to 4.45 against the dollar on Friday as crude prices extended gains, easing concerns over the country’s oil and gas revenues while market remained cautious ahead US non- farm payroll report.

Reuters’s surveys showed that Malaysia’s stockpile of palm oil for November is expected to have grown at its sharpest monthly pace in five months, with a slump in exports outpacing a drop in production.

Southern Peninsula Palm Oil Millers’ Association indicated a 20 per cent output drop in the first five days of December compared with a month earlier.

On Monday, the market hit their highest level in over four years, tracking rival oil markets gains and lower output expectation boosted the market bullish sentiment.

On Tuesday, the market rose for second consecutive day, tracking soybean oil market gains and lower output expectation boosted the market bullish sentiment.

On Wednesday, the market post sharpest drop in three week as market weighed down by weaker performing soybean oil and market correction.

On Thursday, the crude palm oil market hit one-week high as edible oil markets sentiment continue to be boosted by a stronger energy market.

On Friday, the market hit their highest in more than four years before easing to a close in negative territory on profit taking and tracking soybean oil market losses.

Technical analysis

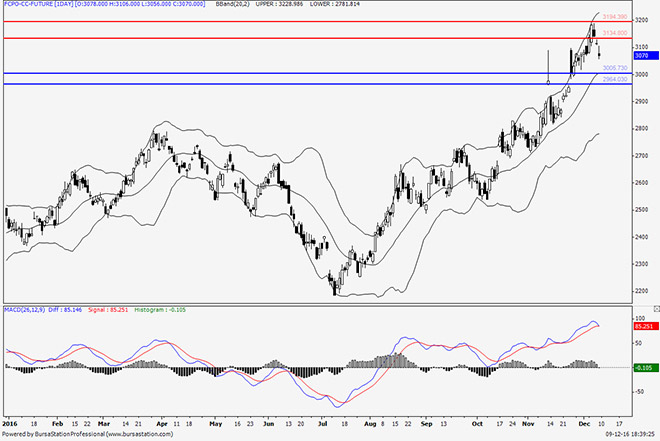

According to the weekly FCPO chart, weekly candlestick opened higher while the current market remained under pressure by the upper Bollinger Band.

By the end of the week, the current market closed above the upper band and indicated that the current market stayed at overbought condition.

On Monday, the price rose while the current market remained under pressure by the upper Bollinger Band while Bollinger Bands continued heading upward which could indicate that current uptrend could remain in long term.

On Tuesday, the price rose as a daily bullish ‘Marubozu’ candlestick pattern and MACD histograms showed an increasing sign which indicated an increase in uptrend momentum.

On Wednesday and Thursday, the price rose as the upper and middle Bollinger Band continued heading upward which could indicate a continuation of the current uptrend in the long term.

On Friday, the price fell as the current market remained under pressure by the upper Bollinger Band. MACD histograms continued to show a decreasing sign and this could potentially indicate a decreasing momentum from the current uptrend in the short term.

In the coming week, the price has potential to range between 3,140 and 2,940.

Resistance lines will be placed at 3,194 and 3,140, support lines will be positioned at 2,995 and 2,940, these levels will be observed in the coming week.

Major fundamental news this coming week

MPOB, ITS and SGS report released on December 13 (Tuesday).

Oriental Pacific Futures (OPF) is a Trading Participant and Clearing Participant of Bursa Malaysia Derivatives. You may reach us at www.opf.com.my. Disclaimer: This article is written for general information only. The writers, publishers and OPF will not be held liable for any damage or trading losses that result from the use of this article.