Economists believe that with the current stable political landscape, Malaysia might be on its way to seeing a stable recovery in its economy. — Bernama photo

AFTER almost two years of battling the Covid-19 pandemic, Malaysia’s economy and the market is finally positioned at the start of its recovery process.

As vaccination rates ramp up, with more than 60 per cent of the adult population in Malaysia now fully vaccinated, and more sectors reopen while the political scene in Malaysia is somewhat stable, the final quarter of 2021 (4Q) might offer a moment of respite Malaysia’s economy.

Economists believe that with the current stable political landscape, Malaysia might be on its way to seeing a stable recovery in its economy.

In a report on Malaysia’s 4Q outlook, the research team at Kenanga Investment Bank Bhd (Kenanga Research) highlighted: “The return of a familiar political order has changed the domestic investment landscape. After witnessing three leadership changes in as many years, we believe a semblance of stability has returned.”

A Memorandum of Understanding (MoU) have also been signed by the current government and the Pakatan Harapan (PH) opposition last month.

“Although not a proper agreement, we view this as some sort of a supply and bill agreement seen in other countries between loose coalition members,” the research team at MIDF Amanah Investment Bank Bhd (MIDF Research) viewed.

“Another positive development is that the government can also focus in getting the economy back on track. The MoU stated that the PH opposition would either support or abstain during the vote to pass the national budget, related supply bills as well as other Bills or motions construed as confidence votes.

“Of course, this comes with the condition that the budget, budget-related Bills and other Bills be jointly negotiated between the government and PH,” it added.

“We believe that this allows for the government to propose initiatives via the Budget that can boost the economic recovery phase.

“We opine that this will remove some uncertainty in terms of the economic recovery,” MIDF Research remarked.

Malaysia will also only see its general election held next year.

In the MoU, the government has agreed not to dissolve the parliament before July 31, 2022.

“This means that a general election would not be held until at least August 2022. We believe that this effectively calms and reduce the political uncertainties by reducing the likelihood of impending polls,” the research team said.

“As it prepares for GE15, this coalition will play to the hearts of the rural heartland and East Malaysians that hold a disproportionately large number of parliamentary constituencies. It is partly this emerging stability that has drawn foreign equity interest back along with a recovery in commodity prices on which Malaysia so depends.

“Against a backdrop of stabilising oil prices, a theme of interest for 4Q21 revolves around the long-awaited reopening of the economy that lifts the halt-work order in the sector and the development of East Malaysia’s oil & gas assets, especially those in Sarawak, having been incentivised by its recently hard-won annual state sales tax on oil and gas from Petronas,” Kenanga Research suggested.

Besides that, the research team believe that market confidence is expected to return as the momentum of the reopening of the economy picks up in 4Q.

“After several false starts over the past 18 months, the falling rate of infections that is finally taking root has led us to revisit the economic reopening theme,” it said.

“With the vaccination programme rapidly deployed since April, Malaysia may finally reach the 90 per cent-fully vaccinated rate among the adult population by the end of October.”

In light of the expected reopening, it pointed out that tourism spending will recover from the resumption of interstate and international travel.

“There is an element of pent-up spending that should see an acceleration of physical e-payment transactions which will benefit the likes of GHLS which draws higher MDRs from onsite transactions.

“As for REITs with exposures to malls, our optimism is premised on a rebound in the sector soon as the economy opens up which see earnings normalising in FY22, albeit unlikely to revert yet to pre-pandemic levels.

“The quick rebound is a result of fairly stable occupancy rates at most prime malls as rental rebates had helped struggling tenants get by during the crisis as REITs management had always prioritised occupancy over rental.

“As such, tenants will be able to meet normal rent payments soon as the situation normalises by FY22. It is not too late to get an exposure as the sector’s total return has been flat YTD (just ahead of the FBM KLCI), while 2020’s total return was a disappointing -10 per cent,” it said.

Meanwhile, MIDF Research believe that after months of uncertainties driven by sporadic lockdowns as a measure to curb the spread of Covid-19, local production activities would likely pick up from August onwards as the government allowed more businesses to reopen and vaccinated workers to go back to work.

“The recovering demand will encourage businesses to continue increasing their production activities going forward. Being involved in the global production chain, Malaysia stands to benefit from the strong global demand for E&E components and semiconductors.

“Moreover, the increased global demand will also support the overall trade outlook and local commodity sectors,” it said.

RHB Research Sdn Bhd (RHB Research) in its economic update report for 4Q, noted that a few key events are likely to support a further increase in consumption by the end of this year and early next year.

“First, working capacity could be increased to 100 per cent and operating hours normalised, as states move to higher phases of the National Recovery Programme (NRP). Second, sectors that were deemed nonessential and high risk such as spas and night clubs should gradually be reopened.

“Third, international travel is expected to be allowed, providing support to the tourism-related segments. Mobility should improve as a result of these measures, lending support to the labour market and private consumption recovery.

“In addition, consumer spending is already well positioned to capitalise on the reopening of the economy. Household savings have significantly built up during the pandemic due to mobility restrictions, moratoriums and cash support. The increased savings are arguably involuntary, and mostly in liquid assets which may likely be drawn upon when consumer confidence improves,” it added.

Overall, RHB Research is optimistic on the quarter ahead as 3Q21, high frequency data seems to indicate that the economic bottom was in July, with a rebound in August and gaining pace in September.

“On a net basis, the quarter will see limited growth on a y-o-y basis due to the high base effect in 3Q20. However on a q-o-q basis, we expect positive growth in 3Q21 and 4Q21 versus a contraction of 1.9 per cent in 2Q21,” it forecast.

Some key developments is also expected to shape the external trade performance over the next few quarters.

“First, countries that reopened early in 2021 due to their advanced vaccination rates, particularly the US and Europe, are likely to grow at trend in 2022.

“Global demand will also emanate some countries in Asia as the region re-opens to some extent its domestic economies and its borders as well,” RHB Research added.

Domestically, there are also several key events that could be catalysts to Malaysia’s economic and investment growth in 4Q. Namely further announcements on plans under the 12MP as well as the tabling of Budget 2022.

The 12MP was first tabled by Prime Minister Datuk Seri Ismail Sabri Yaakob in Parliament in end-September. — Bernama photo

Kick-starting the five-year 12MP in 4Q21

THE final quarter of this year is expected see foundations of the five-year 12th Malaysian Plan (12MP) being put in place.

Themed ‘Resetting the economy; strengthening security, wellbeing and inclusivity; and advancing sustainability’, the 12MP was first tabled by newly-minted Prime Minister Datuk Seri Ismail Sabri Yaakob in Parliament late last month.

The plan aims to address current issues and at the same time to restart and rejuvenate Malaysia’s socioeconomic development for long-term sustainability following months of battling the Covid-19 pandemic.

The total development expenditure allocation is estimated to be at RM400 billion in the hopes that Malaysia’s economy could grow between 4.5 to 5.5 per cent per annum, resulting in higher Gross National Income (GNI) per capita of RM57,882 by 2025.

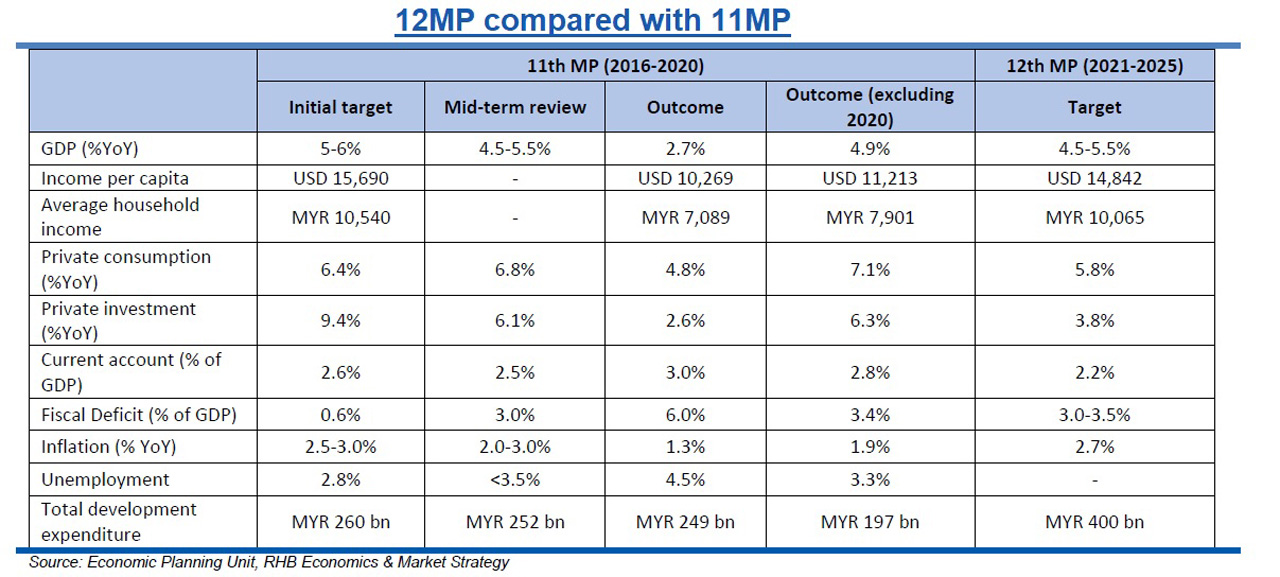

According to RHB Research Sdn Bhd (RHB Research), the 12MP appears to have more realistic targets than the previous 11MP.

Its senior economist Nazmi Idrus in a report commented: “We see the 12MP as the balance between finding new ways to spur economic growth while at the same time keeping government finances in check after battling one of the country’s biggest economic shock.

“In this regard, the focus has been more emphasised towards expediting the 4th Industrial Revolution (4th IR), enhancing the digital economy, raising SMEs contribution, as well as greater focus on renewable energy.”

Nazmi added: “Overall, the 12MP provides a clear direction of fiscal policy over the next five years. The government has set more pragmatic targets in the 12MP relative to the more ambitious 11MP initial targets.”

Nevertheless, the economist pointed out that the development expenditure target is exceptionally high at RM400 billion total for the next five years.

“In our view, development expenditure will continue to face implementation risks for much of 2022, with 2023 being the earliest we expect an improvement in this category of government spending.

“That averages to about RM83 billion annually for 2022 to 2025 (2021 target is RM68.2 billion) and higher than the actual total expenditure under the 11MP at RM249 billion or RM50 billion annually on average. 50 per cent of the development expenditure will be channelled to the six less developed states (namely Sabah, Sarawak, Kelantan, Terengganu, Kedah and Perlis) focusing on infrastructure and poverty eradication programmes.”

The government’s contribution in investment is also projected to increase given the higher development expenditure.

“While the public investment under 10MP and 11MP is relatively flat the government projects public investment to grow by 2.6 per cent y-o-y annually in 12MP, aided by higher capital spending of non-financial public corporations (NFPCs).

“The investment will be largely in infrastructure, transport, utilities as well as the oil and gas industry,” the economist noted.

“Importantly, the fiscal deficit target is projected at three to 3.5 per cent of GDP by 2025. This is a marked improvement compared to current expected fiscal deficit target of 6.5 to seven per cent for 2021.

“In our view, the government’s goal for fiscal consolidation seems reasonable assuming no other negative external shock.

“Of course, this assumes that fiscal environment is status quo. The government’s plan to reintroduce the Goods & Services (GST) tax is nowhere mentioned in the 12MP. Similarly, the capital gains tax and the windfall tax mulled by the Government are also missing. Nevertheless, we did not rule this factor out. There could still be surprises in the Budget 2022 to be tabled in end-October,” Nazmi remarked.

Meanwhile, UOB Group’s research team noted that the 12MP is based on three themes, four catalytic policy enablers, and 14 game changers. The three themes are; resetting the economy, strengthening security, wellbeing and inclusivity, and advancing sustainability.

The four policy enablers are; focus on developing future talent; accelerating technology adoption and innovation; enhancing connectivity and transport infrastructure, and strengthening public service.

“The 14 game changers represent innovative actions to shift mind-sets and change the approach to national development. The plan will require reform and transformation at all levels of government and incorporate ‘political buy-in’ to ensure successful fundamental change.

“The new approach aims to restore economic growth, address socioeconomic challenges, balance regional development, and enhance the country’s competitiveness to be more resilient and sustainable.

“It will also set the path for Malaysia to become a high-income nation. Several broad economic targets were set including GDP growth, GNI per capita, labour productivity growth, share of compensation of employees, mean monthly household incomes, wellbeing index, unemployment, inflation, and fiscal balance,” it observed.

Growth and quantitative targets aside, it also pointed out that there is recognition of socio-economic and socio-political challenges as well as current structural issues including income and growth disparities, inequalities, youth unemployment, rising cost of living, and industries caught in the lower end of the value chain.

“Moreover, there are ongoing downside risks and the pace of economic recovery will depend on the evolving Covid-19 pandemic,” it highlighted.

Nevertheless, the research team cautioned that the 12MP assumes the global economy to regain momentum and global trade to expand 5.3 per cent per annum.

“This will enable Malaysia to achieve GDP growth of between 4.5 to 5.5 per cent per annum during 12MP, and attain a higher GNI per capita of RM57,882 or US$14,842 in 2025 (minimum GNI per capita threshold for high-income status: US$12,696),” it noted.

The upcoming budget is also aimed at carrying out structural reforms for Malaysia to become more competitive in the post-pandemic period with development agenda that is more sustainable and inclusive. — Bernama photo

Budget 2022 a precursor for post-pandemic recovery

Another key event to watch out for in 4Q is the Budget 2022 which is expected to see allocations to areas that align with the 12MP.

According to the Ministry of Finance’s (MoF) pre-budget statement, Budget 2022 is expected to focus on three major themes, which are recovery, resilience and reforms.

Aside from that, special focus will be placed on reviving affected sectors, improving the capability of the public healthcare system and social protection scope, as well as boosting Malaysia’s digital economy.

In other words, according to the research team at MIDF Amanah Investment Bank Bhd (MIDF Research), the design of the upcoming budget is to achieve goals such as spurring recovery and addressing the long-term effects of Covid-19 pandemic on public health and the economy.

The upcoming budget is also aimed at supporting the rakyat and businesses by protecting their livelihood and income opportunities, and improving their reliance to face future crises as well as carry out structural reforms for Malaysia to become more competitive in the post-pandemic period with development agenda that is more sustainable and inclusive.

“From the plan to ensure continuity of programmes for the public health, we believe there will be allocation directed for the healthcare system although the government is guiding the country from the pandemic to an endemic phase,” the research team said.

As the efficacy of the existing vaccines is also seen as waning over time, MIDF Research pointed out that there would be a need to provide booster jabs to improve the public immunity against Covid-19 infections.

There is also the concern over the potential emergence of new variants which would require continued financial support to ensure the nation’s healthcare system remains ready and able to cope with the unexpected changes in Covid-19 situation both locally and globally.

“At the recent parliamentary session, the Deputy Finance Minister II unveiled proposal by the MOF to raise the ceiling of the Covid-19 from RM65 billion to RM110 billion in view of the payment commitment which had grown to RM91.8 billion. This highlights there still an urgent need for allocation to cover the Covid-19-related spending.

“We believe there will still be allocation in the upcoming budget to support the national agenda in containing Covid-19,” it obsever.

Aside from that, as the economy has begun its course of reopening under a possible post-Covid scenario, MIDF Research expected more incentives could be provided to industries and business which have been struggling to revive and recover after being hit by the pandemic and sharp decline in demand.

“Industries such as tourism, hotel & accommodation and aviation, for example, have been impacted by the international border closure and reduced demand for travels and tour,” it said.

Like in the previous budget, the research team also foresee allocations such as grants and financial assistance could be provided to support the small and medium enterprises (SMEs) as well as micro enterprises to revitalise their business activities.

For the general public, the research team expected more incentives could be allocated for the B40 and less privileged segments.

“More importantly, the government is expected to focus on addressing the worsening of socioeconomic well-being of the people as 580,000 or approximately 20 per cent of the M40 households have fallen to the B40 segment as a result of the pandemic.

“Moreover, absolute poverty ratio in the country also worsened to 8.4 per cent in 2020 (2019: 5.6 per cent) as increased number people having monthly income below RM2,208, which is the latest measure of poverty line,” it highlighted.

MIDF Research also expected Budget 2022 to focus on infrastructure developments as the economy reopens.

It foresee the continuity of major projects such as MRT3 and Pan Borneo Highway will continue to support the sector’s growth next year.

The aspiration to become regional hub in technology will also require spending to improve the technology infrastructure in Malaysia.

“We expect spending to promote digital adoption and improving internet connectivity may be included in the Budget 2022. This development expenditure is expected to create more job opportunities and have positive spillover effects to other businesses and sectors in the economy,” it said.

While there is still no indication on the amount allocated under Budget 2022, according to UOB Group’s research team, the Budget 2022 will likely see expansionary policies which include RM32.5 billion for Covid-19 Fund, development expenditure of RM76.1 billion (including rehabilitation plan), continued targeted cash handouts and financial aid particularly for MSMEs.

With that, there comes a need for the government reform the fiscal management to meet to improve the efficiency of public service delivery.

The MOF also issued a consultative paper to get feedback on the government’s plan to introduce Fiscal Responsibility Act.

“We expect this will be among the continuous effort by the MOF to relook and revamp the overall fiscal management, which will include strengthening the government’s fiscal revenue generation, minimising leakages and low-impact fiscal spending and a more prudent government debt management,” MIDF Research opined.

While the GDP growth 2021 is expected to be slower than expected, with the official forecast revised down to three to four per cent (compared with 6.5 to7.5 per cent forecasted when Budget 2021 was tabled), it expected the government’s fiscal deficit to GDP would go higher than last year.

“Based on our current projection, the size of fiscal deficit to GDP is expected to increase to 6.5 per cent this year (2020: 5.4 per cent; Budget 2021: 5.4 per cent).

“On the back of improving revenue outlook and recovering economy, we estimate the fiscal balance will begin to improve next year with the deficit to GDP to shrink to around -3.5 per cent to -3.0 per cent of GDP by 2025, as outlined in the 12MP,” it said.

“We do not expect there may be any major change in the tax rates, but the government will focus more on other measures such as optimising the tax incentives on investment apart from reducing leakages. Any plans to re-introduce GST will only be appropriate when Malaysia’s economic growth is more stable and sustainable,” it added.

Raising Malaysia’s debt ceiling

The additional fiscal stimulus packages introduced by the government could also require higher amount of borrowing to finance the extra spending by the government.

The MOF has indicated that it has plans to adjust the statutory debt ceiling higher to 65 per cent from 60 per cent of GDP currently to provide greater fiscal space for the government next year.

On September 30, the Ministry of Finance said the government will be tabling a motion on raising its statutory debt limit from 60 per cent to 65 per cent of Gross Domestic Product (GDP).

“As we do not expect there will be any big change on the taxation, the shortfall to cover government spending next year will therefore be financed through additional debt acquisition.

“Again, as we believe the government is looking at improving its fiscal management, we expect the government’s commitment towards fiscal consolidation will be reflected in the medium-term policy strategy, which will ensure greater discipline to achieve the desired fiscal targets,” MIDF Research opined.

Meanwhile, UOB noted that the total government expenditure is projected to rise 2.9 per cent to RM338.1 billion in 2022 (2021F: 4.6 per cent to RM328.4 billion). This will be partly cushioned by an estimated revenue collection of RM230 billion (2021F: RM221.3 billion), leaving a fiscal shortfall of RM107.3 billion for 2022 (2021F: RM106.2 billion).

“The budget gap is equivalent to 6.5 per cent of GDP next year, smaller than an estimated seven per cent of GDP for this year,” it added.

Nevertheless, Covid-19 will continue to be a key risk to Malaysia’s growth prospects. — Bernama photo

Malaysia’s prospects moving ahead

OVERALL, as we reach the final quarter of 2021, analysts have maintained their forecast on the economy despite several lockdowns put in place since early this year.

“After the strong jump in 2Q21, growth will be dragged down by weaker domestic spending following the imposition of full lockdown and limited mobility. The extended lockdown caused spending to weaken further in July 2021, with the distributive falling by 14.7 per cent y-o-y (June 2021: -10.3 per cent y-o-y) as a result of lower retail sales and sharp reduction in motor vehicle sales.

“From 4Q21 onwards, we foresee growth momentum will pick up because restrictions have been gradually eased as states moved to next phases of the National Recovery Plan.

“Lifting of bans on inter-state travels and reopening of tourism sector to domestic travellers will be factors that will support for stronger domestic spending.

“In particular, spending will recover in 4Q21 driven by pent-up demand supported by the accumulated savings during the lockdown and pro-consumption measures included in the government’s fiscal stimulus packages such as i-Citra EPF withdrawals, six-month loan repayment moratorium, and BKC cash handouts.

“Furthermore, business activities will be able to produce at higher capacity utilisation as more workers who have been fully vaccinated allowed to return to work,” it said.

Nevertheless, Covid-19 will continue to be a key risk to Malaysia’s growth prospects.

“While the new positive cases of Covid-19 have stabilise and started to trend lower, the renewed rise in Covid-19 cases and tightening of restrictions on the economy remain as the immediate downside risk to near-term growth outlook,” MIDF Research commented.

Furthermore, the emergence of new variants and the waning effect of available vaccines could increase the risk of infections.

“Limited mobility and fears of the infections not only will worsen labour and wage shortages and supply-chain constraints, tighter containment measures will also result in weaker spending activities,” it said.

Other risks to the growth outlook include heightened volatility in the financial market as monetary authorities in the advanced markets begin to taper their asset buying programmes, and the sluggish recovery in the job market as the jobless rate will take time to fall back pre-pandemic levels, MIDF Research added.

“On a positive note, concerns about the local political development had also subsided as the government and the opposition agreed to prioritise on improving the public health condition and reviving the economy,” it said.

Consumer pending is expected to recover in 4Q21 driven by pent-up demand. — Bernama photo