Sim Kwang Gek

AS Malaysia moves into a post-pandemic recovery stage, the recently announced Budget 2022 aims to accelerate the nation’s recovery by focusing on boosting economic recovery, restore national resilience, and catalyse reforms.

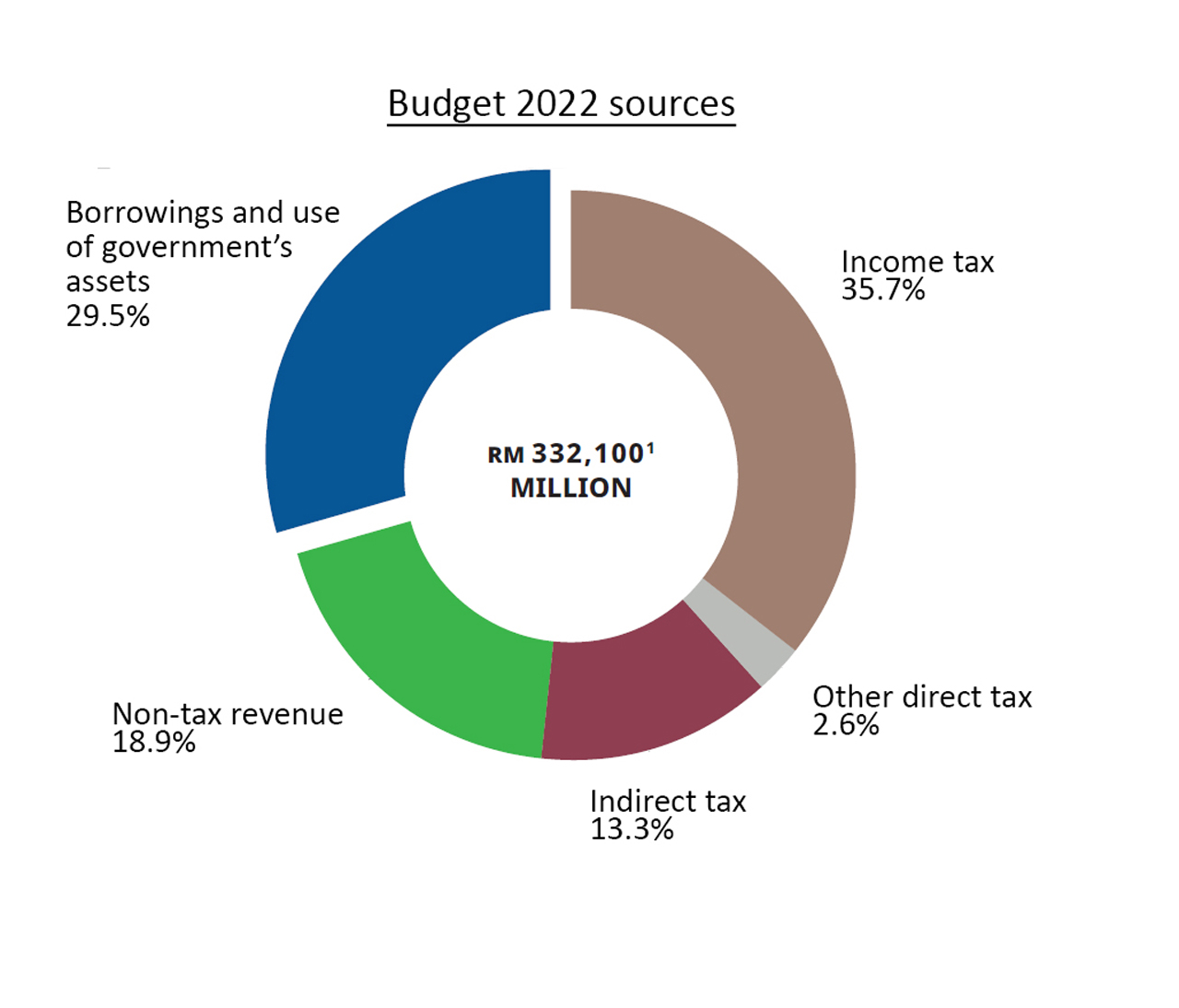

In order to achieve this, the government said it will continue with an expansionary fiscal policy and this led to a record-high budget of RM332.1 billion includes a higher allocation of RM75.6 billion for the gross development expenditure.

According to the research team at MIDF Amanah Investment Bank Bhd (MIDF Research), based on the projection for Budget 2022, the government’s fiscal deficit is expected to fall to six per cent of Malaysia’s gross domestic product (GDP) as the size of the overall deficit will decline slightly to RM97.5 billion.

However, it pointed out that the reduction in the deficit mainly reflects the lower allocation for Covid-19 fund. The fiscal spending, both operating expenditure (OE) and development expenditures (DE), will increase further next year following the expansionary government spending.

Under Budget 2022, tax is one of the most focused topics as the overall fiscal revenue is projected to increase by 5.9 per cent to RM234 billion next year, mainly driven by higher collection from tax revenue that accounts for the large portion (or 73.2 per cent) of the total revenue.

To replenish the government’s depleting coffers, several new taxes were introduced under Budget 2022. In addition to that, measures pertaining to generating more tax revenue were also announced under the Budget 2022.

MIDF Research noted that the RM7.3 billion increase in tax collection will be supported by an eight per cent increase in tax payment from the corporate sector and a three per cent rebound in taxes on personal income, where both taxes will contribute 44 per cent of the total revenue next year.

In addition, petroleum income tax is also projected to rebound by 7.8 per cent, contributing RM12.4 billion to the fiscal revenue compared with RM11.5 billion in 2021.

Tax experts at Deloitte Malaysia also pointed out that tax collection is expected to increase by 5.9 per cent on the back of a better economic outlook with the government anticipating a 5.5 per cent to 6.5 per cent GDP growth in year 2022.

“Corporate income tax collection is expected to increase by 8.1 per cent to RM65.5 billion, which is higher than pre-pandemic numbers in 2019.

“This is optimistic but remains challenging as many businesses are still attempting to bounce back post Covid-19. The introduction of the one-off tax on companies that make super profits and taxation on foreign-sourced income may provide some cushion,” Deloitte Malaysia country tax leader Sim Kwang Gek commented in special report on Malaysia’s Budget 2022.

“Overall, Budget 2022 places greater emphasis on measures to revive the economy and provides assistance to those affected by the pandemic, together with some measures to boost tax collection,” she added.

Source: Ministry of Finance

Cukai Makmur: Talk of the town

One of the most talked-about tax announced during Budget 2022 is a one-off corporate tax called ‘Cukai Makmur’ which is expected to be imposed on companies generating a high income during the Covid-19 pandemic period.

This is also in line with recent international trends such as the Organisation for Economic Cooperation and Development’s (OECD) move to impose higher taxes on larger and more profitable companies from the year 2023.

According to the Ministry of Finance, companies are expected to see its chargeable income up to the first RM100 million subjected to a 24 per cent tax rate while the remaining chargeable income is taxed at 33 per cent.

The tax is expected to be effective next year.

Deloitte Malaysia noted that instead of windfall tax, a similar concept in the form of the above prosperity tax is imposed on companies that generate high income during this Covid-19 pandemic period. This is in support of the government’s initiative that those prospering in such trying times assist those adversely affected, in the spirit of shared national prosperity.

“While the intention is to tax companies that have done well despite the pandemic, it remains to be seen how much tax revenue can be generated from this proposal, considering more than 90 per cent of business establishments in Malaysia are SMEs,” it said in its post-Budget commentary.

“As this proposal affects all companies, it appears that the oil palm plantation sector, that is already subject to the windfall profit levy, will be caught too.

“Perhaps, the proposal to increase the threshold of crude palm oil (CPO) prices for imposition of this levy is intended to provide some relief to this sector.

“On the flip side, Cukai Makmur could incentivise large corporates to increase business spending and accelerate capital investment, in an effort to reduce taxable profits below the threshold.

“The proposed extension of various incentives such as the special reinvestment allowance would be a strong influence to encourage corporates to invest more,” it added.

Taxing foreign-sourced income

Aside from the Cukai Makmur, the government is also looking to review the tax on foreign sourced income (FSI).

Under Budget 2022, this tax is aimed at providing equitable tax treatment with the income accrued in Malaysia or derived from Malaysia and in line with Malaysia’s commitment towards compliance with the international tax best practices. It is proposed income tax be imposed to residents in Malaysia on income derived from foreign sources and received in Malaysia.

According to Deloitte Malaysia, as a transition, it is proposed that the FSI received in Malaysia from January 1, 2022 until June 30, 2022 will be taxed at three per cent on a gross basis. The FSI received in Malaysia from July 1, 2022 onwards would be subject to tax, based on the prevailing income tax rate.

“Given the recent inclusion of Malaysia in the European Union (EU) grey list where Malaysia’s territorial sourced tax regime is considered harmful, this proposal in Budget 2022 is not a total surprise.

“However, since EU is concerned only where such regimes create situations of double non-taxation, income such as dividend would not be a concern as it would not rank for a deduction.

“That being said, the Finance Bill 2021 seems to cover all kinds of FSI, including foreign dividends received in Malaysia,” it noted.

On the possible impact of this tax on companies, Deloitte Malaysia explained that dividends received in Malaysia by Malaysian resident companies from foreign subsidiaries would be taxed in Malaysia with effect from January 1, 2022.

Foreign dividend withholding tax suffered would be creditable against Malaysian tax payable while certain tax treaties allow foreign tax paid by subsidiary companies in respect of their income out of which dividends are paid to be part of the credit.

It noted that another common situation would be the interest from money lent to borrowers outside Malaysia, including intra-group lending, would also be taxed upon remittance moving forward. Remittance of profits of operations outside Malaysia, notably branch profits, would also be subject to Malaysian tax after taking into account the foreign tax paid.

“All-in-all, additional top-up tax would occur where Malaysian tax is higher than the foreign taxes,” it said.

As for Malaysians, this tax could also the rental income earned by a Malaysian tax resident from a real property located outside of Malaysia.

“From January 1, 2022 next year, income remitted to Malaysia would be taxed. In this case, both countries have the right to tax,” it highlighted.

To avoid double taxation on the same rental, Malaysia, being the country of residence would grant a foreign tax credit based on a prescribed formula that takes into account the taxes paid in the foreign country, against the Malaysian tax payable. However, the Malaysian resident landlord would still need to pay the net tax to the Malaysian Government, it said.

It is also worth noting that this tax could affect Malaysians residing in Malaysia but are working abroad.

Deloitte Malaysia explained that before January 1, 2022, Malaysians could remit their salary in Malaysia without paying Malaysian tax. However, under the new rule, their remittance would be subjected to Malaysian tax.

In short, there would be an incremental tax.

“An immediate course of action would be to identify any FSI (which may not have been given much attention before this), timing of their receipt and the quantum of any incremental tax liability after factoring in the availability of any tax credits.

“This is especially important for companies with a December 31 financial year end since the deadline for submitting their estimate of tax payable for year of assessment 2022 is close.

“Moving forward, businesses would also have to consider the potential tax impact when planning the timing of repatriation of their FSI to meet their commercial requirements locally,” Deloitte Malaysia advised.

Under the new sales tax, it is proposed that LVG sold online by seller and delivered to consumers in Malaysia via air courier service is expected to be subjected to a sales tax. — Bernama photo

Shoring up the nation’s indirect tax revenue

THE government had also announced several indirect tax measures to boost tax revenue.

Some of these new taxes include the imposition of sales tax on low value goods.

Of note, currently, sales tax is imposed and levied on all taxable goods manufactured in Malaysia or imported into Malaysia. However, sales tax exemption is given on imported goods not exceeding RM500 (except for cigarettes, tobacco and intoxicating liquor) using air courier services through designated international airports. The exemption is provided under Item 24, Schedule A, Sales Tax (Persons Exempted From Payment Of Tax) Order 2018.

Under the new sales tax, it is proposed that goods not exceeding RM500 from abroad (Low Value Goods – LVG) sold online by seller and delivered to consumers in Malaysia via air courier service is expected to be subjected to a sales tax.

With the imposition of sales tax on LVG, exemption under Item 24, Schedule A, Sales Tax (Persons Exempted From Payment Of Tax) Order 2018 will be revoked.

The imposition of sales tax on LVG is to be implemented through the new provision in Sales Tax Act 2018. Through this provision, sellers from Malaysia or abroad who sell LVG to consumers in Malaysia are required to register and charge sales tax.

This new tax is expected to be effective on January 1, 2023.

Deloitte Malaysia noted that this sales tax on LVG is in line with similar developments in the European Union, Australia, New Zealand and Singapore, albeit under a GST/VAT system. The imposition of sales tax on LVG sold by online merchants would level the playing field between local and foreign sellers.

However, in order to gauge how this could affect foreign sellers and domestic consumers, further details are needed on how the sales tax on LVG would be administered, in particular how foreign sellers are to be registered and the method for collection and payment of the tax.

Tax on courier, delivery services

Service tax on goods delivery services have also been announced under Budget 2022 and this could see service tax is to be charged on all delivery services for goods, by any service provider including e-Commerce platforms.

The delivery of food and beverages as well as logistics services, however, will be excluded from service tax.

Currently, courier delivery services for documents or parcels not exceeding 30 kilogrammes by service providers licensed under Section 10, Postal Services Act 2012 is subject to service tax under Group I, First Schedule of Service Tax Regulations 2018. While the goods delivery services by service providers not licensed under the Postal Services Act 2012 is not subject to service tax.

This service tax is expected to come into effect on July 1, 2022.

Deloitte Malaysia remarked, “The change is intended to ensure equal treatment for all goods delivery services. It is not yet clear what thresholds will be set for registration; however, it is hoped that a sufficiently high threshold be set (RM500,000 and above) to ensure that smaller service providers are not brought into the net and imposed with this additional compliance burden.”

It also noted that currently, express delivery services for documents and parcels not exceeding 30kg by a licensed service provider under the Postal Services Act 2012 are subject to service tax, while unlicensed service providers are not.

“The proposed change would apply service tax to all forms of express delivery services regardless of license.

“The only exceptions are food and beverage delivery services and logistics services. Consequently, the broad range of delivery services including those provided in relation to the purchase of goods through online websites and platforms would be within the scope of the tax,” it added.

On sugar and nicotine tax

In support of a healthy lifestyle, the government proposes to expand the imposition of excise duty on sugar sweetened beverages in the form of pre-mixed preparations of chocolate or cocoa, malt, coffee and tea. The government also plans to impose excise duty on liquid or gel products containing nicotine that are used for electronic cigarettes and vaping.

Currently, beverages in ready-to-drink form are subject to excise duty at the rate of RM0.40 per litre, if they exceed certain threshold values of sugar content.

It is now proposed that excise duty will be imposed on pre-mixed preparations products

categorised under tariff codes 18.06, 19.01 and 21.01 at the rate of RM0.47 per 100g.

“The Government had introduced excise duty on sugary beverage products effective July 1, 2019, as part of its measures to address health issues like diabetes, obesity etc. It has now extended the scope of excise duty to cover pre-mixed preparation products containing sugar, for similar reasons.”

It also proposes to impose an excise duty on liquid or gel products used in electronic cigarettes and vape.

Excise duty will be imposed at the rate of RM1.20 per millilitre. Excise duty for non-nicotine liquid or gel used for electronic cigarettes and vape will be increased from RM0.40 per millilitre to RM1.20 per millilitre similar to excise duty for liquid or gel containing nicotine.

This excise duty is expected to be effective by January 1, 2022.

The Budget 2022 also highlights the government’s efforts in elevating the people’s burden by extending several exemptions for businesses or consumers affected by restrictions to curb the spread of the pandemic. — Bernama photo

Supporting multiple sectors

DESPITE the slew of new taxes and enhanced taxes introduced during Budget 2022, the government also placed emphasis on supporting sectors that are affected by the pandemic.

The Budget 2022 also highlights the government’s efforts in elevating the people’s burden by extending several exemptions for businesses or consumers affected by restrictions to curb the spread of the pandemic.

Among these measures is the extension of relief for businesses and individuals involved in the tourism sector.

In the Budget 2022, the government proposed an extension of the special relief for individual income tax on domestic tourism expenses as well as the extension of tax incentive for organising arts, cultural, sports and recreational activities in Malaysia and extension of tax incentive for the purchase of tourism vehicles.

The government had also proposed to an extension of tourism tax exemption.

The general purpose for these extensions and exemptions are to assist and support the arts, cultural, sports and recreational activities as well as the tourism industry which was badly affected by the closure of borders and restriction of movement since March 2020.

These extensions and exemptions of taxes are expected to come in place from 2022 until 2025.

“This is a great initiative by the government to help the tourism industry which has been hit hard by the pandemic. The ACA claim will assist in easing cash flow concerns of tour operators,” Deloitte remarked.

It added, “It is not surprising that the Minister has extended the tax incentive to the tourism sector, as it is one of the worst hit by the Covid-19 pandemic. This key measure introduced by the government introduced aims to revive the tourism industry, enabling it to resume operations at maximum capacity.”

A boon for struggling businesses

Aside from that, other notable corporate income tax proposals were the extension of expiry date for accumulated business losses, the extension of further tax deductions on employees’ accommodation expenses (SAFE@WORK) as well as the extension of special reinvestment allowance incentive.

“These proposals will be welcomed by companies suffering from the pandemic as well as companies looking to reinvest as the business climate improves,” Ernst & Young Tax Consultants Sdn Bhd Malaysia Tax Markets leader Farah Rosley remarked.

“When faced with an unprecedented crisis, responding to immediate threats is crucial. The proposed extension of expiry date for accumulated business losses sends a strong signal that the government will support affected loss-making businesses to preserve the unabsorbed business losses for a longer period, pending recovery of the Malaysian economy,” Deloitte Malaysia commented.

“The proposal to allow all businesses to revise the estimated income tax payable in the 11th month before October 31, 2022 is a welcomed relief.

“It offers businesses some flexibility in managing their tax estimates and cash flow,” it added.

However, it pointed out that the cut-off on October 31, 2022 would mean that companies closing their financial year on December 31, 2022 will not be able to benefit from this amendment as their 11th month of the basis period will fall after October 31, 2022.

“As many companies in Malaysia adopt a December financial year end, this proposal may not provide much relief,” it added.

In regards to the extension of further tax deductions on employees’ accommodation expenses (SAFE@WORK), Deloitte Malaysia said: “The proposal extends the existing further deduction to December 31, 2022 that is due to expire on December 31, 2021.

“It is hoped that the government will consider extending such further deduction to other industries such as construction, plantation, hotel, and others apart from manufacturing companies to help alleviate the cost of doing business during this challenging period.”

The government has also proposed individual income tax reliefs of up to RM2,500 for EV charging facilities and roadtax exemptions for EV owners. — Bernama photo

Stamp duty exemptions for loans

Aside from tax exemptions, several stamp duty exemptions were also announced under Budget 2022 with the aim of supporting businesses, particularly small and medium enterprises (SMEs).

These exemptions include stamp duty exemption on loan/financing agreements for Peer-to-Peer (P2P) financing and the extension of stamp duty exemption on qualifying loan restructuring and rescheduling agreements.

It is proposed that 100 per cent stamp duty exemption be given for five years on P2P loan/financing agreements made between SMEs and investors. This exemption is only given for P2P financing made through P2P platforms registered and recognised by the Securities Commission.

To reduce the cost of borrowing to borrowers who restructure or reschedule loan/financing, it is also proposed 100 per cent stamp duty exemption on restructuring or rescheduling of loan/financingagreement be extended for another year.

“The extension of the exemption is welcomed as it would alleviate part of the burden of businesses still struggling with the impact of the pandemic shutdowns,” Deloitte Malaysia remarked.

It also noted that the stamp duty exemption on loan/financing agreements for P2P financing is aimed at encouraging SMEs to increase their business capital and to reduce their cost of financing through P2P alternative financing.

Tax reliefs for the people

Besides tax exemptions, for consumers, several individual income tax reliefs were announced under Budget 2022.

To support and improve Malaysia’s public health system, for next year, the government proposes to provide individual tax relief and tax deduction to employers on costs associated with the adoption of self-funded booster vaccines.

Aside from that, mental health issues were also highlighted during the Budget 2022. Over the past year or so, the pandemic has exacerbated the problems of poverty, domestic violence and depression which have become the root causes of mental health issues.

Aware of this, under Budget 2022, the government is expected to allocate RM70 million to ensure that mental health issues are continuously given due priority, by among others, strengthening mental health support services, counselling and psychosocial support, increasing mental health advocacy programmes and strengthening the role of NGOs as movers of mental health programmes.

It has also proposed to expand the scope for individual income tax relief for full medical check-up expenses to cover the cost of check-up or consultation service related to mental health from psychiatrists, clinical psychologists and registered counsellors.

Aside from that, the government also announced the extension of individual income tax relief up to RM3,000 for payment of nursery and kindergarten fees until the year of assessment 2023.

Other individual income tax relief proposed under Budget 2022 include the extension of the special individual income tax relief of up to RM2,500 for the purchase of mobile phones, computers and tablets.

The limit of individual income tax relief for up-skilling and self-enhancement course fees will be increased from RM1,000 to RM2,000 and extended to assessment year 2023. In addition, those who undertake courses with approved professional bodies will be eligible for a tax relief of up to RM7,000.

Additionally, the government has also proposed individual income tax reliefs of up to RM2,500 will be given for the purchase and installation, rental and hire-purchase of EV charging facilities as well as payment of EV charging facility subscription fees while road tax exemptions of up to 100 per cent will also be given to EV owners.

The government is looking to expand the scope for individual income tax relief for full medical check-up expenses to cover the cost mental health check-ups and consultations. — Bernama photo

Ensuring tax compliance

Budget 2022 proposed various measures to enhance tax compliance to sustain tax revenue.

A Special Voluntary Disclosure Programme is expected to be introduced by the Royal Malaysian Customs Department in phases with a penalty remission incentive of 100 per cent for the first phase and a penalty remission of 50 per cent for the second phase.

A tax remission will also be considered for certain cases.

A Tax Compliance Certificate has also been proposed to be issued by the Inland Revenue Board Malaysia be made as part of pre-requisite for companies to participate in Government procurement beginning January 1, 2023.

No further details were made available in the Budget 2022 announcement, including what taxes the SVDP would cover.

“Although certain to cover Sales Tax and Service Tax, we would need to see if it also covers the legacy GST and also other duties and taxes administered by RMCD such as customs duties and excise duties.

“Other important details that may impact the success of the programme would include the level of scrutiny that would be undertaken and whether it would escalate to full scale audits by RMCD.

“Businesses generally try their best to stay on top of compliance requirements.

“However as indirect taxes are imposed on a transactional basis, it is possible to get something wrong and for that error to be compounded across multiple transactions before it is discovered.

“The announcement of the SVDP should encourage greater compliance among businesses,” Deloitte Malaysia said.

The concept of a tax compliance certification is also not new and it has been adopted in other countries such as the US, UK, South Africa and Cambodia to varying degrees and purpose.

“The method of certification is not yet known but it is anticipated that the taxpayer can make an application to the IRB for certification (similar to the issuance of a certificate of tax residence) and the IRB will certify that the taxpayer has complied with all their tax obligations as at the date of certification.

“Making this a pre-requisite for government procurement is likely a form of check and balance to ensure that the government only does business with parties that are responsible taxpayers,” Deloitte Malaysia said.

However, it pointed out that an area of concern is if ongoing disputes with the inland revenue board would influence the issuance of this certification for the taxpayer.