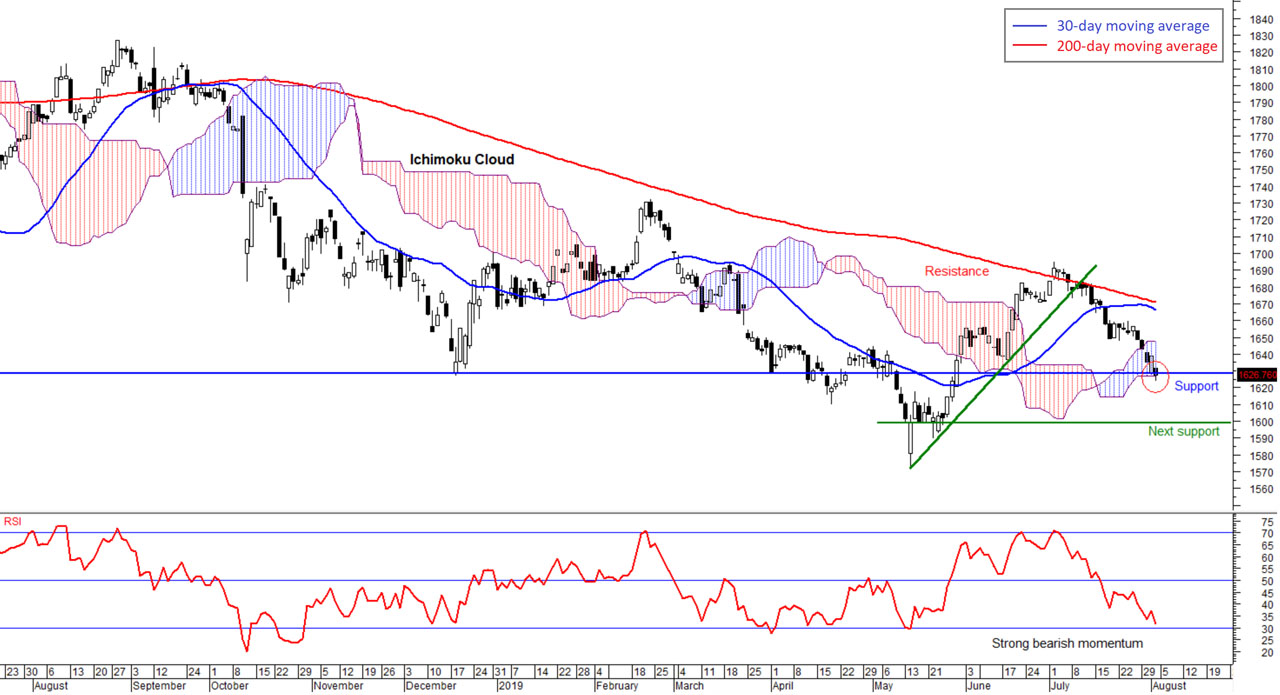

Daily FBM KLCI chart as at August 2 2019

After breaking below the immediate support level at 1,657 points two weeks ago, the FBM KLCI continued to decline last week on bearish global markets performances. Furthermore, weak Ringgit against the US dollar has also dampened market sentiment.

The FBM KLCI declined for the fourth week last week, falling 1.3 per cent in a week to 1,626.76 points last Friday, the lowest in two months.

Trading volume remained weak. The average daily trading volume has declined to 2.6 billion shares last week from three billion shares the week before. The average daily trading value was firm at RM2.1 billion.

In the FBM KLCI, decliners beat gainers five to one. The top three gainers were Press Metal Aluminium Holdings Bhd (4.5 per cent in a week to RM4.85), Westports Holdings Bhd (2.1 per cent to RM3.97) and Tenaga Nasional Bhd (1.8 per cent to RM13.86).

The top three decliners were Hartalega Holdings Bhd (5.5 per cent to RM4.86), Hong Leong Financial Group Bhd (five per cent to RM17.58) and Genting Bhd (4.3 per cent to RM6.76).

Global markets performances were bearish. The biggest loser was Hong Kong. The Hang Seng index fell 5.1 per cent in a weak on continuous street protest against the government. European markets were also hit by stronger US dollar and despite the stronger US dollar, the US market turned red as well.

The US dollar has slightly strengthened against major currencies. The US dollar Index slightly increased to 98.1 points from 97.9 points two weeks ago. Hence, the Malaysian Ringgit was weaker against the US dollar at RM4.15 last Friday from RM4.12 two weeks ago.

In the commodities market, crude oil (Brent) declined 2.9 per cent in a week to US$61.27 per barrel last Friday. Gold rose 2.3 per cent to US$1,452.50 an ounce, the highest since May 2013. Locally, crude palm oil (BMD) declined 0.2 per cent in a week to close at RM2,061 per metric tonne.

Two weeks ago, the FBM KLCI fell below a technical support level and this week another support level at 1,630 points was broken. This indicates a bearish sentiment. The next support level is at 1,600 points.

Trend-wise the FBM KLCI trend is bearish below both the short and long term 30- and 200-day moving averages.

Furthermore, the FBM KLCI fell slightly below the Ichimoku Cloud and this shows that the market is getting strongly bearish. When price falls below the Ichimoku Cloud, expect the market to go into a storm.

Momentum indicators continued to decline and this indicates that the short-term bearish momentum is strong. The RSI and Momentum Oscillator indicators are declining and are below their mid-levels. Furthermore, the MACD indicator is declining and remained below its moving average.

The market confidence turned from weak to bearish last week. The local market was also affected by weaker Ringgit and bearish global markets performances.

Henceforth, the FBM KLCI is expected to continue to decline and test the next support level at 1,600 points if the index fails to rebound above 1,657 points.

The above commentary is solely used for educational purposes and is the contributor’s point of view using technical al analysis. The commentary should not be construed as investment advice or any form of recommendation. Should you need investment advice, please consult a licensed investment advisor.

Global markets indices and commodities performances as at August 2, 2019