The market failed to rebound last week despite finding some support two weeks ago. Market sentiment was still bearish on extended US-China trade war. Asian markets were main casualties. The FBM KLCI fell 1.6 per cent in a week to 1,663.86 points last Friday.

Trading volume has increased last week but trading value fell significantly. The average daily trading volume increased to 2.1 billion shares from two billion shares two weeks ago and the average daily trading value fell to RM1.7 billion from RM2.3 billion. This indicates more low-capped counters normally traded by retail market participants were being traded.

Foreign institutions continued to reduce market exposure. Net sell from foreign institutions was RM704 million while net buys from local institutions and local retail were RM589 million and RM115 million respectively.

In the FBM KLCI, decliners beat gainers 19 to eight while three stocks were unchanged. The top three gainers were Telekom Malaysia Bhd (9.3 per cent to RM3.40), Dialog Group Bhd (1.9 per cent to RM3.15) and Axiata Group Bhd (1.3 per cent to RM3.85). The top decliners were Press Metal Aluminium Holdings Bhd (6.9 per cent to RM4.06), RHB Bank Bhd (5.3 per cent to RM5.17) and KLCC Property Holdings Bhd (4.8 per cent to RM7.62).

In the global scene, Asian markets were bearish and the fall was led by a 3.5 per cent decline in the Shanghai Stock Exchange Composite Index. European and US markets were slightly bullish while London closed marginally lower on a week to week basis.

The US dollar Index, which measures the US dollar against a basket of major currencies, closed slightly lower at 94 points last Friday. The Malaysian ringgit was firm against the greenback at RM4.04 to a US dollar last Friday.

Safe investment haven, gold, rebounded from a six-month low and finished marginally higher in a week. Gold (COMEX) increased 0.1 per cent in a week to US$1,255.90 an ounce. Crude oil, on the other hand, fell 2.7 per cent in a week to US$77.29 a barrel. In the local market, crude palm oil futures declined 2.5 per cent in a week to RM2,264 per metric tonne last Friday on demand worries.

Last week, we were expecting the FBM KLCI to stage a technical rebound but that clearly did not happen. This indicates that the market sentiment is still bearish. Immediate support level is at 1,658 points and further declines are expected if this level is broken. Immediate resistance level is at 1,702 and the trend can only turn bullish in the short term if it breaks above this level.

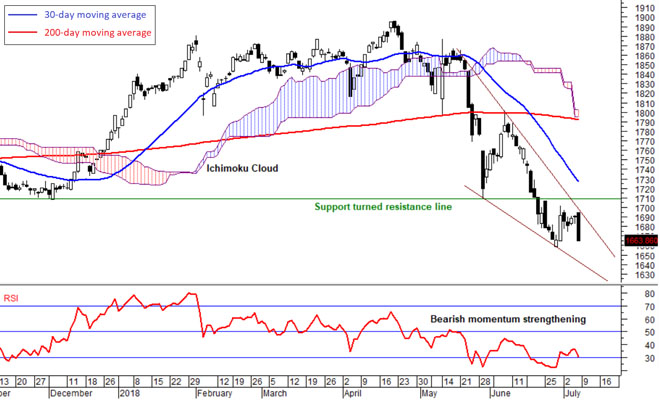

Technically, the FBM KLCI remained bearish below both the short and long term 30- and 200- day moving averages and these averages continue to decline. The 30-day moving average is currently at 1,727 points. Furthermore, the index is below the Ichimoku Cloud and the expanding Cloud indicates a strong bearish trend.

Momentum indicators like the RSI, MACD and Momentum Oscillator are starting to decline after rebounded two weeks ago. This shows a strong bearish momentum. The RSI and Momentum Oscillator also indicate that the FBM KLCI is oversold. With the strengthening bearish momentum, the index is expected to continue despite being technically oversold.

It seems that the market has more bearish than bullish catalysts. Trade war between the US and China, Weaker ringgit and continuous foreign institutions selling send negative vibes to the market since the general elections more than a month ago.

Technically, the indicators also show a strengthening bearish trend.

Henceforth, we expect further declines for the FBM KLCI and the immediate support level at 1,658.0 points will be tested and there is a high chance that the index may fall lower to the next support level at 1,620 points.

The above commentary is solely used for educational purposes and is the contributor’s point of view using technical al analysis. The commentary should not be construed as an investment advice or any form of recommendation. Should you need investment advice, please consult a licensed investment advisor.