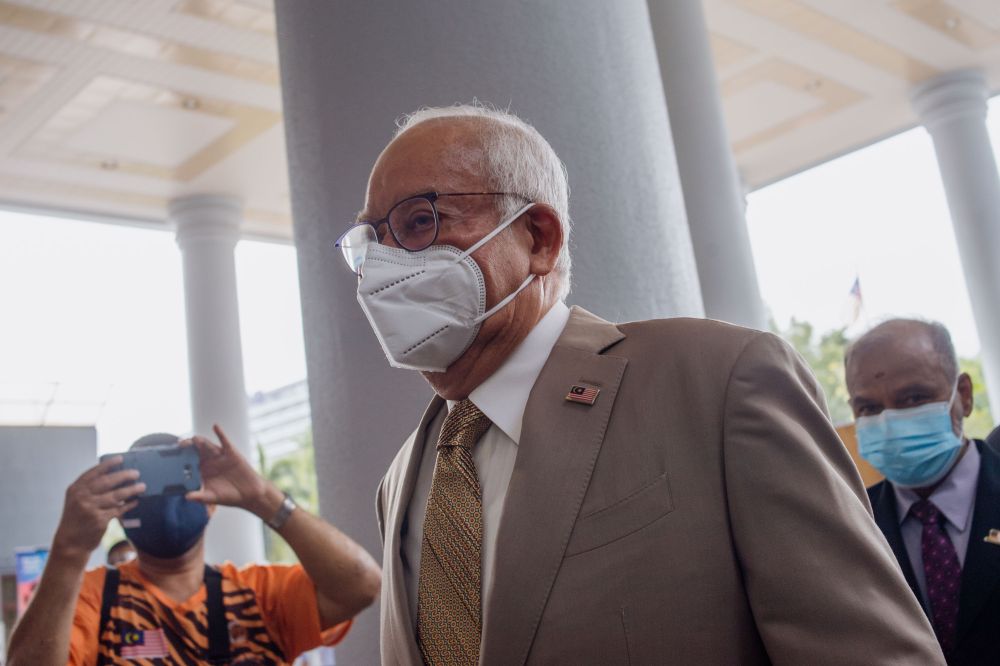

Najib arrives at the Kuala Lumpur High Court on Sept 29, 2021. — Malay Mail photo

KUALA LUMPUR (Nov 16): The High Court was told today that the US$3billion bond guaranteed by the Malaysian government to 1Malaysia Development Berhad’s (1MDB) subsidiary, 1MDB Global Investment Ltd (1MDB GIL) was never used for its intended purpose of funding a 1MDB joint venture.

Former 1MDB Chief Financial Officer (CFO) Azmi Tahir, 48, said the funds were instead used for unrelated purposes such as “donations” to two charities in 2013, paying off debts and transfers to several companies.

“A total of US$205 million of the funds was transferred to two charity organisations for donations in 2013 and US$100 million was transferred to the Kelab Kebajikan 1Malaysia Pulau Pinang, while US$105 million was transferred to the Yayasan Rakyat 1Malaysia (YR1M) between March 25, 2013 and May 2, 2013.

“The US$100 million transfer to Kelab Kebajikan 1Malaysia Pulau Pinang was a donation on the instructions of Datuk Seri Najib Tun Razak’s former principal private secretary, the late Datuk Azlin Alias, which I believe is an instruction from Datuk Seri Najib,” he said.

Azmi said the US$105 million transferred into YR1M was also a donation on Azlin’s orders, which he believes was also upon instructions from Najib as YR1M trustee.

Azmi said this when reading his 127-page witness statement at Najib’s corruption and money laundering trial, involving RM2.3 million belonging to 1MDB.

Prior to this, the witness had confirmed that there had been an agreement between Aabar Investment PJS and 1MDB, dated March 12, 2013 in which the agreement was for the purpose of setting up an investment joint venture known as Abu Dhabi Malaysia Investment Company (ADMIC).

From this joint venture agreement, 1MDB has issued bonds through 1MDB GIL worth US$3 billion for the purpose of funding ADMIC’s proposed investment.

Azmi also told the court that the money (US$3billion) was also transferred into several accounts to pay off debts between March 2013 and September 2013.

The 12th prosecution witness said parts of that amount were also transferred to several entities, namely Enterprise Emerging Markets Fund or EEMF (US$414.8 million), Cistenique Investment Fund (US$379.6 million), Devonshire Funds Ltd ( US$586.9 million), Brazen Sky (US$3.3 million), Pacific Harbour Global Growth (US$126 million), Standard & Poor’s Singapore Pte Ltd (US$1.15 million), Linklaters Singapore Pte Ltd (US$1.5 million) and Corporate Trust Services (US$62.3 million).

Azmi said a total of US$791.8 million was also transferred into 1MDB’s account for the purchase of land in Ayer Hitam and for the payment of other debts.

Meanwhile, Azmi said he and 1MDB board members did not know that there was a difference between Aabar Investments PJS and Aabar Investments PJS Ltd, which were named in several agreements with a 1MDB-owned subsidiary, 1MDB Energy (Langat) Ltd.

Those agreements led to 1MDB payments amounting to US699.3 million to the two companies.

Azmi said in 2012, 1MDB had signed an Option Agreement with Aabar Investments PJS while a Collaboration Agreement for Credit Enhancement was signed with Aabar Investments PJS Ltd.

“Prior to this, I had never known that there was a difference between the names of the two Aabars. In fact, the 1MDB board of directors also did not notice the difference.

“This is because in both agreements, the company address given is the same apart from both being represented by the same person, Mohamed Al-Hoseiny,” he said, adding that all the agreements were prepared by former 1MDB lawyer, Jasmine Loo.

Azmi said he only realised the difference after it was raised by the National Audit Department (NAD) during the 1MDB audit process in 2015.

“I asked 1MDB deputy chief financial officer Terence Geh about this (difference) and Terence at that time also confirmed that both Aabars were subsidiaries of International Petroleum Investment Company (IPIC).

“As far as I know, Terence had submitted the Incumbency document to the NAD that proves both Aabars were owned by IPIC and I did not see any problems with the difference until I was called to give my statement to the authorities in 2015,” he said.

In previous proceedings, the court was told that Najib himself had proposed a joint venture between 1MDB and the IPIC subsidiary to ensure the government-to-government joint-venture involving Abu Dhabi and Malaysia was successful.

Najib, 68, is facing four charges of using his position to obtain bribes totalling RM2.3 billion from 1MDB funds and 21 charges of money laundering involving the same amount.

The trial before Justice Datuk Collin Lawrence Sequerah continues tomorrow. — Bernama