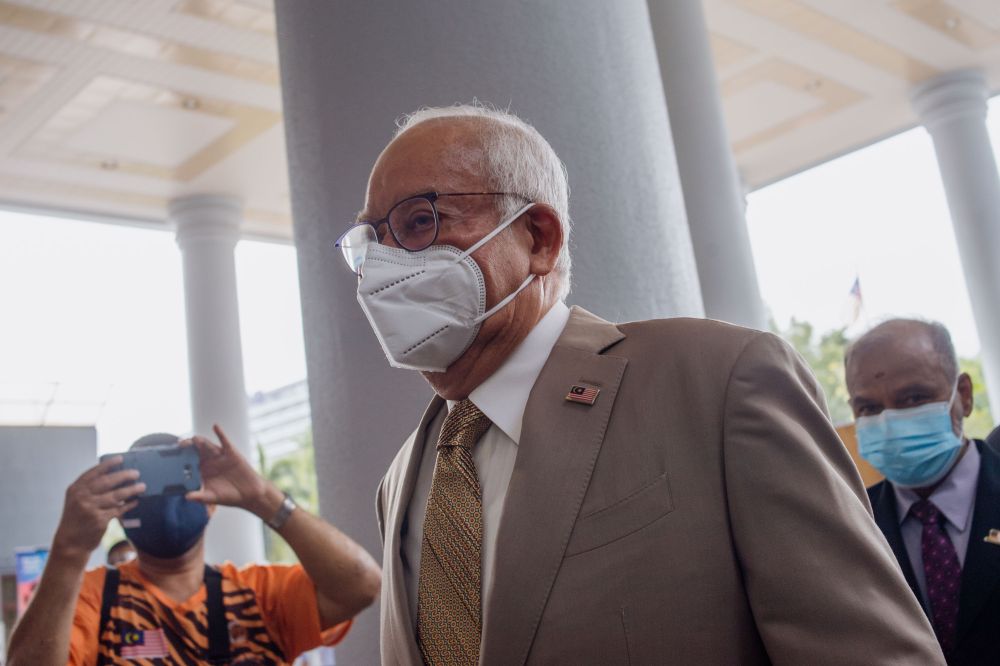

The Malaysian Bar stated that the case involved an important constitutional issue whether Section 106 (3) of the Income Tax Act 1967 contradicted or contravened Article 121 of the Federal Constitution and asked the court to accept its lawyers as an ‘amicus curiae’ to present arguments and views to assist the court in reaching an appropriate decision. – MalayMail photo

PUTRAJAYA (Oct 14): The Malaysian Bar has applied to be an “amicus curiae” or friend of the court in the appeal proceedings filed by former prime minister Datuk Seri Najib Razak and his son Datuk Mohd Nazifuddin regarding the payment of income tax, amounting to RM1.69 billion and RM37.6 million respectively, to the Inland Revenue Board (IRB) before the Federal Court.

Based on a letter dated October 13 sent to the Federal Court, the Malaysian Bar applied for the court to allow eight of its lawyers to be admitted as “amicus curiae” to hear the appeal.

Najib and Mohd Nazifuddin filed a notice of motion to the Federal Court to seek leave to appeal against the decision of the Court of Appeal dismissing their appeal to set aside the High Court’s decision on the payment of the tax.

The Malaysian Bar in the letter, among others, stated that the case involved an important constitutional issue whether Section 106 (3) of the Income Tax Act 1967 contradicted or contravened Article 121 of the Federal Constitution and asked the court to accept its lawyers as an “amicus curiae” to present arguments and views to assist the court in reaching an appropriate decision.

Meanwhile, lawyer Wee Yeong Kang, who represented Najib and Mohd Nazifuddin, when contacted by reporters, confirmed that his team had received the letter via email today.

The lawyer said further case management was set for October 29 before Federal Court deputy registrar Rasidah Roslee.

On September 9, the Court of Appeal upheld the High Court’s decision allowing the IRB’s application for a direct judgment to claim tax arrears of RM1.69 billion from Najib and RM37.6 million from Mohd Nazifuddin.

Direct judgment is when the court decides a particular case through argument without hearing the testimony of witnesses at the trial. – Bernama