KUCHING: Malaysia’s initial public offering (IPO) market has seen encouraging interest so far this year, coming off last year’s high.

KUCHING: Malaysia’s initial public offering (IPO) market has seen encouraging interest so far this year, coming off last year’s high.

Having seen sporadic bouts of listing from January to May — totalling 10 in four months – June and July saw a massive 11 listings.

As at July 30, 21 IPOs have made their debut on Bursa Malaysia, with a further breakdown to nine IPOs on the ACE Market, seven for the LEAP Market and five for the Main Market.

The Securities Commission (SC) previously anticipated for 30 companies to debut on Bursa Malaysia this year, as its chairman Datuk Syed Zaid Syed Jaffar Albar described the IPO projection as a “healthy” figure.

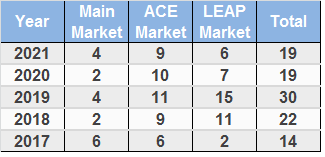

Disruptions caused by the Covid- 19 pandemic last year saw only 19 new listings, including two new companies on the Main Market.

To compare, 2019 saw 30 companies make their debuts consisting of four on the Main Market, 11 on the ACE Market and 15 on the LEAP Market. In 2018, there were 22 IPOs.

“Investor appetite remains strong for IPO and there are still opportunities for businesses to tap into this source of fund to support their business expansion,” commented Chua Zhu Lian, Vision Group managing director to BizHive.

“We also can observe that companies operating in the right sectors, coupled with good corporate planning and strong storytelling can lead to huge value creation.”

When asked if the Covid-19 pandemic had any change to the trends of listing on the bourse, Chua believed it to have increased retail participation.

“I think the biggest positive change Covid has brought to the stock market is definitely the large increase in retail participation. This will give rise to a new generation of population which are financially savvier in terms of stock market and financial investments,” he added.

The ACE and Main Markets are still ideal for companies aspiring to go listing in terms of better valuations, stronger exposure and higher market liquidity. On the other hand, LEAP would be suitable for companies who wants an accelerated route to listing.”

Rise of technology listings

A huge trend spotted in Bursa’s listings is riding on the waves of technology.

This year, the gem in the spotlight is credit reporting agency CTOS Digital Bhd (CTOS), which listed on the Main Market on July 19 and made its mark as Malaysia’s largest IPO this year with its RM1.2 billion listing.

The gem in the spotlight this year is credit reporting agency CTOS, which listed on the Main Market on July 19 and made its mark as Malaysia’s largest IPO this year with its RM1.2 billion listing.

The group had attracted RM1.38 billion for its retail IPO tranche, the largest retail demand for an IPO since 2013. The group also garnered a record 23 cornerstone investors in its book-building exercise, with renowned names such as Employees Provident Fund Board, Permodalan Nasional Bhd, Aberdeen Standard Investment, AIA, Eastspring Investments, FIL Investment Management and JP Morgan Asset Management.

At the virtual listing ceremony, group chief executive officer Dennis Martin reaffirmed the trend of technology: “Going forward, we will focus on providing more innovative digital solutions across the entire lifecycle of financial institutions, companies, and small- and-medium enterprises, as well as supporting individuals on their own financial literacy.”

CTOS joins a string of technology related companies successfully listing on Bursa this year.

More recently, insurance technology specialist DynaFront Holdings Bhd (Dynafront) debuted on Bursa Malaysia’s LEAP Market on July 23. It specialises in developing and providing proprietary and customised enterprise information technology (IT) solutions for a broad range of life insurance companies.

The group offers a comprehensive suite of software solutions including PrecentiaCMS for front-end sales automation system, PrecentiaLife for back-end individual life administration system, as well as PrecentiaGroup, a suite of back-end group life administration systems for employee benefits.

DynaFront’s Chan (left) affirms that prevailing market sentiments are positive for technology companies, notwithstanding the ongoing pandemic.

“DynaFront also offers PrecentiaTakaful supporting the Wakalah, Mudharabah, and hybrid concepts and can be integrated into various Takaful models,” the group added.

With its listing, Dynafront is moving into the virtual insurance space, with its research and development team focusing on the development and implementation of new mobile applications in wearable technologies.

These technologies include web-enabled smart devices that use embedded systems, such as processors, sensors, and communication hardware, to collect, send and act on data acquired from their environments such as temperature screenings and movement detections to smartwatches and wearable health devices.

The group added that real-time syncing and processing of data between wearables and its platform microservices as well as real-time health monitoring will enable life insurance companies to structure insurance products that are more customised and suited for the policyholders.

“The timing of listing is very much in line with our regional expansion plans and our belief that it is an optimal time to refresh our branding and elevate our profile,” DynaFront managing director and group chief executive office Chan Eng Lim said in an email interview with BizHive.

He affirmed that prevailing market sentiments are positive for technology companies, notwithstanding the ongoing pandemic.

“I believe investors by and large recognise the urgent need for digitalization, in order for businesses to be less impacted by black swan events such as Covid and to better compete in an increasingly technology-centric environment going forward.

“We implore insurance companies, being one of the key pillars of the economy, to update and upgrade their technology backbone, especially if they still rely on legacy systems. We believe it is a good time to reinvest in technology and strengthen their operations amidst the economic downturn. It is far cheaper to invest now than to do so when market is booming.

“And when the economy recovers — which it always will — those who have invested will be in better position to reap the fruits of their investments and improved efficiencies.”

Human capital management solutions Ramssol Group Bhd debut on the ACE market on July 13, with its group managing director and chief executive officer Cllement Tan Chee Seng expecting the prospects for the group to remain favourable as digitalised human resources for greater operational and cross departmental efficiency is expected to drive demand for human capital management solutions amid the Covid-19 pandemic.

“Since the outbreak of the global pandemic, remote collaboration and digital transformation have become increasingly important as more and more organisations adopt working remotely,” he commented after the listing.

“Digitalisation leads to increased demand for human capital management solutions, ad hoc IT personnel that align with our IT augmentation and also employee engagement platform for greater efficiency which will eventually benefit the industry players in the long term, including Ramssol,” said Tan.

Meanwhile, the July 1 listing of Novelplus Technology Bhd (Novelplus), an online social reading and writing platform developer and operator, puts the group in a better position to focus on new business expansion and pursue future growth opportunities.

NovelPlus platform allows readers to browse and select e-books, personalise their experience and manage their profile as well as interact with writers registered on the platform.

For writers, the NovelPlus platform allows them to write, edit and self-publish their serialized novels, build readerships and receive reviews and tokens of appreciation from readers. Advertisers can also advertise on the mobile application and web browser, with the advertisements targeted towards users who are not subscribed.

Chief executive officer, Crystal Lai told BizHive that the Covid-19 crisis forced the change of almost every aspect of the business world, accelerating years of digital transformation into months.

“The accelerated digital transformation came with many business opportunities, which allowed us to stay on course. This year, however, is likely to be the year when the world transitions to the next normal.

“To remain relevant in the market, we will need to continuously develop new capabilities, enable leading technologies, and provide a seamless experience,” she said.

For NovelPlus, Lai revealed that the pandemic caused them to pause its listing plan based on the Covid-19’s impact on the markets.

“It was a good time for us to take a step back and look at our company and users to make sure we had a resilient business.

“Turns out, this was the best period from a new business perspective in our company’s history as NovelPlus successfully established a vibrant community of readers and writers by putting into practice our core mission which is to change the way people publish and read,” she enthused.

“Once we got a little more wind underneath us in early 2021, we brought the plans for the IPO back off the shelf. The process has certainly been a journey.

“We definitely made an impact for our brand, and we are now in a better position to focus on new business expansion and pursue future growth opportunities.”

Virtually available

Perhaps what made the listing process easier for companies is the shift to online. Starting October last year, Bursa Malaysia mandated all new listings to be done via virtual ceremonies arising from the reinstatement of the conditional movement control order (CMCO) in Selangor, Kuala Lumpur and Putrajaya.

In line with the CMCO requirements, Bursa Malaysia introduced this virtual listing service, enabling flexibility for new issuers during CMCO.

At the time, Bursa Malaysia chief executive officer Datuk Muhamad Umar Swift, said, “Historically, listing ceremonies on Bursa Malaysia marks a significant milestone in a company’s life cycle.

“The event usually attracts many invited guests of the company who come together to celebrate the event with the company’s owners and promoters. The occasion is marked with the traditional act of striking the gong at the opening of the market day.

“Notwithstanding the CMCO, we are happy to maintain this longstanding tradition. We will continue to leverage on technology to adapt our traditions to the continuously changing environment while always prioritising the health and safety of our stakeholders.”

Another move making the listing process easier is additional relief measures under the PEMERKASA Strategic Programme announced by the Prime Minister on 17 March 2021.

These measures, which include a 12-month waiver and rebate on listing-related fees, will reduce the fundraising cost for companies and provide further financial relief to listed issuers.

Details of these measures include a 12-month waiver on listing-related fees for IPOs effective March 17,2021; a 100 per cent waiver on processing fee, including prospectus registration fee for companies seeking to list on ACE and LEAP Market, as well as those with less than RM500 million market capitalisation on Main Market; 100 per cent waiver on initial fees and annual listing fee for companies with less than RM500 million market capitalisation; and 50 per cent waiver on initial fee and annual listing fee for companies of RM500 million market capitalisation and above.

It also offers a 50 per cent rebate of annual listing fees for the year 2021 for listed issuers that meet the following criteria:

a. Market capitalisation below RM500 million as of December 31, 2020;

b. Report financial losses as measured by Group loss after tax in their quarterly report for a quarter ended on any date between February 1, 2021 to April 30, 2021 (inclusive) notwithstanding the date of submission of the same.

Additionally, a waiver on processing, perusal and listing fees on regularisation proposals received by December 31, 2021:

a. From listed issuers that have been classified as a PN17/GN3 company;

b. Cash company as set out in para 8.03 of the Main Market listing requirements and ACE Market listing requirements;

c. Companies with an inadequate level of operations as set out in para 8.03A of the Main Market listing requirements and ACE Market listing requirements.

On July 1 this year, the Securities Commission Malaysia (SC) has made several amendments to the Capital Markets and Services Act 2007 (CMSA), which came into force immediately.

Among said changes is to Schedule 5 of the CMSA, which sets out the type of corporate proposals that do not require the SC’s approval, had also been amended to include initial exchange offerings of digital assets through a recognised market operator.

This includes an IPO or cross-listing of the shares in a public company or listed corporation on a stock exchange outside Malaysia, said the regulator.

Global IPO momentum continues at record-breaking pace

The pandemic was no deterrent for listings worldwide. Hot IPO momentum from the first quarter of the year (1Q21) continued into the second quarter, resulting in the most active quarter by deal numbers and proceeds in the last 20 years.

According to global accounting firm EY in its “Global IPO Trends: 2Q 2021” report, while 1Q was dominated by special purpose acquisition company (SPAC) IPOs, traditional IPOs stepped back into the spotlight in 2Q helped by a number of factors including ample liquidity in the financial systems and strong global equity market performance among others.

Through the first half of the year (1H21), there was a total of 1,070 IPOs worldwide, raising US$222 billion in proceeds. These represent an increase of 150 per cent and 215 per cent, respectively, year-on-year.

Table shows the comparison of IPOs by region in 2Q21 (SOURCE: EY)

EY said the positive performance of the global IPO market indicated global economic recovery was well underway, although the pace of recovery varied across markets.

“While special purpose acquisition companies (SPACs) continue to be a hot topic, the US’ SPACs have stepped out of the driver’s seat through 2Q after a high level of activity for the past 12 months,” it said in a statement accompanying the report’s release earlier this month.

“At the same time, European SPAC IPO activity grew, totalling 21 SPAC IPOs through 1H.

“IPO activities in the Americas continued at a fast pace through 1H, with 276 IPOs raising US$93.9 billion. In the Asia-Pacific region, IPO activity remained steady with 471 IPOs raising US$74.3 billion.”

Hot on the heels of a strong bull run are the Europe, Middle East and Africa (EMEIA) equities markets, whereby IPO activity through 1H21 surged, resulting in 323 IPOs raising US$53.8 billion.

In fact, EMEIA recorded the highest growth rates year-on-year among the three regions.

“For the fourth consecutive quarter starting from 3Q20, technology has led the sectors by deal number, accounting for over a quarter (27 per cent) of all 1H deals with 284 IPOs raising US$90.2 billion,” EY added.

“The health care sector followed suit, accounting for 17 per cent of 1H21 IPOs with 187 deals raising US$33.4 billion, followed by industrials which saw 140 IPOs raise US$24.3 billion.”

EY’s global IPO leader Paul Go commented that IPO markets put in a strong performance in 2Q21 as traditional IPOs continued to benefit from the momentum in the first quarter while SPACs took a pause.

“IPO-bound companies wanting to take advantage of favorable market sentiment and high liquidity were keen to complete their transactions before an expected mid-year slow-down,” he said.

“Companies considering an IPO should prepare multipronged strategies that demonstrate resilience against geopolitics, the evolving Covid-19 pandemic situation, valuations and governance challenges.”

Asia-Pacific IPO markets remain resilient

Markets in the Asia-Pacific region maintained momentum through the first half of 2021, seeing the highest proceeds for the first half of the year in more than 20 years.

EY saw that overall IPO volume resulted in 471 IPOs raising US$74.3 billion by proceeds, a 76 per cent and 108 per cent respective increase year-on-year.

Technology continues to lead the sectors by both volume (99 IPOs) and proceeds (US$25.1 billion).

Greater China continued at a positive pace through the first half of 2021 seeing 293 IPOs raise US$60.3 billion by proceeds. Mega IPOs played a key role in Greater China, with five of the top 10 global IPOs launched on Greater Chinese exchanges.

Despite new waves of the Covid-19 pandemic in Japan, the country saw 1H21 IPO numbers rise 59 per cent to 54 deals, raising US$3 billion by proceeds. South Korea posted two mega IPOs in the first half of 2021, including the fifth largest IPO globally in 2Q21 by proceeds, which raised US$2 billion.

In Australia and New Zealand, steady economic recovery helped to propel IPO activity, with 1H21 IPO volumes rising five times, and proceeds increased by more than 28 times, compared with 1H 2020.

As for the South East Asian region, Asean’s exchanges remained steady, recording a total of 54 deals raising US$5.1 billion, compared to 44 deals raising US$3.2 billion over the same period in 2020.

In proceeds, Thailand’s exchanges led with 15 deals raising US$2.9 billion, followed by the Philippines, which saw two deals raising US$1.3 billion.

Indonesia posted the largest number of IPOs with 22 deals raising US$0.5 billion, while exchanges in Malaysia and Singapore saw 12 deals raising US$0.1 billion, and 3 deals raising US$0.24b respectively.

Max Loh, EY Asean IPO Leader, affirmed that Asean had a respectable IPO showing in 1H21, recording the best first-half result over the past few years, where it saw 44 IPOs raising US$3.2 billion in 2020 and 40 IPOs raising US$1.9 billion in 2019.

“In spite of the ongoing pandemic, Asean’s corporates are showing optimism and confidence in the region’s ultimate economic recovery and leveraging the capital markets for growth and emerging digital opportunities,” he enthused.

“This momentum is expected to hold steady going into the second half of 2021, led by Thailand and Indonesia. The introduction of Asean SPACs into the mix may well provide the ballast for more public listings going forward.”

Overall, EY expects investor confidence in Asia-Pacific IPO markets to remain buoyant through the remainder of the year. However, as governments around the world begin to wind down their stimulus programs, it warned of risks of potential market adjustments in 2H21 that could slow down IPO activity.

“The most active sectors will continue to be technology, health care and consumer products. Despite a lack of track record profits, there are several sizeable biotech companies in the IPO pipeline that we expect will launch in 2H21.

“Meanwhile, as consumers start to spend again and unlock the pent-up demand, consumer products will stand to benefit, positioning them well for IPOs.

“In Asean, we expect several mega IPOs in the pipeline to launch in 2H 2021, fueling investor confidence and maintaining the momentum of IPO activity. At the same time, some high-growth companies that may not yet be ready to go public via the traditional IPO route are considering an alternative path through a SPAC merger.

“For companies looking to go public, it is advisable to choose the best location for your IPO, regardless of politics.”

America’s IPO deals reach highest point in 20 years

Another interesting trend observed is that IPO activities in the Americas region sustained strong momentum through 1H21, experiencing record-breaking volume resulting in 276 IPOs, raising US$93.9 billion by proceeds – a 229 per cent increase by volume and 282 per cent rise by proceeds year-on-year.

Rachel Gerring, EY Americas IPO Leader, said: “Americas IPO market maintained robust activity in 2Q21, driven by record breaking levels of technology IPOs not seen in more than two decades.

“Aftermarket performance has not been as strong as 2020, but the IPO pipeline is filling up, indicating a busy mid-year.

“We anticipate strong activity for the rest of the year supported by the high valuations in the broader market, solid performance of the IPO asset class, along with disruptive companies in traditional industries building the pipeline.”

Healthcare topped the sectors in terms of volume representing 36 per cent of deals, followed by technology with 31 per cent. By proceeds, those sectors flipped, with technology raising nearly half (49 per cent) of all proceeds while health care accounted for 23 per cent.

The second quarter of 2021 saw a dramatic decrease in SPAC appetite, particularly in the US with only 59 SPAC IPOs raising US$12 billion. While US SPAC activity has lulled, activity is expected to remain steady over the US summer months, picking up speed in the fall.

As for traditional US IPO activity, 1H21 deal numbers surged in June resulting in 218 IPOs, raising US$84.2 billion in proceeds. The US continues to produce unicorns, seeing 41 unicorn companies launching IPOs in 1H21 compared to 27 unicorn listings through all of 2020.