Covid-19 and the unprecedented movement control order (MCO) along with its subsequent editions has left its mark on Bursa Malaysia as listed firms assess the pandemic’s impact and figure out ways to move forward cautiously.

Covid-19 and the unprecedented movement control order (MCO) along with its subsequent editions has left its mark on Bursa Malaysia as listed firms assess the pandemic’s impact and figure out ways to move forward cautiously.

The pandemic may be seen as a deterrent to future companies seeking to list on the local bourse. This led Bursa Malaysia to revise its number of new initial public offering (IPO) listings downward to 25 companies from 40 companies set early this year.

This compares to 30 initial public offerings (IPOs) in 2019, making it the year with the highest amount of listings seen since 2006.

Chief executive officer Datuk Muhammad Umar Swift advised that the key thing to remember when people taking a company to the market is they need to have results.

“Now, with the impact of the movement control order (MCO), we have seen these companies reevaluate their business and forecast.

“So we are hopeful of seeing more companies at this point of time. While we have a healthy pipeline, unfortunately the pipeline has been pushed back,” he told a media briefing on the company’s first half financial performance on July 28.

Earlier in the year, the exchange attracted InNature Bhd, Polydamic Group Bhd, Cosmo Technology International Bhd and ACO Group Bhd to list. In July, the listing stream continued with Reservoir Link Energy Bhd, Ocean Vantage Holdings Bhd, TCS Group Holdings Bhd, Aurora Italia International Bhd and Redplanet Bhd. Coming up is Optimax Holdings Bhd and Aneka Jaringan Holdings Bhd.

“Now, of course, we are hopeful to see more companies,” Muhammad Umar said.

“We are currently seeing that the (last) two listings were very well received, so it is the right time to come to the market, but of course the recipe has to be correct – you have to have the earnings and price expectation and so on. Our ongoing efforts to increase market vibrancy and liquidity is having a positive impact.”

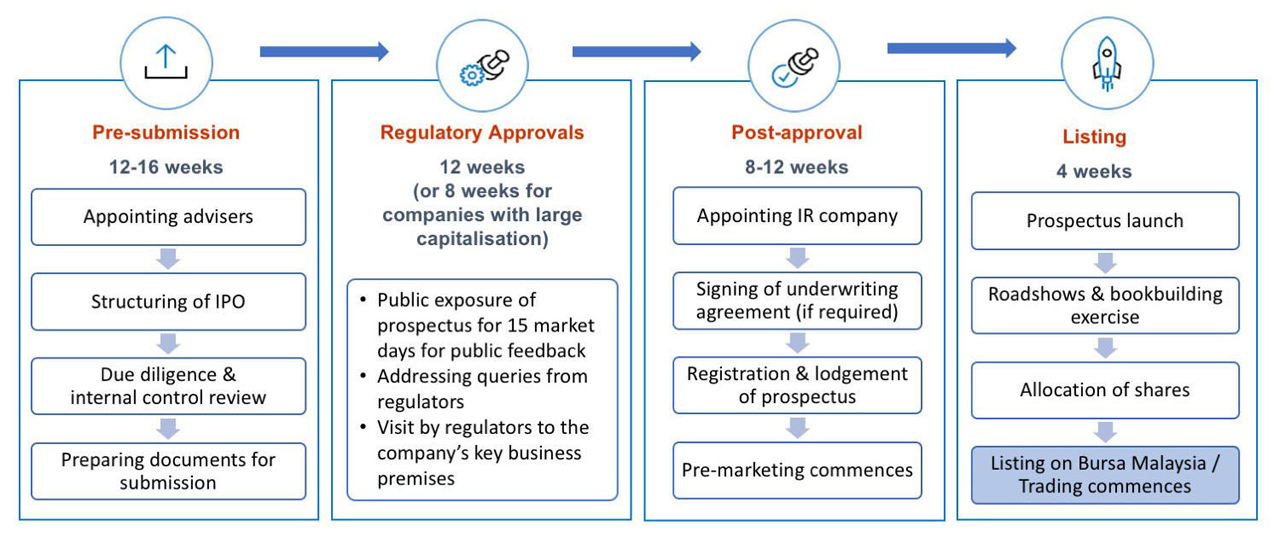

Listing Process for Main Market and ACE Market (SOURCE: Bursa Malaysia)

Buoyant retail participation

And the bourse is indeed vibrant as it witnessed new highs in trading, thanks to strong retail participation. Bursa Malaysia’s equity trading volumes and values hit record levels in the first week of August, consistently at RM7.6 billion to RM10 billion in average daily value (ADV).

The robust trading activities were driven by retail participation, which had increased from 32 to 33 per cent in 2Q20 to as high as 48 per cent in August 2020, according to data from Bursa Malaysia.

“We believe that the buoyant and rising retail sentiment was fuelled by optimism as the country was lifted from the MCO stage (March 18 to May 12, 2020) to CMCO (May 13 to June 17, 2020) and RMCO (since June 8 up to date).”

Meanwhile, ample market liquidity was also fuelled by the six-month loan moratorium offered to individuals/SMEs from April 1, 2020 onwards until end of September as well as the sharp interest rate cuts.

Speaking on this matter, Vision Group partner-in-charge of group strategy Chua Zhu Lian opined that there was unprecedented volatility in the markets driven by three main factors.

“These include prolonged low interest rate environment coupled with quantitative easing in the global scene , and record high retail participation ‘Covid plays,’ “ he said in an interview with BizHive.

“In my personal opinion, it will be wise to stick with investing in stocks with strong track record and fundamentals as the market is presently filled with speculative plays. Investors can study the situation back in the Asian Financial Crisis 1997 and be extremely careful not to be caught with speculative companies with unjustified valuations and unproven track record to avoid painful investment losses.”

Listing Process for LEAP Market (SOURCE: Bursa Malaysia)

Going for the LEAP

Meanwhile, Chua suggested that the presence of Bursa’s third listing option opened up a new avenue for companies to list.

Currently, Bursa Malaysia offers a choice of three markets to companies seeking for listing in Malaysia: the Main Market, ACE Market and LEAP Market.

The Main Market is a prime market for established companies that have met the standards in terms of quality, size and operations, whilst the ACE Market is a sponsor-driven market designed for companies with growth prospects.

Both markets provide companies with greater visibility via the capital market and a clearly defined platform to raise funds from both institutional and retail investors.

In a bid to further spur the number of listings, Bursa Malaysia launched a new board called the Leading Entrepreneur Accelerator Platform (LEAP) market in 2017.

Designed to address the funding gap for SMEs and make it easier for them to take their businesses to the next level through raising funds in the capital market, the LEAP Market is an alternative capital raising platform which is the first of its kind in Asean.

As an adviser-driven market which aims to provide emerging companies, including small- and medium-sized enterprises with greater fund raising access and visibility via the capital market, it is accessible only to sophisticated investors as prescribed under the Capital Markets and Services Act 2007.

“This new market reduces the barriers of entry for new companies to become publicly listed,” Chua told BizHive. “The barriers to list on the main market remains high for many companies.

“On the other hand, investors interest in alternative markets is picking up strongly especially in the ACE market.

“The shorter time frame to get listed on the non-main alternative markets allows for more companies to tap into the capital markets and obtain capital advantage at a much earlier stage.”

Notably, the listing process – beginning from the time you engage an adviser to the day of listing – will normally take four to nine months, depending on the structure and complexity of the listing scheme. Upon approval, companies will be given six months to complete your IPO exercise.

“I believe the groundwork for the recent listings have begun way before this pandemic started,” Chua said. “The timing of this “wave” of the listings is most probably caused by a backlog of listings which was already in the pipeline as well as a potential acceleration in case another lockdown is administered.

“In my personal opinion, I do not think that there is any correlation between the pandemic and the wave of listings observed, it should just be a backlog issue.”

Wan Hassan (fourth left) alongside other board of directors from Reservoir Link during their listing ceremony on July 16.

Sarawakian listings join the fray

An interesting trend seen this year is a rise in listings from Sarawakian companies, after the last Sarawakian company to list was Serba Dinamik Holdings Bhd back in February 2017.

This year, Reservoir Link listed on July 16, marking Bursa’s eighth listing year-to-date as well as the first IPO listing since the country went into a lockdown.

This was followed by Ocean Vantage which listed on Sarawak Day, July 22. Both were on the ACE Market of Bursa Malaysia.

Investors welcomed the two Sarawakian stocks well as can be seen by their oversubscription rates and rising share prices.

Reservoir Link’s offer of 14.25 million new shares to the public under its listing exercise was oversubscribed by 11.49 times. Reservoir Link’s share price jumped as much as 92.7 per cent upon its debut.

Ocean Vantage’s IPO was oversubscribed by 15.9 times. Upon listing on July 22, the stock saw strong buying interest, to rising by as much as 111.54 per cent during day trade.

“In addition to the investors’ confidence on the companies, the high subscription rate could also be partly driven by market factors, such as the higher retail participation in the current market as well as a higher availability of funds during the loan moratorium period,” opined Chua.

“Given that both companies have just recently been listed, more time would be needed to observe and study them in order to understand the companies’ fundamentals, sector outlook and investment value as well as to assess if they would be good long term investments.”

If the companies can continue their growth track record for the next three to five, years and with a high precision investor engagement strategy to create greater visibility, Chua believed they would get the attention of the market, especially in challenging times like this where many companies are facing downward pressure in earnings.

“Companies which are new to investor engagements can consider hiring consultants who specialise in the field of engagement to lend them a helping hand in how to best angle their company’s story to stakeholders,” he added.

Post-Covid status

When asked about the outlook post-Covid, Chua said the pandemic “had certainly accelerated the need for companies to have more diversified fund raising options in order to survive the storm, especially companies in sectors directly impacted by Covid i.e. aviation, tourism & hospitality and F&B.

“With a listed status, companies will be more able to tap into the capital markets, either through private placements or rights issue to raise funding in the tough operating environment.

“This can be for a myriad of reasons, such as to weather through the storm; execute strategic acquisitions to strengthen their market position; or execute strategic procurement to take advantage of lower prices of raw materials.

“As the groundwork for listing could take up to a few years, businesses will need to plan ahead to make sure they can maximise the leverage from capital markets when they need the capital to support their business plans and expansion or when the market cycle is favourable for the sector the company operates in.

“In this Covid crisis, we can also observe that many companies in the right sector, especially those in the Covid-related supply chain, such as gloves and PPE have fetched a huge premium on their valuations and some of them have taken the opportunity to execute fundraising activities.”

Call to East Malaysian firms

Meanwhile, the lack of East Malaysian firms on Bursa so far could be caused by limited exposure to capital markets here in Sabah and Sarawak, opined Chua.

“If Borneo companies are more proactive in tapping into the capital markets, I believe we will see an increasing amount of strong world class companies originating from Borneo soil.

“I also strongly believe that the creation of more world class companies will lead to a positive spill over on the standard of living of Borneo citizens through higher salaries and more extensive career options.”

Chua observed that generally, there is a good diversity of sectors among the Sarawakian listed companies.

“As the state government continue to encourage new business areas in the state, I believe we will see new listings emerging in the market which will not be confined to just the oil and gas sector.

“State led initiatives such as the push for digital economy and projects like the Samalaju Industrial Park will certainly bring the rise of a new wave of companies that will become the next backbone of the Sarawak economy.”

Chua further called on more Sabah and Sarawak companies to consider listing as a way to accelerate growth, bearing in mind its many benefits aside from enhancing a businesses’ capital advantage.

“Listing can also be a process to improve the sustainability of a business as it forces the entire organisation to adopt higher standards of professionalism, governance and transparency,” he said.

“I have come across many management of family ran businesses who claimed that the listing process has forced them to re-think, re-design and re-strategise their business to adopt best practices in order to pass the barrier of listing.

“They have also benefited from better brand exposure and have since listing, been able to penetrate new customer segments and markets which were previously only accessible by their listed peers.”

In addition to achieving capital market advantage through listing, Chua suggested that East Malaysian companies can proactively explore several measures to differentiate themselves and further strengthen their competitive edge.

“These include alternative funding options (such as peer-to-peer lending, equity crowdfunding and digital fundraising (initial coin offering and initial token offering); digitalisation of existing business processes; and investing into innovative start-ups with the potential of becoming profitable businesses or a strong complement to their existing businesses.

“The push for a digital economy by the Sarawak government will also be a strong enabler for businesses that are able to adapt quickly and connect into the new digital ecosystem spearheaded by the state.

“In a nutshell, we live in a digital era with technology advancing at an unprecedented pace. I believe this will be the dominant trend ahead that may disrupt a lot of existing businesses which have been profitable in the past and only businesses which can continue to adapt and innovate will remain the survivors of the new digital age.”

Kenny (right) and Ocean Vantage’s board of directors pose in front of Bursa’s board after its listing ceremony on Sarawak Day.

Riding on Sarawak’s top sector

Perhaps one of the reasons why Reservoir Link and Ocean Vantage did well was their main business providing support services to the oil and gas sector.

Both of these Sarawakian companies are in the field of oil & gas (O&G) and have demonstrated very strong growth in earnings before finally getting listed on the ACE market.

As an upstream oil & gas (O&G) well related services provider, Reservoir Link is set to improve on its position in the market from its listing, says chief executive officer/managing director Datuk Wan Hassan Mohd Jamil.

“We are committed to further enhance our current business and improve our competitiveness by purchasing our own well testing equipment, which will significantly boost our capabilities to better serve our clients as well as improve Reservoir Link’s margins,” he said during a press conference after its listing.

“Subsequently, we intend to expand beyond our current market reach and secure more jobs with our untiring perseverance and strong dedication.”

“The oil price’s gradual improvement augurs well for us. We will definitely position ourselves to be more competitive and ready to bid for more contracts in the future.

“We remain focused on delivering quality services and value to our shareholders and stakeholders alike and adapt accordingly to the O&G industry’s competitive landscape.”

Reservoir Link executive director Thien Chiet-Chai also shared the same view on the stabilising O&G market.

“I think the oil market has stabilised. If you look at the oil price, it has stabilised over the last few weeks. Our services are in production and end-of-life wells; it is not exploitation or development,” he said.

“Right now, operators will slow down the drilling of new wells, but all existing wells need to be maintained. We are actively participating in contracts. We foresee that Petroliam Nasional Bhd and other Pan Malaysia Petroleum Arrangement Contractors’ operators still need to maintain their wells; the bulk of our business is in the maintenance of the wells.”

Fellow O&G support services provider, Ocean Vantage, strives to be the ‘One-Stop’ business partner for the oil and gas majors across the upstream and downstream segments.

According to its managing director Kenny Ronald Ngalin, Ocean Vantage’s listing marks its next step to expand its footprint into the untapped territories as it continues to grow its ecosystem of services.

“With the RM21.4 million IPO proceeds, we will expand our range of support services in the EPC and project management division for the upstream oil and gas segment.

“Another priority for us will be to strengthen our market presence in the downstream oil and gas segment, which we currently have limited exposure to,” he said to BizHive after its listing ceremony on Sarawak Day.

“Together, our team has experienced both the upturn and downturn of the oil price cycle. We have operated in the landscape where oil price fluctuated between the low of US$10 per barrel to a high of US$120 per barrel.

“Not only have we survived the low oil price environment, we actually thrived and continued to achieve commendable annual growth. This was made possible by having a strong leadership team, who collectively has more than 70 years of experience in the oil and gas industry, along with a team of loyal and dedicated personnel who share the Group’s passion and vision

“Ocean Vantage is very agile, regardless if the services needed is upstream or downstream, we can adapt to any situations out there and that’s been shown in our track records for the past years whereby we continue to grow even during difficult times.”

On the outlook of the O&G sector, specifically in Sarawak, Ocean Vantage remained optimistic on the industry in Sarawak especially given the state government’s increased effort in encouraging O&G activities here.

“We are quite positive on the outlook of the O&G sector and we foresee a lot of projects coming up in Bintulu. There’s the Sarawak Petrochemical Hub coming up and I believe with the Sarawak government and with Petroleum Sarawak Bhd (Petros) trying to develop the local O&G scene and local contractors in Sarawak here, I am optimistic about the industry here.

“We are optimistic that we will be there for all these upcoming projects and we have a lot of integrated services that we can offer to the Sarawak O&G industry,” Kenny said.

Bursa Malaysia’s Muhamad Umar Swift (right) speaks during a press conference after Bursa Malaysia’s first half financial performance on July 28. — Bernama photo

‘Best ever’ for Bursa since 2005

There could not be a better time for Bursa Malaysia than the first six months of 2020, when it recorded its best-ever first-half financial performance (1H20) since its listing back in 2005.

“We anticipate two Main Market, 16 ACE Market and seven LEAP Market listings this year,” Bursa CEO Muhamad Umar Swift told a press conference post 2Q results announcement.

Amidst the influx of listings, Umar said RM1.6 billion was raised in the first half of the year from new listings compared with RM1.4 billion in 1H last year due to the bigger IPO sizes.

To recap, Bursa recorded a profit after tax and minority interest (PATAMI) of RM151 million for the first half ended June 30, 2020 (1H20), a 62 per cent increase from RM93.2 million reported in the previous corresponding half ended June 30, 2019 (1H19).

For the six months period, its net profit jumped 62 per cent to RM150.96 million from RM93.19 million due to higher operating revenue, which increased by 33.6 per cent to RM320.7 million from RM240 million in 1H19.

Revenue was up 32 per cent to RM330.53 million from RM250.49 million in the previous year corresponding period.

Total operating expenses in 1H20 increased by 3.7 per cent to RM127.1 million from RM122.6 million in 1H19, mainly due to higher staff and technology costs.

Its annualised return on equity and earnings per share of 39 per cent and 18.7 sen respectively have allowed the board to declare an interim dividend of 17 sen, or a dividend payout ratio of 91.1 per cent.

According to Bursa, the elevated market volatility had resulted in higher trading activities in both the Securities and Derivatives Markets.

“We did anticipate high levels of volatility to persist as investors seek comfort in counters which are the least scathed by the Covid-19 pandemic and falling commodity prices,” the research arm of Kenanga Investment Bank Bhd (Kenanga Research) said in its analysis on Bursa’s results.

“We expected on retailers taking on bets in the heightened activity, with rebounds from low bases appearing to be a favourite theme but we did not bet on the heightened participation (at 33 per cent its best 10-Year performance) – which we believe alluded to retailers looking for better returns given the slew of overnight policy rate (OPR) cuts recently and possibly funded by additional cash available as a result of the loan moratorium.

“While we expect volatility to continue to persist, we expect it to taper in the fourth quarter (4Q) given the soft economic data.”

Rising tides, hidden gems

Meanwhile, analysts are encouraged by Bursa Malaysia’s equity trading volumes and values hit record levels in the first week of August, consistently at RM7.6 billion to RM10 billion in average daily value (ADV), outperforming July’s ADV of RM5.5 billion and the recent second quarter of RM3.85 billion.

Affin Hwang Investment Bank Bhd (AffinHwang Capital) earlier this week saw that July’s ADV grew by 18.6 per cent month on month (m-o-m). Based on the seven trading days of August of RM8.66 billion, this represents an increase of 56.3 per cent against July.

“Market velocity surged to circa 120 per cent in August versus 77 per cent in July, a phenomenon we have not seen in the last 20 years or so,” it said in a special report yesterday. “Meanwhile, this has raised our concern of investors getting caught up in the frenzy of excessive speculation activities.

“The robust trading activities were driven by retail participation, which had increased from 32 to 33 per cent in 2Q20 to as high as 48 per cent in August 2020, according to data from Bursa Malaysia.

“A comparison of Bursa’s July trading values against June saw a growth of 24 per cent m-o-m,” AffinHwang Capital highlighted. “We note that other regional Asian markets with the exception of the Hong Kong Stock Exchange, saw month-on-month contractions in July’s equity market ADV.

“In recent days, the market was clearly jolted by several developments which came at the same time, such as news of Russia registering its ‘first vaccine’ against

Covid-19 and claiming that it offers sustainable immunity against the virus, fall in crude oil prices and gold prices plunging overnight as “smart money” shifted to equities and treasuries,” it recapped.

“We believe that corrections in over-speculated share prices will normalize trading behaviour and drive investors to trade rationally and focus on fundamentals. Over the longer term, we are confident that a healthy market uptrend is intact and that the market will be more orderly.

“Hence, it will not be a surprise to see Bursa’s equity market ADV heading lower in 2021, which in our 2021 and 2022 estimate assumptions are at RM2.9 billion and RM2.8 billion respectively against a RM4.1 billionn ADV in 2020.”

Eyeing new offerings

On new offerings, Umar said the bourse is interested in exchange-traded funds and new derivatives products, looking at potential options around rubber and coffee.

“We’re also engaging with other exchanges to bring their products to Malaysia’s derivatives space,” he detailled, adding that one of Bursa’s key objectives is to ‘democratise’ the investing process.

“We would like to see the opportunities provided to private banking clients, private wealth clients to be available on the exchange.”

“We see confidence coming back to the market. However we are also mindful because this is fragile. If we see a re-emergence of Covid-19 infections, that would also impact the volatility and confidence of the market,“ said Umar.

“We will continue to introduce initiatives and streamlined product offerings, such as expanding the range of trading channels and platforms to improve the seamless digital journey on Bursa Malaysia for the new generation of investors.”

On Thursday, Bursa Malaysia Bhd amended the Main Market and ACE Market listing requirements to enhance the disclosure requirements in connection with new issue of securities, as well as to address gaps for greater shareholder protection and confidence.

At the same time, integrity and quality of the board remain a key focus for the exchange, it said in a statement on August 13.

“The exchange has also enhanced the definition of independent directors by extending the cooling-off period for specific persons (such as an existing or former officer, adviser or transacting party of the listed issuer or its related corporation) to three years from the current two-year period, and subjecting a non-independent non-executive director to such revised cooling-off period.

“This is to strengthen the independence of a proposed director so that he is free from any business or other relationship which could interfere with the exercise of independent judgement of a director,” it said.

Most of the amendments will take effect immediately, while other amendments such as the enhanced definition of independent directors will become effective Oct 1, 2020.