WITH the recent debacle on the China real estate sector, investors that have exposure to this sector could be impacted. In this article, we look to share the impact to our managed portfolios, as well as some comments from the fund house.

WITH the recent debacle on the China real estate sector, investors that have exposure to this sector could be impacted. In this article, we look to share the impact to our managed portfolios, as well as some comments from the fund house.

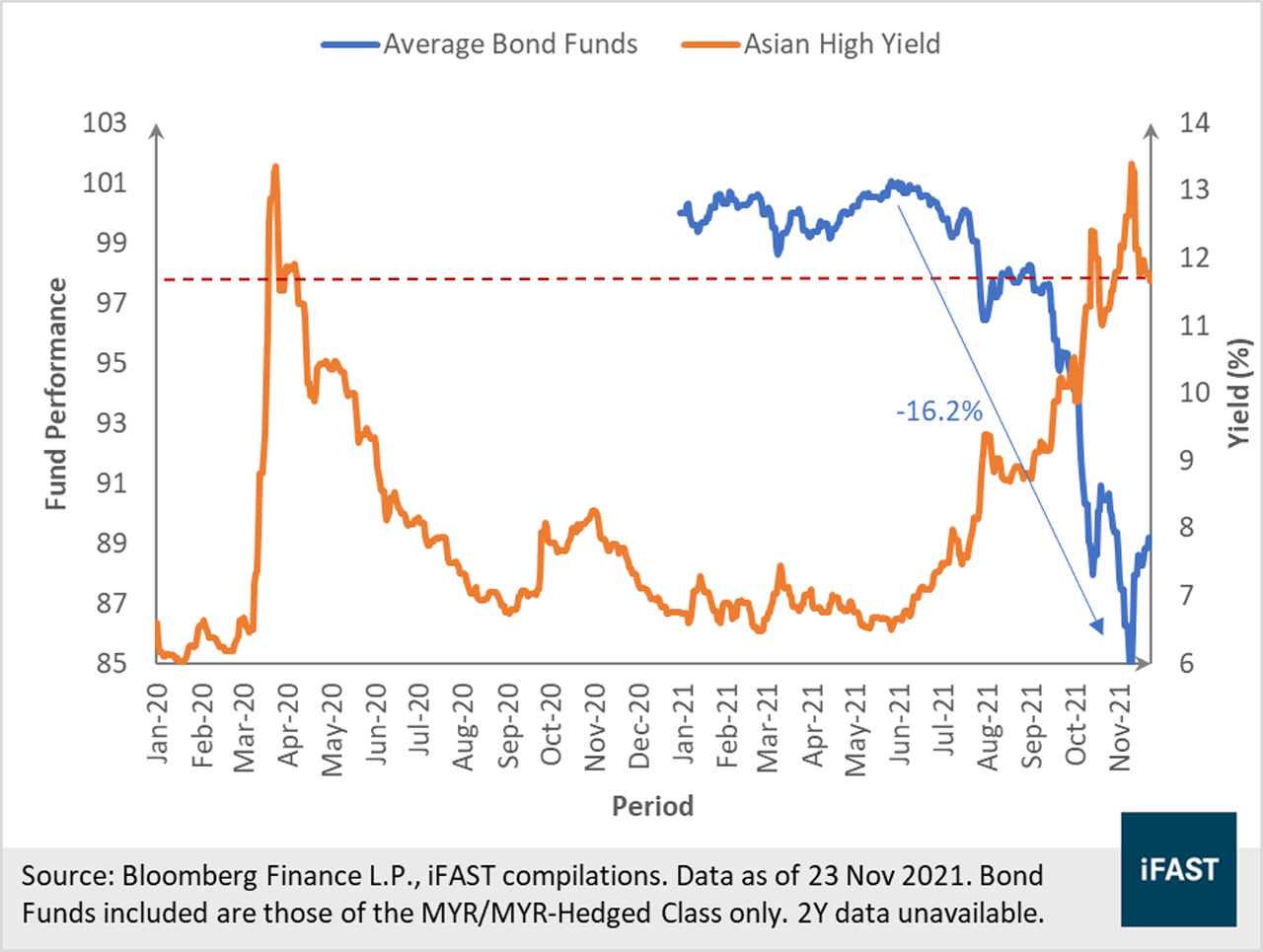

The Asian high yield segment faced immense volatility over the past two years. The Covid-19 pandemic has plagued global securities market in 2020, while the 2021 fall is due to the missed bond repayment of property developer Evergrande which has domino-ed into an industry wide concern.

Subsequently, the volatility has also impacted the performance of the fixed income segment of our managed portfolios. Thus, we look to discuss some of the impact from the Asian High yield segment, and our action plan going ahead.

China currently has one of the highest dollar-denominated debt globally, capturing almost 40 per cent of the US dollar Asian high yield bond index. Over the past few decades, the country’s economy has grown rapidly, fueling the domestic real estate sector as more Chinese middle-class view owning a property as a key milestone in their careers.

Such demand for properties has led to real estate developers turning to global markets for funding needs, resulting in the Asian High Yield Bond Index to be mainly occupied by Chinese developers.

As such, any volatility within the Chinese real estate sector as we are facing now would also impact the broader index. The recent challenges faced by China Evergrande has spilled over to the Chinese real estate sector.

Yields for the Asian High Yield segment have risen drastically to 2020 levels at nearly 12 per cent, while the aggregate Asian High Yield bond funds on our platform have also fallen by north of 15 per cent peak to trough.

With housing prices skyrocketing over the past decade amidst unrelenting demand for properties, the Chinese government looks to cool housing prices to make it more affordable for its people.

Furthermore, the growing debt on various companies’ balance sheet are also a concern as the sector is seen as systematically important to the Chinese economy, strongly interconnected to upstream and downstream industries.

Against this backdrop of rising prices and weakening balance sheet, China imposed three red lines in August 2020 to access the financial situation of developers. The number of lines breached would thus determine the amount of debt these companies can grow annually.

Yields have risen to 2020 levels

Managed portfolio were minimally affected by the sector’s uncertainties

Within our managed portfolios, our conservative to balanced portfolios are exposed to the Asian high yield segment via Eastspring Investment Asian High Yield Bond MY Fund with an allocation of nine, seven and five per cents respectively.

Amongst our managed portfolio, the conservative portfolio has the highest allocation to the Asian high yield segment due to its higher fixed income allocation relative to other risk profiles.

With an exposure of nine per cent, it translated into a loss of minus 1.34 per cent and minus 0.52 per cent on a year to date (YTD) basis and since inception respectively for the Conservative portfolio.

This demonstrates that impact towards the managed portfolios is reasonably low due to our diversified and value-oriented approach to investing despite the sector’s volatility over the past few quarters.

China captures the majority of Asian High Yield Index

Eastspring Investment’s view on the Chinese real estate sector

Recently during our communication with the fund house, they shared their thoughts regarding the sector and their portfolio’s standing within their investable universe.

With more policy clarity on China properties, they expect the sector to experience a positive reversion as they do not think the Chinese government will allow the sector to collapse.

According to JP Morgan, current prices are implying a default probability higher than what analyst consensus are estimating. This indicates that the market could be overly pessimistic which suggest further downside to be limited from current levels.

In order to sieve out stronger companies, the fund manager also looks at off balance sheet items or pre-sales on top of the three red line measure. Current holdings which are at risk are Evergrande, Fantasia, Kaisa all of which has an exposure of less than two per cent of the total portfolio value.

Other than those companies mentioned, the fund does not invest in “red-zone” companies. Moving forward, the fund manager will pay more attention to companies that are sold indiscriminately.

Overall, we share the same view as the fund house. While it is likely that we have not seen the end of regulator’s intervention, we note that companies will come out of this event with a stronger balance sheet.

This bodes well for the sector and ultimately should be more sustainable longer term. Deleveraging would also lower credit risk which should stabilise future price movements of the fixed income market.

Furthermore, we opine the sector has decent risk-reward profile as the highly attractive valuations of 2020 Covid levels compensates for the risk involved.

All in all, the Evergrande saga has sparked widespread concern to global investors, pulling the Asian High Yield Index to historically lower levels. Investors that are exposed to this sector could see some drawdown in their respective portfolios.

While managed portfolios did not avoid this bloodbath, our diversified approach to investing has led to minor losses from this front.

Our stance towards the Asian high yield segment remains firm as we opine this to have attractive risk-reward profiles.